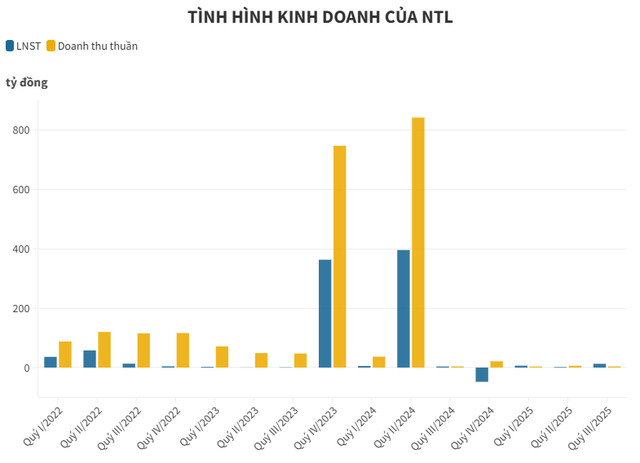

Urban Development Corporation Tu Liem (Lideco, HoSSE: NTL) has released its Q3 2025 financial results, revealing a continued reliance on financial activities rather than real estate operations.

In Q3, Lideco reported a net revenue of nearly VND 4 billion, flat compared to the same period last year, primarily from service provision with no contribution from real estate.

Meanwhile, the company recorded approximately VND 58 billion in financial revenue, entirely from interest on deposits and securities investments. This enabled the company to report a post-tax profit of nearly VND 13 billion, 3.5 times higher than the same period last year.

Notably, without financial activity income, the company would have reported a significant loss, as the cost of goods sold exceeded net revenue, resulting in a negative gross profit; additionally, other income was also negative at over VND 17 billion.

According to Lideco’s leadership, in 2025, the company will continue to explore investment opportunities in new projects valued at VND 1,500–2,000 billion through bidding, auctions, or joint ventures in approved projects to secure land in Hanoi and surrounding provinces.

While searching for new projects, NTL will increase short-term investments in securities to generate additional revenue.

For the first nine months, Lideco achieved a net revenue of VND 13.5 billion and financial revenue of VND 91.5 billion, resulting in a post-tax profit of VND 20.5 billion, a sharp decline from the VND 655 billion recorded in the same period last year.

As of September 30, 2025, Lideco’s total assets reached nearly VND 2,000 billion, a decrease of VND 200 billion compared to the beginning of the year. Cash and bank deposits accounted for VND 515 billion, while inventory stood at nearly VND 506 billion, primarily comprising work-in-progress costs for the Dich Vong Urban Area project in Hanoi.

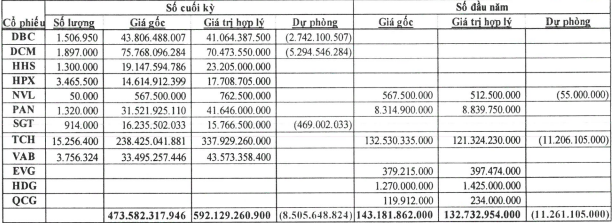

Notably, the trading securities portfolio had a book value of over VND 470 billion, a threefold increase from the beginning of the year. The fair value of this portfolio as of September 30 was VND 592 billion, indicating a temporary gain of VND 118 billion.

Currently, the company holds stocks such as DBC, HHS, HPX, NVL, PAN, SGT, TCH, and VAB. Among these, TCH generated the largest profit, nearly VND 100 billion. Compared to the beginning of the year, NTL has sold all shares of EVG, HDC, and QCG.

NTL’s securities portfolio as of September 30, 2025.

By the end of Q3, Lideco had no financial liabilities, with total payables amounting to only VND 243 billion, a 42% decrease from the beginning of the year. The majority of this debt is payable to Ha Do Group Corporation (HDG), related to product allocation in the Dich Vong project (VND 145 billion).

According to explanations, although reported as “payable,” this is not an actual payment obligation but rather an internal accounting cost during the cooperation between the two parties. The project has already allocated products, with Ha Do retaining plots CC3, DX1, DX2, and a mixed-use plot, while NTL continues to develop the remaining portions.

IMEXPHARM’s Gross Revenue Surges 21% to VND 2,118 Billion in First Nine Months of 2025

On October 20, 2025, Imexpharm announced its business results for the first nine months of 2025, reporting net revenue of VND 1,800 billion, a 16% increase compared to the same period last year, with EBITDA margin rising to 22.3%.

IMEXPHARM’s Net Revenue Surges 16% to VND 1.8 Trillion in First Nine Months of 2025

In September 2025, Imexpharm’s pre-tax profit surged by 101%, while EBITDA grew by 48%. For the first nine months of 2025, the company recorded gross revenue of VND 2,118 billion and net revenue of VND 1,800 billion, marking increases of 21% and 16%, respectively.