Tay Ninh Rubber Company (TRC) Reports Stellar Q3 2025 Financial Results

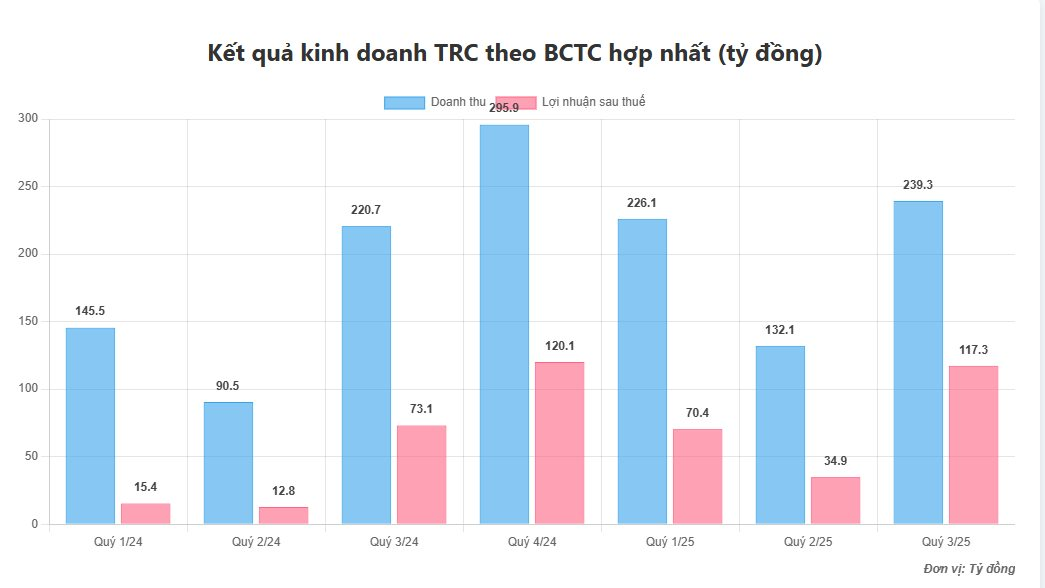

Tay Ninh Rubber Joint Stock Company (TRC) has announced impressive financial results for the third quarter of 2025. The company’s standalone net profit surged by 135% year-over-year to VND 137.3 billion, compared to VND 58.5 billion in the same period of 2024. Consolidated net profit also rose significantly, increasing by over 60% to VND 117.3 billion.

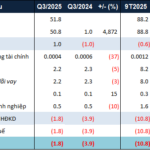

This growth momentum has been consistent throughout the year. In the first nine months, TRC’s consolidated net revenue reached VND 597.5 billion, a nearly 31% increase, while net profit soared 2.2 times to VND 222.6 billion compared to the same period in 2024.

Key Drivers of TRC’s Remarkable Performance

TRC’s leadership attributed this exceptional performance primarily to the rise in average rubber latex prices for both the parent company and its Cambodian subsidiary.

Notably, the subsidiary, Tay Ninh Siem Reap Rubber Development Company, has made a substantial contribution. During the period, the parent company recorded a dividend income of VND 54.1 billion from the subsidiary. Additionally, revenue from rubber tree liquidation and reduced interest expenses at the subsidiary further bolstered overall profitability.

Robust Financial Health and Debt-Free Status

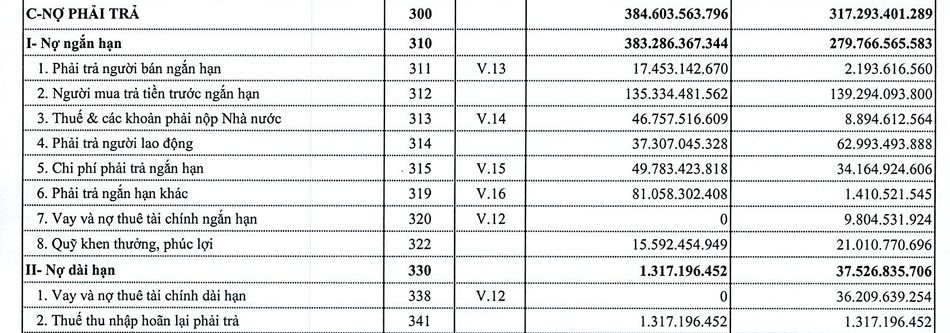

TRC’s financial health remains robust, with total assets reaching VND 2,436 billion by the end of Q3, an 11% increase from the beginning of the year. Cash and cash equivalents surged to VND 474 billion. Notably, the company has fully settled all financial liabilities, reducing its total debt from over VND 46 billion at the start of the year to zero, underscoring a strong and healthy financial structure.

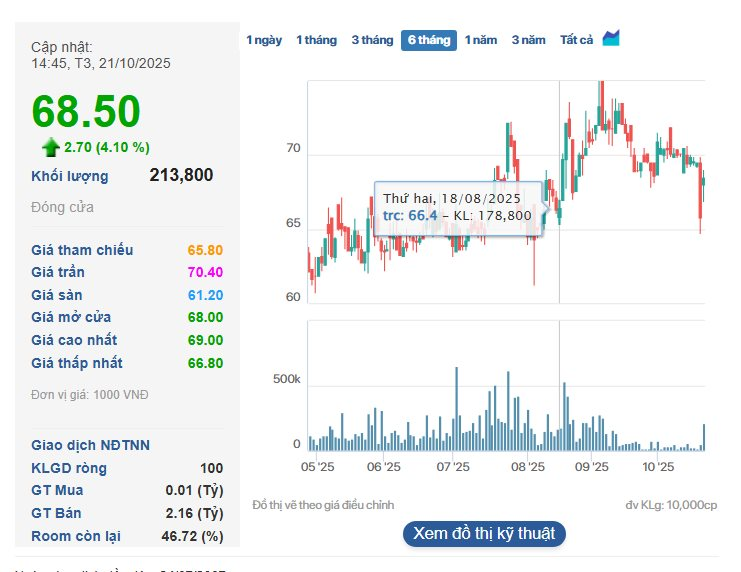

Strong Stock Market Performance

On the stock market, TRC’s share price has maintained an upward trend, rising from VND 62,000 per share in May to peak above VND 70,000 per share. As of the close of trading on October 21, the stock was trading at around VND 68,500 per share.

Thermal Power Company Reports 70x Profit Surge in First Nine Months of 2025

Net profit after tax in Q3 reached VND 214 billion, nearly five times higher than the VND 44 billion recorded in the same period last year.

Surprising Profit Surge: 4 Vietnamese Companies on the Stock Market Making Headlines

GELEX Electric’s after-tax profit for Q3/2025 soared by 329% year-over-year, reaching an impressive 1.791 trillion VND.