VICEM Hoang Mai Cement JSC (HNX: HOM) reported its Q3 2025 financial results, with net revenue reaching VND 377 billion, a 6% increase year-over-year. Net profit exceeded VND 8 billion, compared to a loss of over VND 11 billion in the same period last year, marking the highest profit in 13 quarters (since Q3 2022).

| HOM’s Net Profit from Q1 2022 to Q3 2025 |

HOM attributed this growth to higher clinker prices and increased production at its plant, along with nearly VND 4 billion in revenue from waste treatment services (operational since October 2024). Additionally, the use of alternative materials (bark, wood chips, and solid waste group I) in place of part of the coal dust in clinker production contributed to the profit increase.

Source: VietstockFinance

|

For the first nine months, net revenue was nearly VND 1,219 billion, a slight 1% increase year-over-year. After-tax profit reached VND 16 billion, compared to a loss of over VND 51 billion in the same period last year. With a 2025 target of VND 1,565 billion in revenue and VND 15 billion in after-tax profit, Hoang Mai Cement has achieved 78% of its revenue goal and surpassed its profit target by 7%.

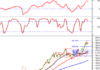

HOM shares surged to the ceiling price of VND 5,200 per share on October 22, with trading volume spiking to nearly 306,000 units, nine times higher than the previous session and the highest in nearly three months. Since the beginning of the year, HOM shares have risen by nearly 41%, with average liquidity of around 38,000 shares per session.

| HOM Share Price Trends Since 2025 |

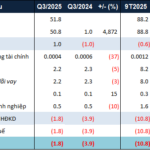

The company still faces financial challenges, with accumulated losses of over VND 79 billion as of September. Total assets increased by 17% since the beginning of the year to over VND 1,449 billion, but cash on hand plummeted by 92% to nearly VND 18 billion. Short-term receivables from customers exceeded VND 384 billion, 2.3 times higher than at the start of the year, while inventory also rose by 70% to nearly VND 153 billion.

HOM’s total liabilities stood at nearly VND 574 billion, a 51% increase year-to-date. Financial debt accounted for over VND 150 billion, up nearly 60%, representing 26% of the company’s total debt.

– 09:10 23/10/2025

Thermal Power Company Reports 70x Profit Surge in First Nine Months of 2025

Net profit after tax in Q3 reached VND 214 billion, nearly five times higher than the VND 44 billion recorded in the same period last year.