VND 8 Trillion in Bonds Flows into Thoi Dai Moi T&T in a Single Day

According to the Hanoi Stock Exchange (HNX), Thoi Dai Moi T&T Joint Stock Company (Thoi Dai Moi T&T) has announced the issuance results of its NTJ32502 bond series.

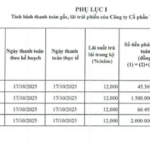

The bond series has a face value of VND 100 million per bond, with a total issuance value of VND 2.5 trillion, a 12-month term, and is denominated in VND for domestic issuance.

The issuance and completion date is October 14, 2025, with a 12-month term, and the bonds are expected to mature on October 14, 2026.

Notably, on the same day, October 14, 2025, Thoi Dai Moi T&T also issued 55,500 NTJ12501 bonds with a face value of VND 100 million per bond, successfully raising VND 5.5 trillion. These bonds have a 36-month term and are expected to mature on October 14, 2028.

Details about bondholders, issuance purposes, and collateral assets have not been disclosed. However, according to HNX, the NTJ32502 series has an issuance interest rate of 8.95% per annum, while the NTJ12501 series has a combined interest rate of 9.45% per annum.

Just days before the issuance of these two bond series, Thoi Dai Moi T&T pledged the rights arising from Business Cooperation Contract No. 01/2025/HTĐT/CTC-T&T, signed on October 9, 2025 (effective October 9, 2025), and its accompanying agreements and appendices (if any) with Capitaland Tower at Techcombank (TCB).

In addition to the above contract, the basis for the arising rights also includes the Component Project Transfer Contract No. 3009/HĐCNMPDABĐS/DLCG-CTC, signed on September 30, 2025 (effective September 30, 2025), between Can Gio Tourism Urban Area JSC and Capitaland Tower. According to this contract, Can Gio Tourism Urban Area transferred a portion of the Can Gio Coastal Tourism Urban Area Expansion Project to Capitaland Tower, located in Long Hoa Commune and Can Thanh Town, Can Gio District, Ho Chi Minh City (now Can Gio Commune, Ho Chi Minh City).

Also, in early October 2025, Thoi Dai Moi T&T pledged all property rights and receivables arising from and/or related to Business Cooperation Contract No. 02/2025/HTĐT/CTC-T&T, signed on October 7, 2025, between the company and Capitaland Tower, at Techcom Securities (TCBS).

Rendering of the Vinhomes Co Loa project.

Thoi Dai Moi T&T is known as the investor of land plots CCĐT-01, CCĐT-02, and CCĐT-03, which are part of the new urban area development project in Xuan Canh, Dong Hoi, and Mai Lam communes, former Dong Anh District, Hanoi. This project is known as Vinhomes Co Loa, with the commercial name Vinhomes Global Gate, and is invested by Vietnam Exhibition and Fair Centre JSC (VEFAC).

Previously, in March 2025, the Hanoi People’s Committee issued Decision No. 1408/QĐ-UBND, allowing VEFAC to transfer a portion of the Vinhomes Co Loa project to Thoi Dai Moi T&T.

The transferred portion includes land for high-rise and low-rise housing, mixed-use buildings, and public land for commercial purposes, with a total area of 75 hectares, of which nearly 43 hectares are residential land and 32 hectares are public land. The total investment for the transferred portion is approximately VND 30,360.5 billion.

The transferred project portion has completed land clearance and is currently under construction according to the approved investment plan.

The funds for paying a portion of the transfer price come from the cooperation agreement between Thoi Dai Moi T&T and Saigon Investment and Development JSC (SDI).

Specifically, according to our research, SDI and TCO Real Estate Consulting and Trading JSC (TCO) signed Business Cooperation Contract No. 1003/2025/HTĐT/SDI-TCO, effective March 10, 2025, to contribute capital and cooperate in business activities.

Based on the capital contribution from TCO, SDI will fulfill its capital contribution obligation with Thoi Dai Moi T&T, allowing T&T to pay a portion of the transfer price to VEFAC.

Regarding the project transfer between VEFAC and Thoi Dai Moi T&T, on September 12, 2025, Thoi Dai Moi T&T pledged all proceeds, business benefits, and land use rights exploitation value from its owned portion of the Vinhomes Co Loa project at TCB.

TCB is also a familiar credit partner of Thoi Dai Moi T&T, as the company has frequently conducted secured transactions with this bank.

According to our research, in 2024, Thoi Dai Moi T&T used its asset rights, such as debt claims and insurance benefits, obtained by the guarantor under the Assignment Agreements of Sales Contracts with Mr. Nguyen Thanh Tung and Mr. Nguyen Duc Thuan, to secure the transfer of Sales Contracts signed between Mr. Nguyen Thanh Tung and Elegance Real Estate Investment JSC, and between Mr. Nguyen Duc Thuan and Elegance Real Estate Investment JSC for apartments in the HH4-1, HH4-2, HH4-3 Office-Service-Commercial Apartment Building Complex, Saigon – Ba Son, at TCB and TCB Medium-Sized Corporate Banking Division.

What is Thoi Dai Moi T&T’s Financial Strength?

Thoi Dai Moi T&T was established in late 2006 and is headquartered at T-Place, 30A Ly Thuong Kiet, Hanoi.

At the time of establishment, Thoi Dai Moi T&T had four founding shareholders. According to the business registration change in October 2016, the company had a charter capital of VND 1.2 trillion, with only one remaining founding shareholder, Tan Hoang Minh Hotel Trading Service LLC, holding 90.25% of the shares. The other three founding shareholders had transferred all their capital contributions.

Thoi Dai Moi T&T is known for its acquisition of 4,000 square meters of “prime land” at 22-24 Hang Bai in 2010. After years of inactivity, the project was launched as The Grand Hanoi.

After several adjustments, by mid-November 2024, the company’s charter capital reached VND 7,999.5 billion.

Currently, Thoi Dai Moi T&T has two legal representatives: Mr. Nguyen Van Hai (born 1970), Chairman of the Board, and Ms. Phung Thi Minh (born 1979), General Director.

Ms. Phung Thi Minh is also the representative of Thanh Quang Investment, Business, and Development LLC.

Thanh Quang was established in late January 2019 and is headquartered on the 1st floor of T-Place, 30A Ly Thuong Kiet, Hanoi. According to the registration change in November 2024, the company increased its capital from VND 2.8 trillion to VND 8.8 trillion. Notably, Mr. Nguyen Van Hai, Chairman of Thoi Dai Moi T&T, as mentioned above, is authorized to manage the entire VND 8.8 trillion capital contribution.

Vinhomes Invests Over 3,600 Billion VND to Settle Two Bond Lots

Vinhomes has successfully redeemed two bond lots, VHMB2325002 and VHMB232503, with a total payout exceeding 3.6 trillion VND.

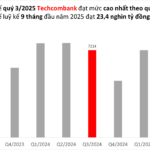

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.