|

QTP’s Business Targets for Q3/2025

Source: VietstockFinance

|

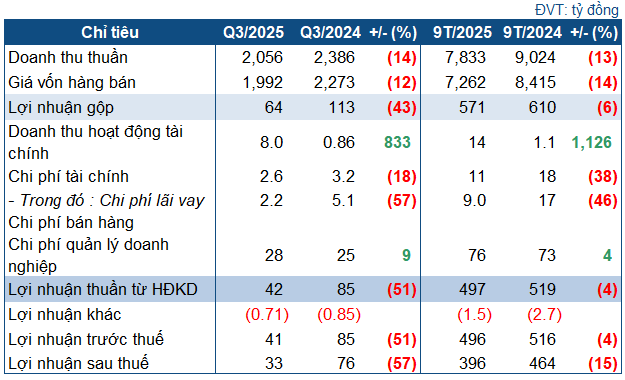

In Q3, QTP recorded nearly VND 2.06 trillion in net revenue, a 14% decline year-over-year, primarily due to reduced electricity selling prices. The cost of goods sold decreased by only 12%, resulting in a gross profit of VND 64 billion, down 43% compared to the same period last year.

Financial activities showed improvement, with financial revenue surging to VND 8 billion (up from just over VND 860 million in the same quarter last year). Conversely, financial expenses dropped by 18% to VND 2.6 billion, largely attributed to lower interest expenses as a result of reduced debt levels. Administrative expenses rose by 9% to VND 28 billion.

After deducting all expenses, QTP’s post-tax profit stood at VND 33 billion, a 57% decrease year-over-year.

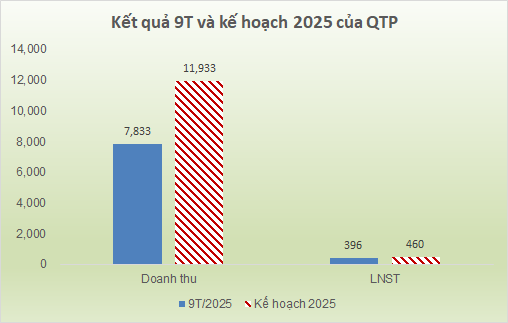

For the first nine months of the year, QTP achieved over VND 7.8 trillion in net revenue, a 13% decline compared to the same period last year; post-tax profit reached over VND 396 billion, down 15%. Despite the downturn, QTP’s performance remains stable relative to the 2025 Annual General Meeting’s targets, achieving 66% of its revenue goal and 86% of its post-tax profit plan.

Source: VietstockFinance

|

By the end of Q3, QTP’s total assets reached nearly VND 6.9 trillion, an 8% decrease from the beginning of the year, with approximately VND 4.4 trillion in current assets, slightly down. Notably, cash and cash equivalents surged to nearly VND 1.09 trillion, doubling since the start of the year.

Conversely, short-term receivables plummeted by 23% to VND 2.3 trillion, primarily due to reduced receivables from EVN’s Power Trading Company. Inventory levels decreased slightly by 6.8% to VND 822 billion.

On the liabilities side, total debt fell sharply by 34% from the beginning of the year to VND 1.57 trillion. All debt categories saw significant reductions, including short-term payables to suppliers, which dropped by 41% to VND 844 billion, and short-term and long-term loans, which decreased by 52% to VND 93 billion (comprising VND 50 billion in short-term loans and VND 43 billion in long-term loans).

– 08:08 23/10/2025

VICEM Bút Sơn Cement Turns Profitable in Q3 Through Waste Management Solutions

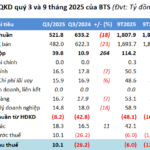

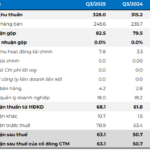

With over VND 18 billion in additional profits from waste treatment, VICEM But Son Cement turned a profit in Q3, reporting earnings of more than VND 10 billion. This marks the second consecutive profitable quarter after a 10-quarter loss streak. However, the company still faces accumulated losses of nearly VND 300 billion.

Profits Surge Over 7,100%: Company Sets New Stock Market Record

After six months of implementing a comprehensive restructuring plan, OCBS Securities Corporation (OCBS) has unveiled its Q3 2025 business results, delivering a remarkable surprise. Key financial and operational metrics have surged dramatically, marking a pivotal milestone in OCBS’s transformation into a leading Investment Banking and Asset Management powerhouse.

Q3/2025 Financial Report Update: SHB Announces Over 50% Pre-Tax Profit Surge, Multiple Subsidiaries Double Their Earnings

ACB reported a Q3 profit of VND 5,382 billion, an 11% increase year-over-year, with a 9-month cumulative profit of VND 16,072 billion, up 5%. Meanwhile, VEF (Giảng Võ Exhibition) posted a Q3 profit of VND 214 billion, doubling from the same period last year, and a 9-month profit of VND 19,295 billion, a staggering 58-fold increase year-over-year.