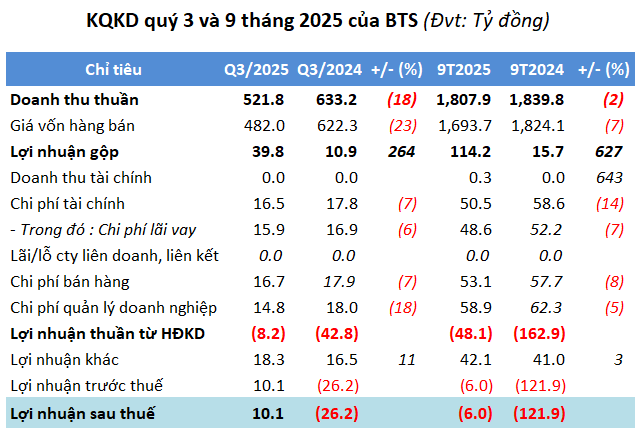

In Q3, VICEM But Son Cement JSC (HNX: BTS) reported net revenue of nearly VND 522 billion, an 18% decline year-over-year. Despite a significant drop in production costs, BTS achieved a gross profit of nearly VND 40 billion, a 3.6-fold increase compared to the same period last year. Consequently, the gross profit margin improved from 2% to 8%.

Total financial, selling, and administrative expenses remained high at nearly VND 48 billion, though down 11%, resulting in a net loss of over VND 8 billion.

However, other income of more than VND 18 billion from waste treatment helped BTS turn a profit, with a net income of over VND 10 billion, compared to a loss of VND 26 billion in the same period last year. This marks the second consecutive profitable quarter after a 10-quarter loss streak.

| BTS Net Profit from Q1/2022 to Q3/2025 |

For the first nine months, net revenue reached nearly VND 1,808 billion, a slight 2% decrease. BTS still recorded a net loss of over VND 6 billion, but this is a significant improvement compared to the VND 122 billion loss in the same period last year.

Source: VietstockFinance

|

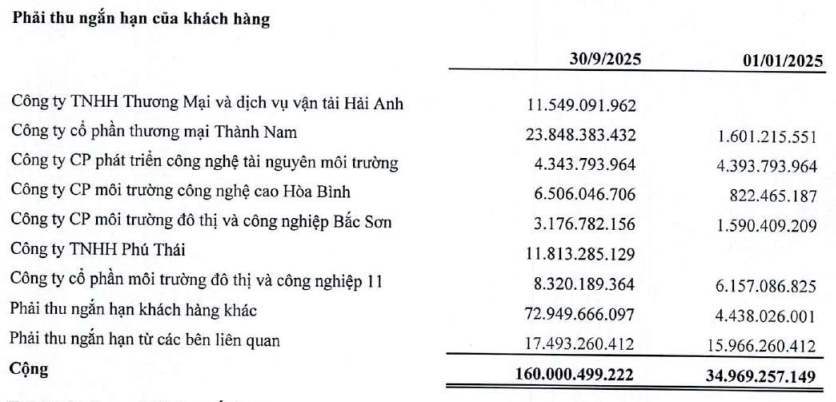

By the end of September, the company carried an accumulated loss of nearly VND 298 billion. Total assets increased by 5% since the beginning of the year to over VND 3,252 billion, but cash on hand dropped by 62% to nearly VND 38 billion. Notably, short-term receivables surged to over VND 257 billion, three times higher than at the start of the year, primarily due to customer receivables of over VND 160 billion.

Source: BTS

|

Inventory stood at over VND 607 billion, up 27%. Construction in progress increased by 72% to nearly VND 203 billion, focused on key projects such as the Ba Sao clay mine, Hoa Binh clay mine, and the dust filtration system upgrade.

Total liabilities reached nearly VND 2,192 billion, an 8% increase year-to-date. Financial debt alone accounted for nearly half at over VND 1,064 billion, despite a 7% reduction. The company also reduced its workforce by 37 employees over the past nine months.

– 16:15 22/10/2025

Profits Surge Over 7,100%: Company Sets New Stock Market Record

After six months of implementing a comprehensive restructuring plan, OCBS Securities Corporation (OCBS) has unveiled its Q3 2025 business results, delivering a remarkable surprise. Key financial and operational metrics have surged dramatically, marking a pivotal milestone in OCBS’s transformation into a leading Investment Banking and Asset Management powerhouse.

Q3/2025 Financial Report Deadline October 22: ACB Records Pre-Tax Profit of Nearly VND 5.4 Trillion, Vingroup Subsidiary Reports 58x Surge in 9-Month Profit YoY

Nam Tân Uyên (NTC) reported a remarkable 104% surge in pre-tax profit for Q3, reaching 151 billion VND. Meanwhile, Sông Đà Cao Cường (SCL) recorded a staggering 1,148% year-over-year increase in pre-tax profit, totaling 22 billion VND for the same quarter.