On October 23, the Ho Chi Minh City Stock Exchange (HOSE) announced the suspension of trading for VMD shares, effective immediately. This decision follows HOSE’s earlier request on October 6, urging VMD to disclose measures and a timeline to address the suspension and trading restrictions. Despite the deadline, HOSE has not received any response from the company.

Concurrently, VMD shares were downgraded from the restricted trading category to the limited trading category due to a delay in submitting the audited semi-annual financial report for 2025, exceeding the 45-day grace period. The stock has been suspended from trading since October 13, as the company failed to provide explanations or remedies after being placed under warning.

Prior to the suspension, VMD shares experienced a six-day consecutive decline from October 3 to 10, with the first two sessions (October 3-4) hitting the lower limit. This downturn followed a three-day rally from September 30 to October 2, during which the stock reached a near two-year high of VND 20,700 per share on October 2. Subsequently, it plummeted over 20% to VND 16,300 per share within a week, just before the suspension.

Volatile VMD share price before trading suspension – Source: VietstockFinance

|

| VMD Share Price Performance Over the Past Year |

HOSE has repeatedly reminded VMD of its obligations. On September 4, the exchange urged the company to promptly submit the audited semi-annual financial report for 2025. Previously, authorities had issued two warnings regarding delays in publishing the Q2 2025 financial report and the six-month corporate governance report.

On September 10, HOSE added VMD to the list of securities ineligible for margin trading due to a five-day delay in report submission. By September 16, the stock was officially placed under warning from September 23 for exceeding the 15-day reporting deadline.

Prolonged Internal Turmoil and Legal Challenges

In late July, Vimedimex requested a three-month extension for submitting the 2025 semi-annual financial report, citing “force majeure.” The company attributed the delay to ongoing legal issues persisting for several years.

Since 2021, former Chairwoman Nguyen Thi Loan has been imprisoned for 36 months due to land auction irregularities. The aftermath of this case has significantly hindered the completion of subsequent financial reports.

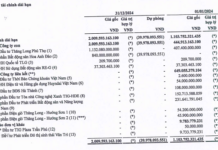

In correspondence with authorities, CEO Nguyen My Linh stated that the 2025 Annual General Meeting on June 26, 2025, rejected the 2024 financial report and demanded a re-audit of the 2022 report. Linh highlighted inaccuracies in various figures, including subsidiary and individual capital contributions, a VND 193 billion vaccine deposit in 2021, and over VND 200 billion in receivables from a Binh Duong subsidiary. The company’s leadership also accused the former Vice Chairman of manipulating data, causing financial losses.

To address these issues, Vimedimex requested an extension until October 28 for the 2025 semi-annual audited report, seeking additional time to verify and clarify data. The 2025 Annual General Meeting restructured the management team, appointing Le Xuan Tung as Chairman, Trinh Thanh Giang as Vice Chairman, and two new members to stabilize operations.

– 10:20 24/10/2025

HOSE Issues Trading Suspension Warning for Stock Amid Sudden Three-Session Limit-Down Streak

The sharp decline occurred immediately after HOSE announced a trading suspension due to the company’s delayed financial report submission and failure to provide a corrective action plan as required.

“CMISTONE’s Stock Trading Suspended Again Due to Negative Equity”

The Hanoi Stock Exchange (HNX) has decided to maintain trading restrictions on the shares of CTCP CMISTONE Vietnam (UPCoM: CMI).