|

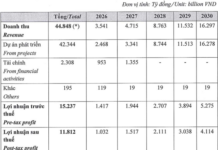

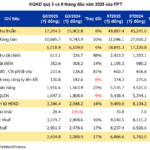

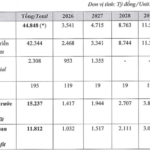

NBP’s Q3/2025 Business Targets

Source: VietstockFinance

|

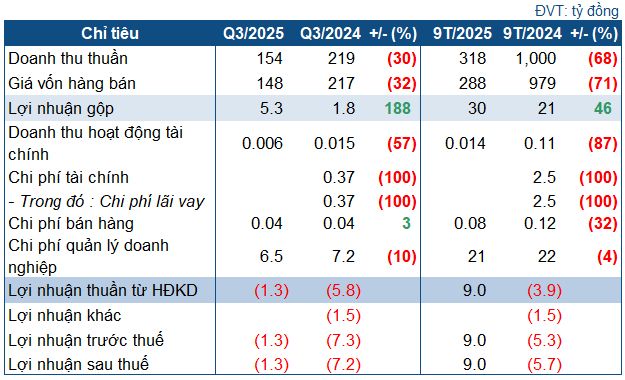

In Q3/2025, NBP’s net revenue reached VND 154 billion, a 30% decline year-over-year. Cost of goods sold dropped more significantly (32%) to VND 148 billion, resulting in a gross profit of nearly VND 5.3 billion, almost triple that of the same period last year.

However, this gross profit was insufficient to cover NBP’s expenses, despite the absence of financial costs and reduced business management expenses. Ultimately, the company reported a net loss of VND 1.3 billion, a substantial improvement from the VND 7.2 billion loss in the same quarter last year.

According to NBP’s explanation, the primary reason for this performance was the necessary shutdown of several units for routine maintenance starting August 15, 2025, which reduced fixed revenue. Nevertheless, the company implemented cost-saving measures, particularly in material expenses for repairs and other cash-related costs, thereby mitigating losses.

For the first nine months of 2025, cumulative net revenue decreased by 58% year-over-year to VND 318 billion, with a net profit of nearly VND 9 billion (compared to a loss of VND 5.7 billion in the same period last year). Against the 2025 Annual General Meeting’s approved plan, the company achieved 37% of its revenue target but exceeded its post-tax profit goal by 264%.

| NBP’s Business Performance |

As of the end of Q3, NBP’s total assets stood at VND 358 billion, a 25% decrease from the beginning of the year. Current assets fell by 30% to VND 256 billion. Cash reserves declined by 18% to VND 20.4 billion, while inventory dropped sharply by 49% to VND 95 billion.

On the capital side, a notable highlight was the 51% reduction in total liabilities compared to the start of the year, amounting to VND 121 billion. This was primarily due to a 62% decrease in short-term payables to sellers, which stood at VND 89 billion. The company also had no outstanding loans.

– 08:39 24/10/2025

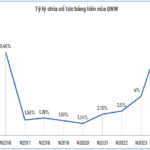

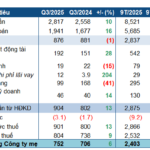

FPT’s Deposits Surge to New Heights, Earning Over 4.5 Billion VND in Interest Daily

FPT Corporation (HOSE: FPT) not only set a new quarterly profit record but also boasts nearly VND 37,000 billion (USD 1.4 billion) in bank deposits, generating an average daily interest income of over VND 4.5 billion in the first nine months of the year.

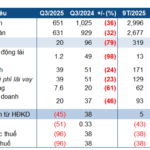

German Chemicals Giant Duc Giang (DGC) Posts Modest Profit Growth Through Cost-Cutting Measures

Leveraging its substantial cash reserves and streamlined sales expenses, Duc Giang Chemical Group Corporation (HOSE: DGC) reported a net profit of over VND 752 billion in Q3/2025, marking a slight increase year-over-year despite a modest decline in gross profit.