According to the State Bank of Vietnam’s (SBV) report on the implementation of Resolution No. 62/2022/QH15 regarding questioning activities at the 3rd Session of the 15th National Assembly, the complete removal of credit growth quotas remains unachievable at this time.

The SBV cites the ongoing reliance on bank credit as the primary source of capital for the economy as the main reason. Without measures to control credit growth, there is a risk of repeating the consequences seen before 2011, including macroeconomic instability, rising inflation, and increased bad debt, which could threaten the safety of the banking system.

Image: Pham Hai |

Meanwhile, credit institutions are still in the process of restructuring and resolving bad debts, gradually improving governance standards to align with international practices.

Therefore, the SBV maintains that credit limits are essential to ensure the safety of the banking system. “The removal of this measure should be approached cautiously, with an appropriate roadmap, ensuring necessary conditions are met when sufficient control measures are in place,” the SBV stated.

Prior to 2023, the SBV assigned credit growth targets to individual credit institutions. In line with the National Assembly and Government’s policy to gradually eliminate credit growth quotas, in August 2024, the SBV announced that certain groups of credit institutions could independently manage their credit growth for 2024.

The SBV reports that credit growth remains safe, efficient, and healthy, with bad debt well-controlled, ensuring the safety of credit institutions’ operations. Credit is directed towards production sectors and priority areas driving economic growth, with strict control over high-risk sectors.

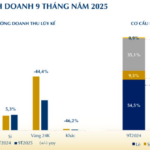

As of September 30, 2024, the entire system’s credit increased by 9% compared to the end of 2023 (6.92% in the same period last year). Credit institutions still have significant room for credit growth to provide loans to the economy.

By Tuan Nguyen

– 09:39 24/10/2025

Central Bank Injects Massive VND Liquidity into Banking System, Nearly 1/4 in 91-Day Term

Previously, OMO tenders primarily focused on maturities ranging from 7 to 28 days, meaning the SBV’s liquidity support to the banking system was short-term (under one month). However, with the 91-day tenor, these loans will not mature until late January 2026.

Three Cases of Deposit Insurance Payouts

According to the Governor of the State Bank of Vietnam, Nguyen Thi Hong, one of the significant new provisions in the draft is the regulation of the timing for insurance premium obligations to arise. This enables regulatory authorities to proactively manage risks and enhance protection for depositors.