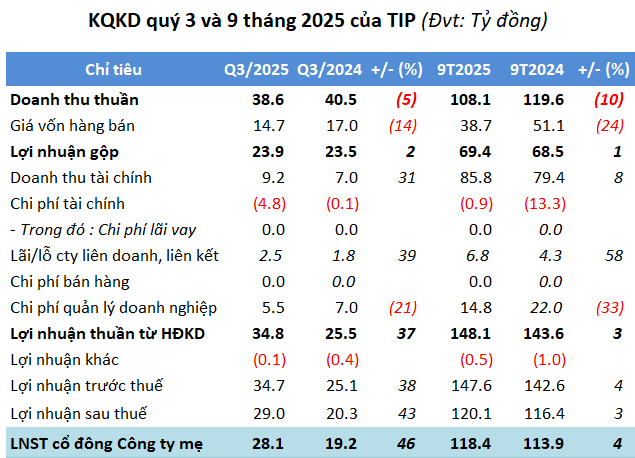

By the end of Q3, Tin Nghia Industrial Park Development JSC (HOSE: TIP) reported net revenue of nearly VND 39 billion, a 5% decrease year-over-year. The primary contributor remains infrastructure fees, which rose by 6% to nearly VND 15 billion, while real estate revenue from Thong Nhat dropped by 56% to just over VND 3.5 billion.

Despite a sharper decline in cost of goods sold, gross profit increased by 2% to nearly VND 24 billion. The gross margin improved from 58% to 62%.

Financial revenue exceeded VND 9 billion, up 31%, primarily from interest on deposits and loans. Additionally, profits from joint ventures and associates contributed VND 2.5 billion, a 39% increase. After deducting financial and operational expenses, TIP achieved a net profit of over VND 28 billion, up 46%.

The company attributed the profit increase to the reversal of financial investment provisions for CTCP Ca Phe Olympic.

For the first nine months, cumulative net revenue reached over VND 108 billion, down 10%, while net profit exceeded VND 118 billion, up 4% year-over-year. With these results, TIP has achieved 70% of its annual revenue and profit targets.

Source: VietstockFinance

|

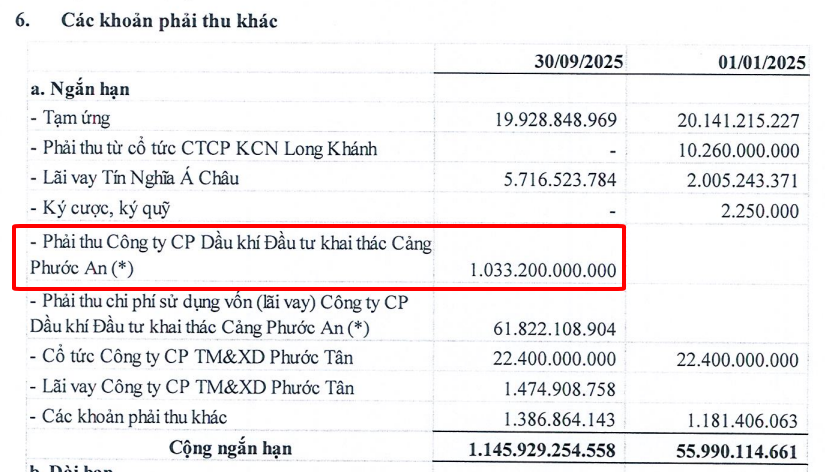

Receivables from PAP exceed VND 1 trillion

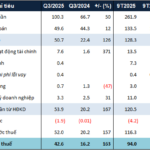

As of Q3, TIP‘s total assets were over VND 2,061 billion, a 3% decrease from the beginning of the year. Cash and cash equivalents plummeted by 82% to just over VND 16 billion.

Additionally, TIP holds short-term receivables of over VND 1,033 billion from Phuoc An Port Investment and Exploitation JSC (UPCoM: PAP). This amount stems from a joint venture with PAP to invest in, develop, and operate a portion of the land within the Phuoc An Industrial Park project.

Source: TIP

|

Under the agreement, PAP is responsible for completing the infrastructure and obtaining permits for Phuoc An Industrial Park, while TIP contributes financially and manages the business operations related to land use rights and infrastructure for up to 60 hectares within the park, located in Phuoc An commune, Nhon Trach district (formerly).

The cooperation price is over VND 3.4 million per square meter. Tin Nghia will contribute capital in two phases: the first phase, completed in October 2022, involved VND 1,033 billion for 30 hectares. The second phase, contingent on the project’s investment approval, allows Tin Nghia to invest in the remaining 30 hectares.

Regarding profit-sharing, TIP retains 100% of the infrastructure fees generated from business operations, land leasing, and infrastructure use within the cooperative area. If market rates at the time of agreement do not ensure a 12% annual return on the cooperation price, PAP guarantees this rate.

Phuoc An retains all management fees, land rent payments to the state, and other revenues, excluding infrastructure fees, from the cooperative area.

In the first half of the year, Tin Nghia recorded a profit equivalent to a 12% return on its actual investment of nearly VND 124 billion, over a 24-month period starting April 27, 2024. Phuoc An paid the first installment of nearly VND 62 billion on July 7, 2025, with the remaining VND 62 billion due by year-end.

In late September 2025, PAP approved the investment plan for the Phuoc An Industrial Park infrastructure project, with a total investment of nearly VND 5.4 trillion. The 330-hectare park is located near the Ben Luc – Long Thanh Expressway, Thi Vai River, and a planned railway line. Construction is scheduled from 2025 to 2028.

PAP invests nearly VND 5.4 trillion in Phuoc An Industrial Park

Inventory stands at VND 129 billion, down 6%, primarily consisting of work-in-progress costs for the 18-hectare Tan Phuoc residential area (Dong Nai) at over VND 43 billion and the Thanh Phu residential area at over VND 59 billion.

Liabilities total over VND 237 billion, down 25% from the beginning of the year, with customer prepayments and unearned revenue at VND 167 billion, up 3%, accounting for 70% of total liabilities. The company has no financial debt.

– 15:40 22/10/2025

VICEM Bút Sơn Cement Turns Profitable in Q3 Through Waste Management Solutions

With over VND 18 billion in additional profits from waste treatment, VICEM But Son Cement turned a profit in Q3, reporting earnings of more than VND 10 billion. This marks the second consecutive profitable quarter after a 10-quarter loss streak. However, the company still faces accumulated losses of nearly VND 300 billion.

VLB Stone Mining Giant Surpasses 43% Profit Target in 9 Months

Biên Hòa Construction and Building Materials Production JSC (UPCoM: VLB) has announced robust Q3 2025 financial results, showcasing a 20% year-over-year profit surge.

Phan Thiet – Phu Quy Route Drives SKG’s Q3 Profit Turnaround

Superdong – Kien Giang JSC (HOSE: SKG) reported a Q3 profit of over VND 7.3 billion, a significant turnaround from the loss incurred in the same period last year. This impressive result was driven by a substantial increase in revenue across multiple routes, most notably the Phan Thiet – Phu Quy line.