According to traders, on October 21st, they received a halt in procurement from warehouses due to ongoing testing procedures. Testing centers announced a temporary suspension of sample registration from 6 PM on October 21st, 2025, until 8 AM on October 27th, 2025, citing equipment maintenance.

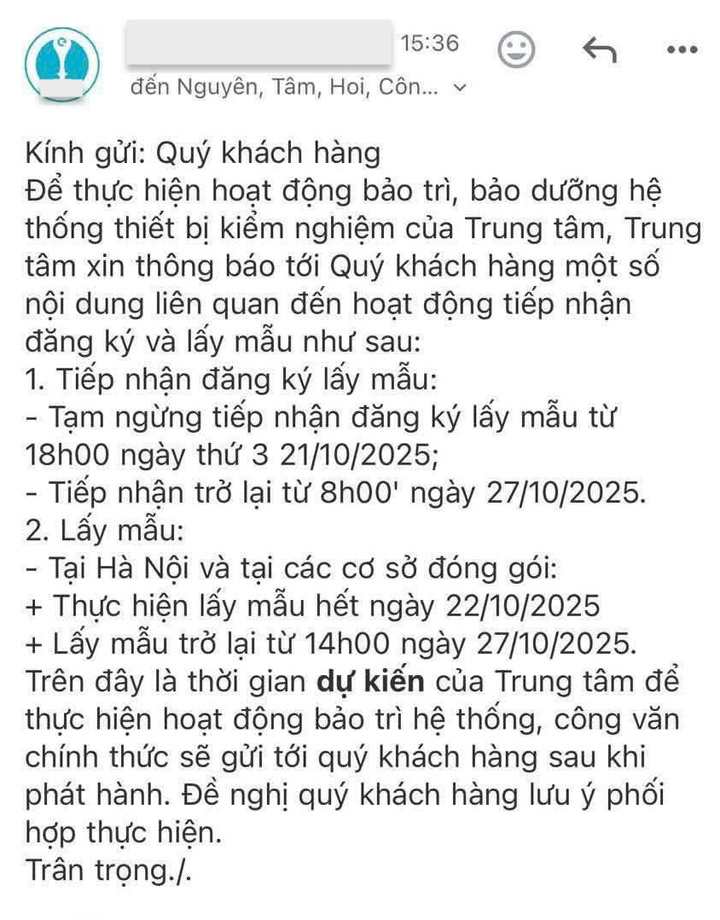

Suspension notice sent to customers.

This information caused panic among exporters and traders. Durian procurement groups immediately saw numerous posts regarding this issue.

Speaking to VTC News, Mr. Nguyen Huu Loi, a durian trader in Dak Lak, stated that many warehouses halted purchases, causing durian prices to plummet.

On October 22nd, farm-gate prices dropped by VND 15,000/kg compared to previous days, from VND 60,000 – 65,000/kg to VND 40,000 – 50,000/kg. Many traders who bought durians at VND 60,000/kg couldn’t sell to warehouses and had to offload them at VND 35,000/kg.

Mr. Loi explained that the warehouses’ suspension stemmed from testing centers halting operations until October 27th, preventing exports.

“Warehouses only accept pre-ordered goods now. New stock is completely halted. Traders like us are all at a loss. One ton of durian incurs a VND 15 million loss. I’ve signed contracts for over 300 tons, just deposits. Farmers are constantly calling, but not buying means losing deposits, which are already in the billions,” Mr. Loi said.

Similarly, Mr. Le Ngoc Vu, a long-time trader in Dak Lak, confirmed the suspension of testing centers and warehouses.

“Testing centers are all shut down, so no certification is issued. Without certification, clearance is impossible. They say testing will resume on October 27th, but it’s uncertain. Traders dare not buy as there’s no one to sell to,” Mr. Vu said.

According to Mr. Vu, the suspension might be due to suspected violations in durian export quality testing, involving heavy metal standards like cadmium and Auramine O.

Durians purchased by traders but unsold to warehouses.

Traders also reported that Grade A durian prices at warehouses dropped sharply, from VND 90,000 to VND 78,000 – 80,000/kg, with Grade B prices falling further and Grade C prices pressured downward.

Speaking to VTC News, Mr. Vo Tan Loi, former Chairman of the Tien Giang Durian Association (pending recognition as the Dong Thap Durian Association), stated that the suspension is linked to recent detections of Auramine O residue in durian exports to China.

“Domestic test results showed no issues, but Chinese tests detected Auramine O exceeding limits. Thus, testing centers are suspected of lacking transparency,” Mr. Loi said.

According to Mr. Loi, this incident led China to tighten controls, causing many companies to halt border shipments and containers to return. Warehouses in the Mekong Delta, preparing for the season, are also suspended. Farmers fear unsold ripe fruit, while businesses wait.

In Dong Thap, Mr. Nguyen Tuan Khanh, a trader, said that if orchards reach harvest time without sales, both traders and farmers will suffer losses. Some companies are returning goods to sell domestically, accepting losses. Prices today dropped by VND 15,000/kg compared to a few days ago.

Traders warn that if the situation isn’t resolved by October 27th-28th, thousands of tons of durians from Dak Lak, Lam Dong, and the Mekong Delta could be stranded. The VND 15,000 – 20,000/kg price drop is just the start, not accounting for storage, transportation, and spoilage risks.

Mr. Vo Tan Loi plans to petition the Departments of Industry and Trade, Agriculture, and Environment for an urgent meeting with businesses, cooperatives, and farmers. “We must immediately address weak links, especially chemical control and testing transparency. Otherwise, every season will face another crisis,” Mr. Loi said.

Mr. Dang Phuoc Nguyen, Secretary-General of the Vietnam Fruit and Vegetable Association, said the Association is closely monitoring border developments and exporter information. According to Mr. Nguyen, post-Mid-Autumn Festival, durian demand in China typically drops as the market slows after peak holiday consumption.

“At this time, Chinese importers tend to limit new transactions to clear existing inventory. This import slowdown is cyclical, not unique to this year,” Mr. Nguyen said.

Black Market Gold Rush Amid Soaring Prices: Experts Warn of Hidden Risks

Gold prices have soared to unprecedented heights, sparking a frenzy as individuals rush to procure gold through unofficial, “black market” channels. Experts caution against these clandestine transactions, highlighting a myriad of inherent risks associated with such off-the-books dealings.

Vietnam’s Fruit and Vegetable Exports Reach Unprecedented High

In September, Vietnam’s fruit and vegetable industry achieved a historic milestone, with export turnover reaching nearly $1.3 billion—the highest level ever recorded. Durian exports, the king of fruits, are leading the charge, propelling the sector toward a new record and paving the way to potentially hit the $8 billion mark this year.