According to data from Phu Quy Jewelry Corporation, silver prices today have stabilized after a sharp decline, with 999 silver (1 tael) listed at VND 1,847,000 (buy) and VND 1,904,000 (sell). This trend has resulted in a 9% loss in silver value over the past week.

Meanwhile, 1kg silver bars (999 purity) also experienced a significant drop, priced at VND 49,253,210 (buy) and VND 50,773,206 (sell) as of 08:55 on October 23.

Globally, silver prices have fallen to $48.2 per ounce.

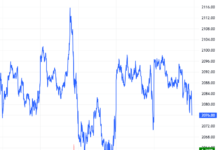

Silver prices dipped below $48.5 per ounce on Tuesday (October 22), continuing a 7% sell-off from the previous session as markets assess whether the recent rally has pushed the metal into overbought territory.

Silver prices on major exchanges have surged nearly 40% since late September, reaching a record high of $54.5 per ounce on October 17. Precious metals have rallied as the U.S. government shutdown, escalating geopolitical tensions, and unsustainable fiscal deficits in major economies have driven investors and governments toward safe-haven assets like gold and silver.

The rally has been amplified for silver due to bullish long-term bets on its industrial applications in electric vehicles, data centers, and solar farms, coupled with tight supplies at vaults in London and Shanghai.

“The trend of buying and accumulating silver in the coming years is clearly a sustainable growth trend. Both globally and in Vietnam, the focus is on achieving Net Zero. Therefore, over the next 30 to 40 years, silver demand will undoubtedly increase over time,” Mr. Huy added.

Silver Prices Plummet After Fierce Rally

Global silver prices plummeted over 7% due to profit-taking and a strengthening US dollar, dragging domestic prices down more than 4% on October 22nd, falling below the 1.7 million VND per tael mark.

Expert Insights: Silver Transcends Ornamental Value, Emerging as a Strategic Investment Avenue Alongside Gold

Silver is emerging as a compelling investment avenue, capturing the attention of investors seeking long-term growth and portfolio diversification. Renowned experts highlight its dual appeal as both a defensive asset and a store of value, mirroring gold’s traditional role. Additionally, silver’s critical role as a raw material in green energy production ensures its demand will continue to rise, solidifying its position as a forward-looking investment opportunity.