According to a report by Vietcap, on October 17, 2025, the Government Inspectorate of Vietnam issued Conclusion No. 276/KL-TTCP dated August 5, 2025, regarding compliance with legal regulations in the issuance and use of capital from privately placed corporate bonds (private corporate bonds) by 67 issuing organizations from January 1, 2015, to June 30, 2023 (the review period).

Vietcap notes that this is a retrospective compliance inspection under Decision No. 605, issued in October 2023, for bond issuances during the 2015–2023 period. It follows the tightened regulations and enforcement measures implemented in the bond market in 2022.

The inspection findings highlight past violations from the Government Inspectorate’s perspective, such as misuse of funds or errors in information disclosure. Vietcap emphasizes that these findings do not indicate further tightening of regulations in the corporate bond market.

Since late 2022, regulatory authorities have implemented stricter control measures and enhanced the legal framework for bond issuances to improve transparency, information disclosure discipline, and investor protection. These changes are reflected in Decree 65/2022/NĐ-CP, the 2024 Securities Law, and Decree 245/NĐ-CP.

The Government Inspectorate’s conclusion mentions Novaland Group and its subsidiaries (NVL) concerning compliance issues related to bond issuance, use of proceeds, information disclosure, and other matters, including principal and interest payments, real estate bond mobilization, collateral assets, and tax obligations.

On October 17, 2025, NVL issued an official statement responding to the Government Inspectorate’s conclusion on bond issuance. The statement clarifies issues related to the use of proceeds, information disclosure, principal and interest payment obligations, and collateral assets.

NVL asserts that it has utilized the bond proceeds in accordance with the approved issuance purposes and plans. Regarding the alleged use of proceeds to purchase equity contributions where the seller’s capital was not genuine, as mentioned in the inspection conclusion, NVL denies any involvement in the seller’s prior transactions.

On information disclosure, NVL attributes delays and minor omissions to objective factors and force majeure events beyond its control, particularly the COVID-19 pandemic. Once these challenges were resolved, NVL fully and accurately disclosed information as required by law.

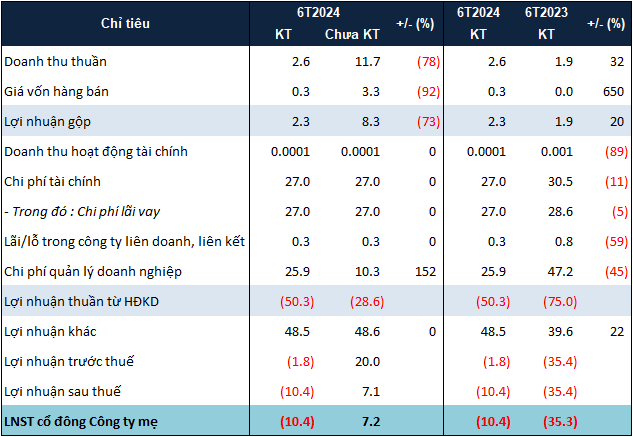

Regarding principal and interest payment obligations, NVL provided updates on bonds issued from February 1, 2015, to June 30, 2023. As of September 30, 2025, NVL had settled VND 15.3 trillion (approximately 44% of the outstanding debt as of June 30, 2023), with the remaining debt at VND 19.6 trillion.

For the 24 bond packages recommended by the Government Inspectorate for referral to relevant authorities: 15 packages (VND 7 trillion) have been fully settled (57.7% of the initial outstanding debt); 1 package (VND 250 billion) was restructured and extended; 7 packages are being repaid on schedule from legal project revenues; and 1 overdue bond has been reduced to VND 833 billion, with ongoing resolution through bondholder-approved measures.

Regarding collateral assets, NVL commits to complying with legal regulations and honoring agreements with bondholders. Additionally, NVL emphasizes that since late 2022, the company has proactively implemented corrective measures and is deploying flexible solutions to expedite the settlement of remaining debts to bondholders. NVL has submitted explanatory documents to the Government Inspectorate for reconsideration of the inspection conclusion and provided updates on outstanding debts and repayment plans, reaffirming its commitment to fulfilling bond obligations.

Vietcap believes that this inspection process will not significantly impact NVL’s business operations, although the company will continue to cooperate with authorities on any arising requests following the inspection conclusion.

In the short term, Vietcap expects NVL to focus on completing legal procedures for key projects and accelerating construction to deliver previously announced products. NVL may prioritize bank loans over new bond issuances.

Despite 2027 being a peak year for bond maturities, Vietcap anticipates that NVL can manage this pressure through improved sales cash flows and positive restructuring prospects.

Six issuing organizations under Masan Group (MSN, MCH, MML, WCM, MHT, and Nui Phao Mining Company) were named in the conclusion, with a total bond value of VND 19 trillion (2015–6/2023).

The violations of these six issuers include: (1) lack of detailed project information, disbursement schedules, and fund usage in issuance documents; use of the phrase “other permitted purposes under applicable law,” which is non-compliant; (2) misuse of bond proceeds; and (3) delayed information disclosure and other violations.

The Government Inspectorate requires the complete rectification of all concluded violations and urgent review, correction, and mitigation of deficiencies, violations, and resulting consequences. It also recommends that the Ministry of Finance and the State Securities Commission strengthen regulations, segregate accounts, and penalize non-compliant issuers.

Vietcap observes that no specific regulations or recommendations are likely to result in penalties or affect MSN and related companies’ future bond issuance capabilities. According to MSN, the companies have fully repaid all obligations for these bond issuances ahead of schedule. No penalties were imposed due to the expiration of the statute of limitations for administrative violations related to the mentioned bonds. MSN has also clarified related issues with authorities.

Cash Flow Monitoring: Revitalizing the Bond Market

The bond market thrives only when trust, knowledge, and discipline converge. When businesses treat transparency as a cornerstone, investors wield understanding as their greatest asset, and regulators harness data as a precision oversight tool, we create a market that is both secure and dynamic—one that fuels sustainable economic growth.

Government Inspectors Uncover Series of Bond Issuance Violations by Multiple Banks and Companies

Government inspectors have uncovered a series of bond issuance violations involving 5 banks, 37 joint-stock companies, and 25 limited liability companies.