In the latest securities industry update, SSI Research anticipates a positive market sentiment throughout 2026, bolstered by market upgrades and a strengthening economic recovery.

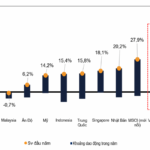

SSI analysts project that passive capital inflows, following FTSE’s official upgrade on October 8, 2025 (effective September 21, 2026), could surpass $1.6 billion. This influx is expected to enhance liquidity and reinforce valuations for listed companies.

Looking ahead, SSI believes Vietnam will continue its commitment to meeting MSCI’s criteria for an upgrade to Emerging Market status within the next 3–5 years. A key milestone in this roadmap is the implementation of a Central Counterparty Clearing (CCP) mechanism, which will align Vietnam with MSCI standards, attract institutional capital, and solidify the long-term growth prospects of the capital market.

Critical Criteria for the March 2026 FTSE Review

Regarding FTSE Russell’s mid-year review in March 2026, SSI highlights the most critical criterion: establishing a comprehensive legal framework enabling foreign institutional investors to trade through global brokerage partners.

This model is expected to align domestic trading practices with international standards, reduce counterparty risk, and enhance investor confidence by fostering relationships with reputable intermediaries.

The evaluation will focus on the role of global brokerages in trading activities—a pivotal factor in ensuring efficient index replication and meeting the operational needs of international asset managers.

According to SSI Research, market participants are currently discussing a draft model to streamline foreign investor participation in Vietnam’s equity market.

“Initial feedback from global brokerages indicates that while the proposed framework conceptually aligns with international practices, practical implementation requires further refinement for operational efficiency,” the report notes.

Nonetheless, SSI Research remains optimistic that amendments to the relevant circulars can be finalized before the March 2026 mid-year review, facilitating effective assessment and implementation.

IPOs and Capital Raises Remain Key Drivers for the Securities Sector in 2026

Additionally, IPOs and capital raises will continue to support the securities sector in 2026.

As the market anticipates FTSE Russell’s upgrade to Emerging Market status, financial capacity will be crucial for securities firms to capitalize on this growth wave.

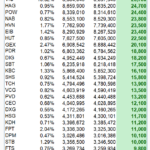

Consequently, a vigorous capital-raising race is underway across the industry. Notably, HCM, VND, and VCI have announced plans to issue new shares, aiming to boost equity and expand margin lending capacity.

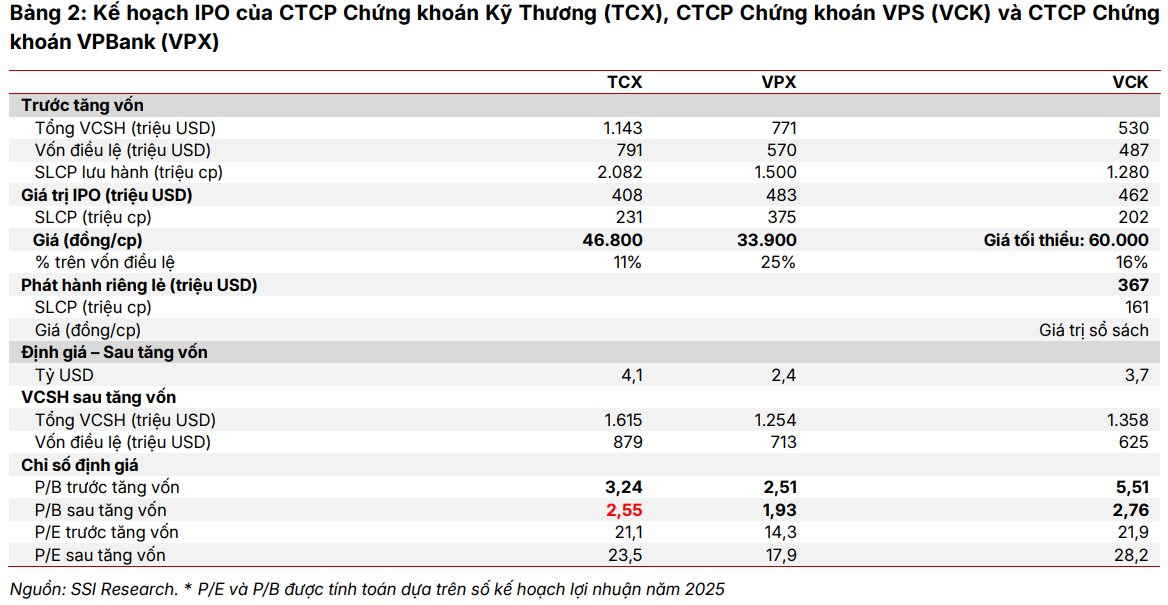

SSI also observes that the IPO wave in the sector is more vibrant than ever. TCX, the leader in listed corporate bond trading, debuted on October 21, 2025, marking the beginning of the IPO cycle in the securities industry.

Subsequently, VPX received approval for its IPO of 375 million shares (25% of its current outstanding shares), with a subscription period from October 6–31, 2025, and expected listing in December 2025.

Meanwhile, VPS, the market leader in brokerage, announced its IPO plans for Q4/2025 to Q1/2026, with registration and payment from October 16 to November 6.

The State Securities Commission has streamlined the IPO process by concurrently reviewing offering and listing applications, reducing approval time from 90 to 30 days.

This change enhances the appeal of IPOs for both domestic and foreign investors, boosting market liquidity and transaction volumes.

With these developments, SSI expects: “The IPO wave will expand beyond finance to sectors like F&B, manufacturing, and infrastructure, supporting investment banking revenue and sustaining market vibrancy in 2026.”

Profit Growth Momentum for Securities Firms to Continue

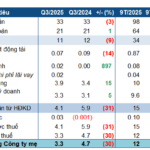

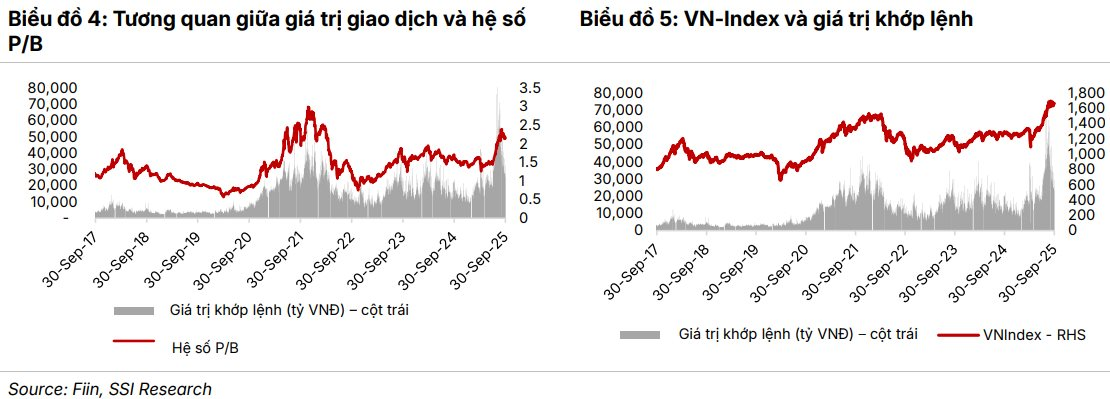

The report also highlights that the securities sector experienced a booming Q3/2025, driven by robust trading on both the spot and derivatives markets. Spot trading volume reached $106 billion, while derivatives surged to $125 billion—1.9 times the previous quarter, marking one of the most active periods in recent years.

Overall, pre-tax profits soared to $460 million, tripling year-on-year and doubling from the previous quarter, reflecting (1) sustained high market liquidity, (2) expanded client leverage, and (3) strong proprietary trading growth.

Going forward, SSI Research predicts that profit growth for securities firms will persist, fueled by high trading volumes, expanded margin lending, and upcoming IPOs.

Well-capitalized securities firms will have a significant advantage in this growth cycle, as capital raises enhance margin lending capacity. However, stock price movements in the sector typically correlate with market liquidity. Therefore, timing will be critical to optimizing returns in this highly cyclical industry.

MSN Tops ETF Buy List in Q4 Rally

According to SSI Research, during the Q4/2025 portfolio rebalancing, Masan (HOSE: MSN) is forecasted to rank among the Top 3 stocks with the strongest net buying by ETFs. Additionally, it is expected to enter the Top 10 of the STOXX Vietnam Total Market Liquid Index, a benchmark widely replicated by international investment funds.

Foreign ETFs Rebound with Net Buying Surge in Upgrade Week

During the week of October 6–10, the VanEck Vectors Vietnam ETF (VNM ETF) reversed its net selling trend, pivoting to robust buying of Vietnamese stocks. This shift coincided with FTSE Russell’s official announcement on October 8, upgrading Vietnam’s market classification from Frontier to Secondary Emerging status.

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

Foreign Capital Poised to Return to Vietnam’s Stock Market Following Upgrade Catalyst

FTSE’s updates could spark an immediate market response, but VNDirect anticipates a subsequent shift back to fundamentals as the driving force.