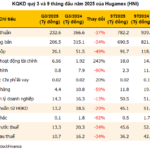

| Vinaseed’s Quarterly Business Results 2020-2025 |

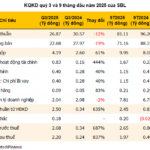

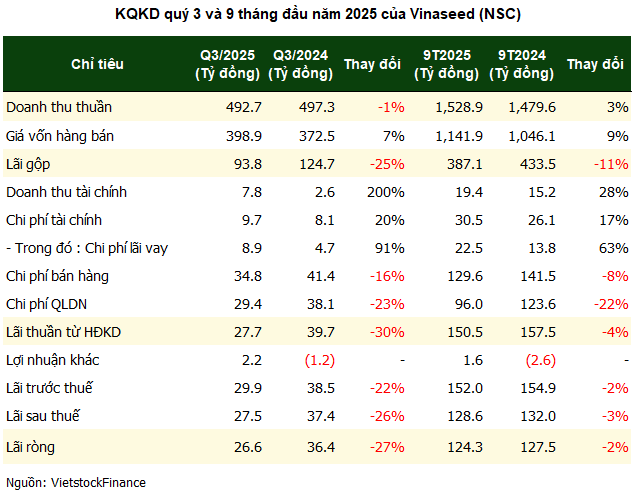

In Q3/2025, Vinaseed recorded a gross profit margin of 19%, the lowest in its operational history, even below the previous record low of 23% set nearly two decades ago. In the same period in 2024, this metric exceeded 25%.

This decline is attributed to a slight 1% drop in net revenue to below VND 493 billion, while the cost of goods sold increased by 7% to nearly VND 399 billion, accounting for 81% of revenue. The shrinking gross profit margin resulted in a net profit of only VND 26.6 billion, a 27% decrease year-over-year and the lowest since Q2/2020, despite significant cuts in selling expenses (down 16%) and administrative costs (down 30%).

Vinaseed cited the leap year as the primary cause, which shifted the planting season for the autumn-winter crop, slowing sales progress and reducing both revenue and profit for the quarter.

|

Strong Financial Activity but Ballooning Debt

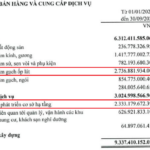

Amid weakening core business performance, financial revenue in Q3 reached nearly VND 8 billion, a 200% increase year-over-year, boosting total financial revenue for the first nine months to over VND 19 billion, up 28%. Interest income from deposits accounted for nearly half of this. As of September, Vinaseed held nearly VND 340 billion in bank deposits, a 23% increase from the beginning of the year.

However, the company also significantly increased its short-term borrowings. Total financial debt at the end of the period reached over VND 753 billion, nearly four times the amount at the start of the year. Vietcombank – Thang Long Branch is the largest creditor with over VND 226 billion, followed by Standard Chartered Bank with nearly VND 169 billion. Interest expenses for the first nine months totaled VND 22.5 billion, a 63% increase year-over-year.

Declining Nine-Month Profit and Surging Inventory

Due to rising interest expenses and a shrinking gross profit margin, Vinaseed reported a net profit of just over VND 124 billion for the first nine months, a 2% decrease year-over-year, despite a 3% increase in revenue to nearly VND 1,529 billion—the highest nine-month revenue in its history. The company has achieved 56% of its annual revenue target and 49% of its profit goal.

Notably, inventory surged to over VND 1,043 billion as of September 30, 2025, an 86% increase from the beginning of the year. Finished goods accounted for nearly VND 956 billion, double the amount at the start of the year, indicating a significant volume of unsold products.

On the HOSE, the NSC stock closed at VND 79,100 per share on October 24, up slightly by over 5% in the past year. Average liquidity remains below 4,000 shares per session. Compared to its historical peak of nearly VND 88,000 per share in late February 2025, the current price has fallen by approximately 10%.

| NSC Stock Price Performance Over the Past Year |

– 16:58 24/10/2025

May Hữu Nghị Surpasses Profit Targets Despite Two-Year Low in Gross Margin

Despite facing significant challenges due to adverse U.S. tariff policies, which led to a sharp decline in gross profit margins in Q3, Huu Nghi Garment Corporation (Hugamex, UPCoM: HNI) has successfully surpassed its 2025 profit targets. This achievement is attributed to a substantial increase in financial revenue and the company’s ability to maintain a debt-free status.

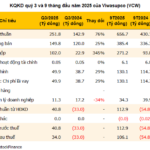

Viwasupco Posts Massive Profits, Seeks Delisting Amid Soaring Debt of Over VND 3,500 Billion

Viwasupco (UPCoM: VCW) reported a remarkable turnaround in Q3 2025, posting a net profit of VND 34 billion, a stark contrast to the VND 33 billion loss incurred in the same period last year. Amidst this robust business recovery, the company is seeking shareholder approval to delist and revoke its public company status.

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.

Construction Firm Poised for 230% Profit Surge After Securing $1.1 Billion in Contracts

With a projected surge in financial profits, Vietcap forecasts VCG’s after-tax profit to reach VND 3,700 billion in 2025, marking a remarkable 236% growth compared to the same period last year.