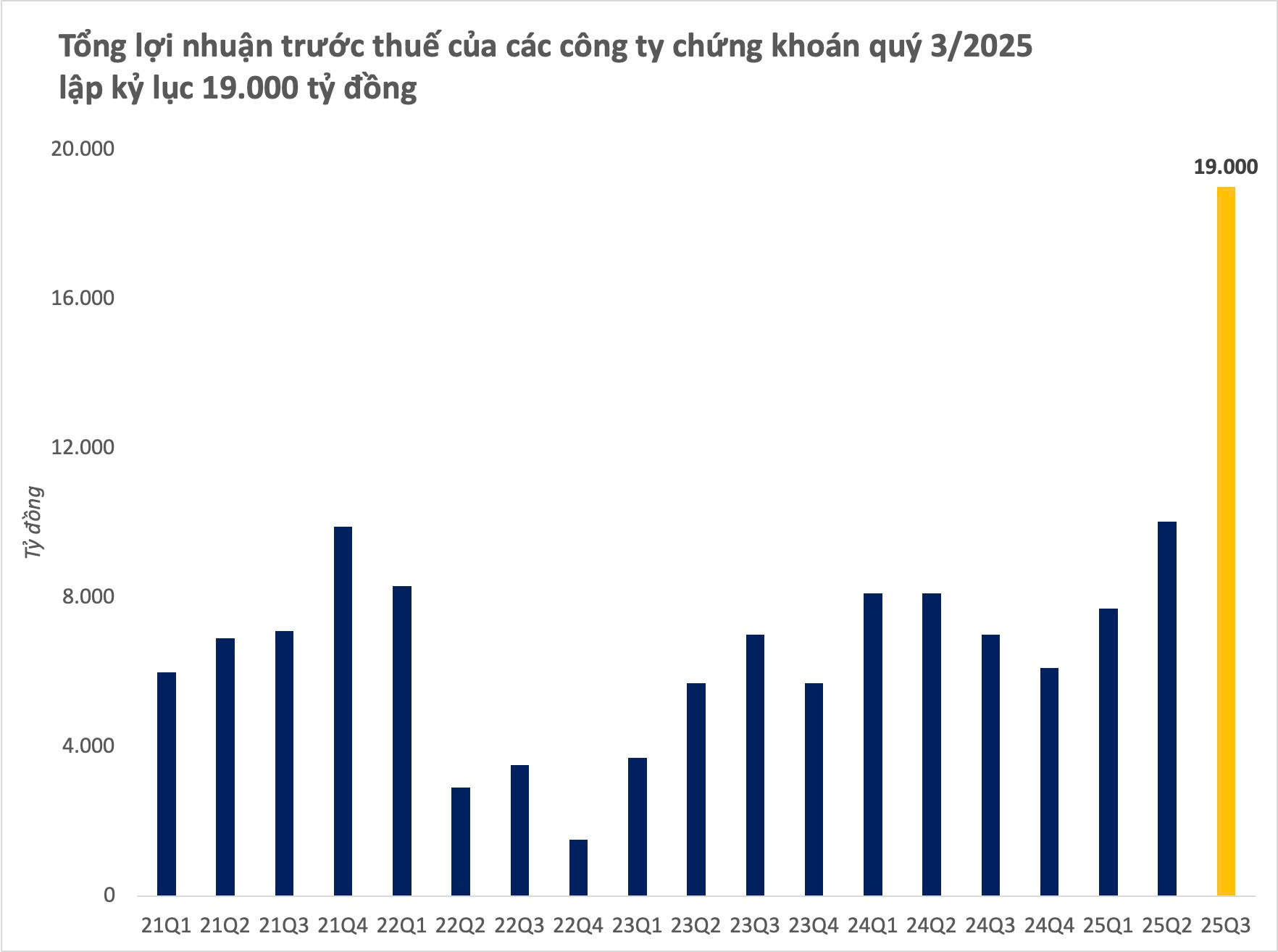

Vietnam’s stock market has just concluded its most vibrant quarter in years, marked by sustained high liquidity, dominant domestic capital flows, and a notable improvement in investor sentiment. Against this backdrop, securities companies—a group closely tied to the market—have experienced an unprecedented windfall.

Industry statistics reveal that the total profit for the third quarter of 2025 is estimated at approximately VND 19 trillion, a staggering 171% increase compared to the same period last year. This figure also surpasses the VND 10 trillion achieved in the previous quarter, setting a new all-time high for the industry.

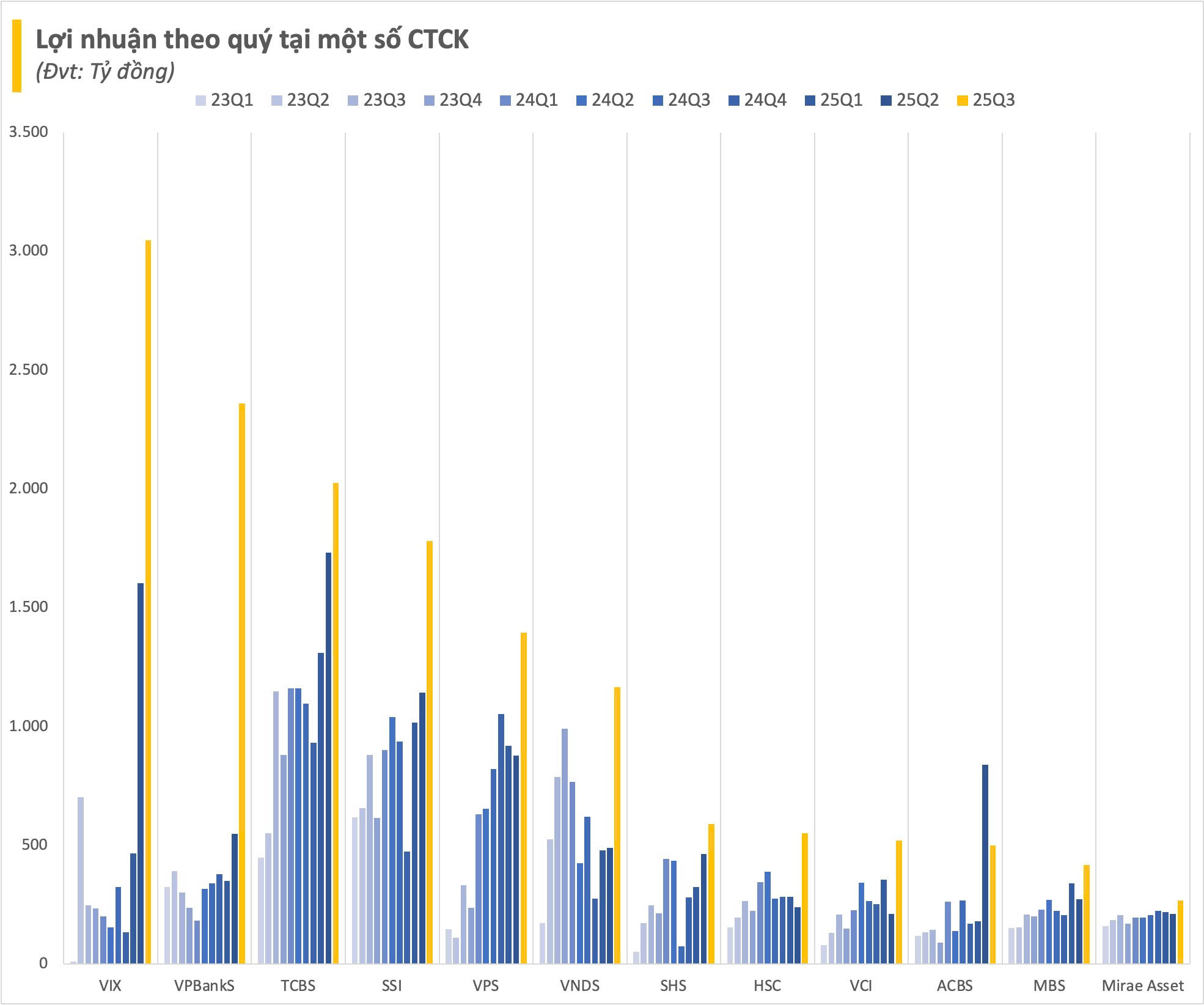

Within this overall picture, six securities companies reported profits in the thousands of billions in the third quarter. VIX Securities led the industry with a pre-tax profit of VND 3,048 billion in Q3, a remarkable 839% surge compared to the same period last year. In the first nine months, VIX achieved a profit of VND 5,116 billion, accounting for nearly 14% of the industry’s total profit.

VPBankS Securities emerged as a notable player, unexpectedly rising to second place in the industry in terms of profit. The company reported a profit of VND 2,360 billion, seven times higher than the same period last year. In the first nine months, VPBankS Securities earned a profit of VND 3,260 billion, nearly four times higher than the same period.

TCBS continued its stable performance with a pre-tax profit of VND 2,024 billion in Q3, an 85% increase compared to the same period. In the first nine months, TCBS profited VND 5,067 billion, ranking second in the industry.

Other familiar securities companies also reported impressive profits, including SSI with a pre-tax profit of VND 1,782 billion, VPS with VND 1,395 billion in Q2, and VNDirect with a pre-tax profit of VND 1,165 billion (up 73%).

Notably, some mid-sized and small securities companies achieved remarkable profit growth. OCBS Securities, for instance, reported a Q3 profit of VND 93 billion, a staggering 6,087% increase compared to the same period. This is the highest growth rate in the industry for this period, bringing OCBS’s nine-month cumulative profit to VND 101 billion, up 721%. Similarly, ASAM Securities reported a Q2 profit nearly 28 times higher than the same period last year, reaching VND 6 billion.

The industry’s profit landscape is brimming with highlights, with one-third of securities companies reporting profit increases of over 100% compared to the same period.

On the flip side, only about 10 companies reported losses in Q3, a record low. BIS Securities reported a loss of VND 7 billion, while it had profited VND 3 billion in the same period last year. Tan Viet Securities continued its losing streak with a Q3 loss of VND 6 billion, similar to CV Securities, which lost VND 5 billion.

The achievements in Q3 2025 have set a historic milestone with record-breaking profits. This aligns with the increase in lending balances among securities companies. As of the end of Q3 2025, the total lending balance (including margin and advance payments) at securities companies is estimated at approximately VND 383 trillion (~USD 14.5 billion), an increase of over VND 80 trillion compared to the end of Q2, marking an all-time high.

Of this, the margin lending balance is estimated at around VND 370 trillion at the end of Q3, an increase of VND 78 trillion compared to the end of Q2, also the highest figure in the history of Vietnam’s stock market.

Simultaneously, the opportunity for a FTSE upgrade, potentially elevating Vietnam to the secondary emerging market status, opens doors to attracting billions of dollars in foreign capital and enhancing overall market liquidity. However, challenges and risks persist, including intensifying competition, margin call risks, and liquidity fluctuations if the market reverses. Therefore, risk management and financial capacity become critical factors distinguishing between sustainable growth and overheating.

Looking ahead, the growth prospects for Vietnam’s securities industry remain robust. After a prolonged accumulation phase, the market is transitioning into a more sustainable development cycle, where companies must proactively adapt, enhance competitiveness, and manage risks to fully capitalize on the potential of a capital market on the path to upgrading and international integration.

Diverse, Low-Cost Capital Mobilization: VPBankS’ Distinctive Competitive Advantage

Setting consecutive records in international capital mobilization with a total scale of $400 million in 2025 alone, VPBankS is solidifying its regional reputation and capabilities. Access to low-cost international capital, combined with domestic commercial bank funding and bond issuance, forms the foundation for VPBankS to maintain liquidity and expand its core business segments, including investment banking and margin lending.

Profits Surge Over 7,100%: Company Sets New Stock Market Record

After six months of implementing a comprehensive restructuring plan, OCBS Securities Corporation (OCBS) has unveiled its Q3 2025 business results, delivering a remarkable surprise. Key financial and operational metrics have surged dramatically, marking a pivotal milestone in OCBS’s transformation into a leading Investment Banking and Asset Management powerhouse.

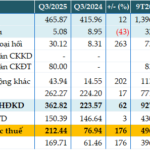

PGBank’s Q3 Pre-Tax Profit Surges 2.8x Year-Over-Year

Prosperity and Development Commercial Joint Stock Bank (PGBank, UPCoM: PGB) has released its Q3 2025 financial report, revealing a pre-tax profit of over 212 billion VND, a 2.8-fold increase compared to the same period last year. However, the bank’s non-performing loan ratio to outstanding loans edged closer to 4% by the end of Q3.

Vietnamese Billionaire Nguyễn Thị Phương Thảo Sets Unprecedented Record for Women in Vietnam

Nguyễn Thị Phương Thảo has made history as the first Vietnamese woman to achieve this remarkable feat. Her groundbreaking accomplishment sets a new standard, inspiring generations to come.