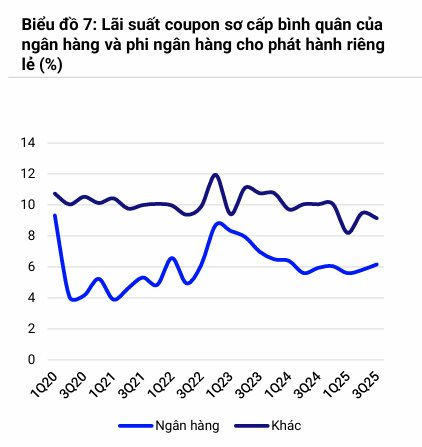

The recently released Q3/2025 Bond Market Report by S&I Ratings highlights a notable trend in the capital market. While banks are increasing coupon rates to raise capital, real estate (RE) and manufacturing companies are securing bond financing at lower costs than before.

Chart Source: S&I Rating; Data from HNX

According to S&I Ratings, RE firms’ capital-raising costs have significantly decreased over the past year, dropping by 50–150 basis points (0.5%–1.5%), despite less frequent issuances compared to banks. Notable examples include VinGroup and Vinhomes (from 12.5% to 11% annually), TCO Real Estate (from 9.6% to 9%), and Van Phu Invest (from 11% to 10%).

This trend extends to non-bank financial institutions and manufacturers. S&I reports that Technocom Securities (TCBS) reduced rates from 7.92% to 7%, and Bao Minh Securities from 10% to 8.5%.

For manufacturers, Vietnam Bond Market Association (VBMA) data shows September issuances by Vietjet Aviation (VJC) at 9.722% annually (5-year term) and Thanh Thanh Cong – Bien Hoa (SBT) at 9.5% annually (1-year term).

S&I Ratings attributes this shift to improved business conditions, a rebounding RE market, and new legal frameworks, all bolstered by positive macroeconomic data (via VBMA): Q3/2025 GDP grew 8.23%, and the manufacturing PMI remained at 50.4. These factors enhance non-bank enterprises’ creditworthiness, enabling them to negotiate lower issuance rates.

Conversely, banks’ funding costs are rising. S&I’s report shows Q3 average coupon rates climbed to 6.18%, a 6-quarter high. This is driven by increased capital needs to support credit growth, which reached 13.37% by September 2025 (VBMA data).

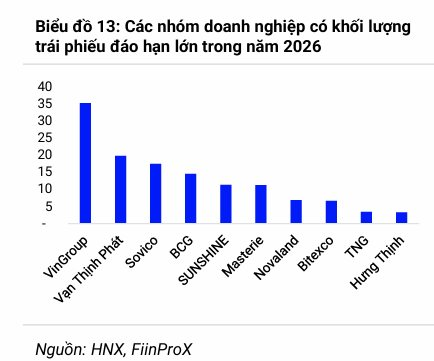

Despite lower costs, RE bond redemptions remain a significant challenge. VBMA data shows Q4/2025 redemptions total VND 18,331 billion (38% of the market). S&I predicts greater pressure in 2026, with total redemptions rising 26% to VND 233 trillion. RE redemptions will hit a record VND 141 trillion, up 81% from 2025, peaking late in the year.

Another key legal update is Decree 245/2025/ND-CP, effective September 11, 2025. It mandates credit ratings for all issuers (excluding banks and fully guaranteed bonds) during registration. S&I expects this to slow primary market activity initially but enhance long-term transparency and investor confidence, fostering sustainable market growth.