Recently, the Supreme People’s Procuracy of Vietnam has issued an indictment against five defendants involved in a loan regulation violation case at a bank’s branch.

The defendants include Nguyen The Binh (currently at large, former Chairman of the Board of Directors of a bank), Duong Thanh Cuong (former Chairman and CEO of Binh Phat Company), Ho Dang Trung (former branch manager of the bank), Ho Van Long (former head of the bank’s branch department), and Do Ngoc Dung (former credit officer at the bank). They are charged with violating lending regulations of credit institutions under Clause 3, Article 179 of the 1999 Penal Code.

Inflated Asset Valuation

According to the indictment, in early 2007, Duong Thanh Cuong met Nguyen The Binh, then acting CEO of a bank, through personal connections.

During their meeting, Cuong requested a loan to purchase land for a project, which Binh approved. Binh instructed Trung to process the loan application, and if it exceeded the branch’s authority, to report it to the bank’s headquarters for Binh’s approval.

Cuong visited the bank’s branch to meet Trung and initiate the loan application. Trung called Ho Van Long, then deputy head of the credit department, to handle Cuong’s loan request. Trung informed Long that Cuong was a client referred by Binh, and the loan should be approved.

Following Trung’s instructions and aware of Cuong’s connection to Binh, Long directed credit officers to process the loan application for Cuong’s Binh Phat Company.

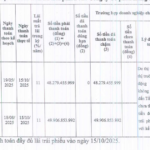

Specifically, the bank’s branch granted Binh Phat Company five short-term credit contracts. The collateral included 18 land plots and one land use rights transfer agreement totaling 33,447 square meters, along with assets on the land in former District 8, comprising residential land, ponds, and factory construction sites.

|

Cuong admitted to inflating the value of land transfer contracts and project consulting agreements, which the bank used to determine the collateral’s value.

In reality, the land was purchased at 1.9 to 3.1 million VND per square meter, but Cuong inflated the value to 12.5 to 13 million VND per square meter in the contracts, resulting in a total overvaluation of 293 billion VND. For the project consulting contract, Binh Phat Company paid only 5 billion VND to Campbell Company, but Cuong inflated this to 52.9 billion VND.

Bank officials were aware that the assets did not meet collateral requirements. However, due to Binh’s influence and directives, they approved and disbursed a total of 302.5 billion VND to Binh Phat Company.

After receiving the funds, Cuong used only 70 billion VND for the intended purpose, diverting the remaining 230 billion VND for other uses.

By December 31, 2007, while the five short-term credit contracts were still active, Cuong settled all principal and interest from a medium-term loan under the December 31, 2007 credit contract, thus avoiding immediate financial loss.

Bank Loans for “Debt Restructuring

According to the indictment, in late 2007, having misused the loan and seeking to extend repayment, Cuong asked Trung to convert the five short-term loans (1-year term) into a single medium-term loan (5-year term).

After reporting to and receiving approval from Binh, Trung instructed Long to execute the conversion.

On December 4, 2007, Cuong signed a loan application at the bank’s branch for 500 billion VND to invest in the Binh Phat Residential and Commercial Project in former District 8, Ho Chi Minh City.

Trung directed credit officers to prepare an appraisal report, falsely claiming the project was “feasible and profitable” and that the collateral was “valuable with complete legal documents,” thus qualifying Binh Phat Company for the loan.

On December 31, 2007, Trung signed a credit contract granting Binh Phat Company 500 billion VND. The collateral included assets formed from the loan, 18 land plots, and assets on the land previously pledged under the five short-term credit contracts.

On the same day, the bank’s branch disbursed 303.1 billion VND to Binh Phat Company. Cuong used over 303 billion VND to settle the principal and interest of the five short-term loans, with the remaining 80 million VND allocated for other payments.

Investigations revealed that the land used as collateral did not meet pledge requirements from the outset of the five short-term loans and was still valued at 420.7 billion VND by the defendants.

The Binh Phat Project had not been approved by competent authorities and thus did not qualify for a loan. However, Trung valued it at 1,460 billion VND. Essentially, the 303.1 billion VND medium-term loan was not used for its intended purpose but to “restructure” the five short-term loans into a single medium-term loan for Binh Phat Company.

By December 19, 2010, while the loan was still active, Cuong repaid over 303 billion VND in principal to the bank’s branch using funds borrowed by THY Company under a credit contract dated November 25, 2010.

The indictment also highlights further violations by bank officials in granting THY Company a 385 billion VND loan under the November 25, 2010 credit contract.

In 2010, as Binh Phat Company defaulted on its loans, the bank’s branch froze the company’s land assets in former District 8. The Binh Phat Project was terminated.

Unable to repay the debt, Cuong collaborated with Vu Thi Bich Loan (deceased, Director of THY Company) to meet Trung and request a 385 billion VND loan for THY Company to purchase 13 land plots (10 of which were pledged by Binh Phat Company for the 303.1 billion VND loan and 3 vegetable plots) from Binh Phat Company along Ho Hoc Lam – An Duong Vuong Street, former District 8.

On August 31, 2010, Cuong signed a contract transferring 29,986 square meters of land use rights to THY Company for 385 billion VND.

THY Company initiated the An Duong Vuong – Ho Hoc Lam Apartment and Pedestrian Street Project. Loan then signed a loan application for 500 billion VND at the bank’s branch, stating the purpose was to acquire land use rights from Binh Phat Company.

Investigations determined that the collateral provided by THY Company, purchased from Cuong, included five land plots leased by the state, which did not qualify for pledge; eight land plots with inflated values; and the An Duong Vuong – Ho Hoc Lam Project, which lacked necessary permits, rendering it ineligible for a loan.

On November 30, 2010, the bank’s branch disbursed 385 billion VND to THY Company. THY Company transferred the entire amount to Binh Phat Company to settle Cuong’s debt with the bank.

After recovering the principal, the bank’s branch released the pledge on 10 land plots for Binh Phat Company, re-pledging them for THY Company’s loan.

Subsequently, THY Company defaulted on the loan, leading to its classification as overdue from November 25, 2011.

According to the indictment, the total damage caused by the case exceeds 1,053 billion VND.

|

Manhunt for Nguyen The Binh The indictment identifies Nguyen The Binh as the primary culprit due to his overarching role and directives. Duong Thanh Cuong and Ho Dang Trung are considered accomplices in execution, while Ho Van Long and Do Ngoc Dung are deemed accessory accomplices. Nguyen The Binh, former bank chairman, is currently at large under Warrant No. 3338 issued on September 13, 2025, by the Ministry of Public Security’s Investigation Agency. If Binh fails to surrender or appear, he will be considered to have waived his right to self-defense and will be investigated, prosecuted, and tried in absentia as prescribed by law. |

SONG MAI

– 12:11 24/10/2025

2021-2025 Term: Government Resilience and Lasting Values

Perhaps no term in the history of the Vietnamese government has begun amidst such formidable challenges. As the 2021–2025 administration assumed office, the COVID-19 pandemic was at its peak, global supply chains were disrupted, the world economy had plunged into recession, and pressing issues like climate change, geopolitical conflicts, energy crises, and food security loomed large.

State-Backed Support Policies Proposed to Help At-Risk Businesses Recover from Bankruptcy

Upon reviewing the report on the draft Bankruptcy Law (amendment), the National Assembly’s Committee on Economics and Finance (KT-TC) noted that, based on feedback from the Standing Committee of the National Assembly and preliminary review opinions, the draft Law has been revised. It now includes provisions for state policies offering support in taxation, credit, interest rates, finance, land, and other measures to assist enterprises and cooperatives facing production and business challenges.

Vietnam’s Government Pioneers an Unprecedented Initiative

The Prime Minister has delivered a comprehensive report on the socio-economic landscape for 2025, highlighting significant achievements over the five-year period from 2021 to 2025. This report underscores key milestones and progress in Vietnam’s economic and social development.