|

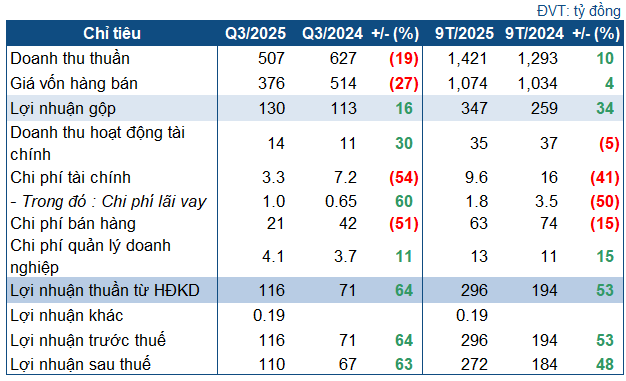

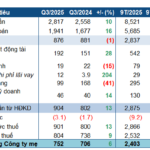

PAT’s Q3/2025 Business Targets

Source: VietstockFinance

|

Specifically, PAT achieved a net revenue of VND 507 billion in Q3, a 19% decrease compared to the same period last year. However, the cost of goods sold dropped significantly by 27% to VND 376 billion, resulting in a gross profit of VND 130 billion, up nearly 16%.

Financial activities during the period were efficient, with financial revenue increasing by 30% to VND 14 billion, while financial expenses decreased by 54% to VND 3.3 billion. Notably, selling expenses plummeted by 51% to VND 21 billion. After deducting all expenses, PAT recorded an after-tax profit of VND 110 billion, a 63% increase.

According to PAT‘s explanation, the decline in output and revenue in Q3/2025 was offset by a 10% increase in the selling price of yellow phosphorus and a significant reduction in selling expenses, leading to robust profit growth.

The cumulative picture for the first nine months of PAT is equally promising, with net revenue rising by 10% year-on-year to over VND 1.4 trillion; after-tax profit reached VND 272 billion, up 48%. Thus, the company has achieved 78% of its revenue target and nearly 91% of its profit plan assigned by the Annual General Meeting.

As of the end of September, PAT‘s total assets amounted to nearly VND 1.15 trillion, a 23% increase from the beginning of the year. Cash and cash equivalents surged to over VND 702 billion, 63% higher than at the start of the year and accounting for 61% of total assets. Meanwhile, inventory decreased by 26% to VND 63 billion.

On the capital side, total liabilities rose by 5.8% to VND 385 billion, all of which are short-term debts. Within this, short-term payables to suppliers decreased sharply by 54% to VND 87 billion, but short-term loans increased significantly to VND 194 billion, 2.3 times higher than at the beginning of the year.

– 3:58 PM, October 24, 2025

FPT’s Deposits Surge to New Heights, Earning Over 4.5 Billion VND in Interest Daily

FPT Corporation (HOSE: FPT) not only set a new quarterly profit record but also boasts nearly VND 37,000 billion (USD 1.4 billion) in bank deposits, generating an average daily interest income of over VND 4.5 billion in the first nine months of the year.

German Chemicals Giant Duc Giang (DGC) Posts Modest Profit Growth Through Cost-Cutting Measures

Leveraging its substantial cash reserves and streamlined sales expenses, Duc Giang Chemical Group Corporation (HOSE: DGC) reported a net profit of over VND 752 billion in Q3/2025, marking a slight increase year-over-year despite a modest decline in gross profit.