SMC Investment and Trading Joint Stock Company (stock code: SMC) announced the Board of Directors’ Resolution dated October 22, 2025, regarding the release of assets currently pledged at VietinBank – Ho Chi Minh City Branch (VietinBank – HCMC Branch) for liquidation and transfer.

Specifically, the assets pledged at VietinBank – HCMC Branch include over 10 million shares of Hoa Binh Construction Group JSC (stock code: HBC) and a deposit contract worth 10 billion VND.

Secondly, SMC Investment and Trading approved the release of assets pledged by SMC Steel Mechanical Engineering LLC at VietinBank – HCMC Branch for liquidation and transfer, including 62 billion VND in deposit contracts; real estate, and the entire existing machinery and equipment system, along with the 2018 ice melting production line.

Additionally, SMC Investment and Trading agreed to release assets pledged by SMC Steel LLC at VietinBank – HCMC Branch, including deposit contracts worth 29.5 billion VND; real estate, and machinery equipment lines in the Steel Pickling – Pressing – Plating workshop.

All proceeds from the asset liquidation will be used to settle existing debt obligations of member units within the SMC Investment and Trading Group that have credit relationships with VietinBank – HCMC Branch.

These resolutions were unanimously approved by 6 out of 8 Board members present.

The deadline for completion is set until the SMC Group companies fully repay their loans (principal, interest, and fees) to VietinBank HCMC Branch.

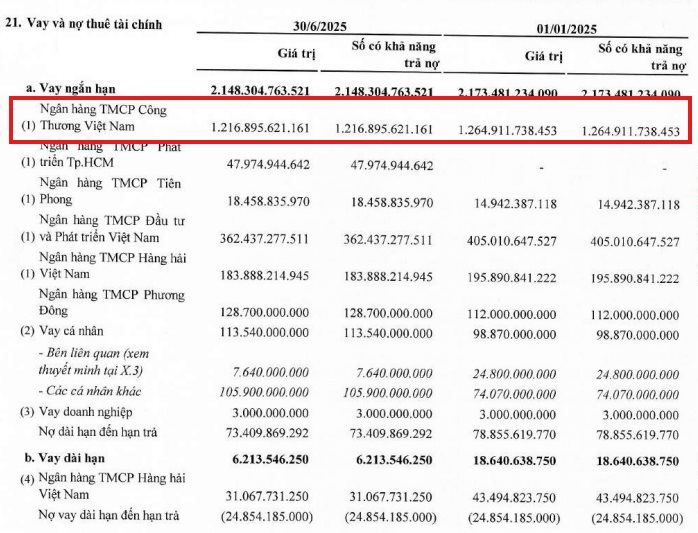

As of June 30, 2025, SMC Investment and Trading had outstanding loans totaling over 2,300 billion VND, four times its equity. This includes nearly 2,150 billion VND in short-term loans and approximately 180 billion VND in long-term loans.

The largest outstanding debt is nearly 1,217 billion VND at VietinBank.

In the first six months of 2025, the Group incurred a loss of 102 billion VND, resulting in an accumulated loss of 242 billion VND. Net cash flow from operating activities in the first half of 2025 was negative 129 billion VND. As of June 30, 2025, short-term liabilities exceeded short-term assets by 971 billion VND.

“These factors raise doubts about the Group’s ability to continue operating in the future,” the auditor emphasized in the 2025 Semi-annual Financial Review Report.

SMC was once Vietnam’s leading steel trading enterprise, achieving a record net revenue of 21,000 billion VND and after-tax profit of 901 billion VND in 2021. However, since 2022, business results have plummeted due to falling steel prices and difficulties in recovering receivables from customers in the construction and real estate sectors.

As of the close of trading on October 23, SMC shares were priced at 10,600 VND per share, a 37% decline compared to late September.

SMC Liquidates Over 10 Million HBC Shares and Assets to Settle Debts

SMC is seeking to liquidate nearly 10.5 million HBC shares and a series of assets currently pledged at the bank. The goal is to sell these assets and transfer ownership to settle outstanding debts.

“Two Hanoi Wards Under 2 km² Host Headquarters of Major Banks Like BIDV, Vietcombank, VietinBank, Techcombank, and More”

Nestled within their modest footprint, these two districts boast the highest concentration of bank headquarters in all of Hanoi.