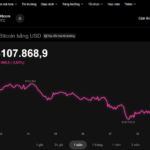

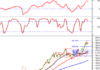

On the evening of October 22, the digital asset market experienced a slight decline. Data from the OKX exchange reveals that over the past 24 hours, Bitcoin (BTC) dropped by more than 0.3%, falling to $108,240.

Bitcoin Plunges to Around $108,000

Other major cryptocurrencies also saw downward movements. Ethereum (ETH) and XRP both decreased by nearly 1%, settling at $3,850 and $2.40, respectively. Solana (SOL) experienced a minor dip of 0.1%, reaching $185, while BNB saw a slight increase to $1,070.

According to CoinDesk, Bitcoin tumbled from $113,000 to around $108,000, halting its short-term recovery and resulting in over $600 million in liquidated derivative positions, as reported by CoinGlass.

Alex Kuptsikevich, a senior analyst at FxPro, noted that Bitcoin is retreating toward its 200-day moving average. It may consolidate around this level before potentially rallying if an optimistic scenario unfolds.

Bitcoin is currently trading at $108,240. Source: OKX

Alexia Theodorou, Director of Derivatives at Kraken, stated that despite the sharp decline, the market is showing signs of stabilization.

“The buy-sell ratio has returned to equilibrium, and many traders view the recent sell-off as overdone, now exploring opportunities for a rebound,” Theodorou commented.

Investors are now awaiting the U.S. Federal Reserve’s meeting on October 29, anticipating a 0.25% interest rate cut to boost liquidity.

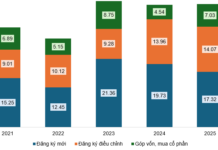

Mandatory 10-Year Storage of Crypto Transaction Data

The Anti-Money Laundering Department of the State Bank of Vietnam has announced new regulations requiring Vietnamese cryptocurrency service providers to store transaction data and customer information on domestic servers for a minimum of 10 years. This measure aims to combat money laundering and terrorist financing.

The State Bank is developing criteria to identify suspicious transactions in the digital asset sector. Under Resolution 05, providers must verify customers for transactions exceeding $1,000 and maintain records of transaction histories, wallet addresses, IP addresses, access devices, and linked bank accounts.

When engaging third-party services, organizations must ensure partners meet cybersecurity standards, protect data, and comply with anti-money laundering, terrorist financing, and proliferation financing regulations.

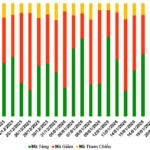

Notably, by the 10th day of the first month of each quarter, banks holding foreign investors’ dedicated accounts must submit written reports to the Ministry of Finance, Ministry of Public Security, and the State Bank (Anti-Money Laundering Department and Foreign Exchange Management Department). These reports detail the previous quarter’s inflows and outflows related to foreign investors’ cryptocurrency transactions.

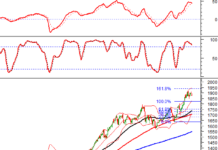

The Steepest Stock Market Plunge in History: Unraveling the Causes Behind the Dramatic Crash

The trading session on October 20th marked the most significant single-day decline in the history of Vietnam’s stock market, with the VN-Index plunging dramatically. Analysts suggest the market’s reaction was unexpectedly severe, surpassing even the most pessimistic forecasts. However, investors should avoid panic; this downturn presents a strategic opportunity for portfolio restructuring, particularly for those who remain calm and hold sufficient cash reserves.

Today’s Crypto Market, October 21: Another Enterprise Enters the Digital Asset Arena

Digital currency investors are forecasting a potential drop in Bitcoin’s value, predicting it could fall to $100,000 or even $95,000 if buying momentum fails to strengthen.

Today’s Crypto Market, October 19: How a 2-Person Company is Diving into Digital Assets

Bitcoin’s price trajectory is under scrutiny as experts forecast a potential dip to $95,000, with some even suggesting a further decline to the $91,000 range.