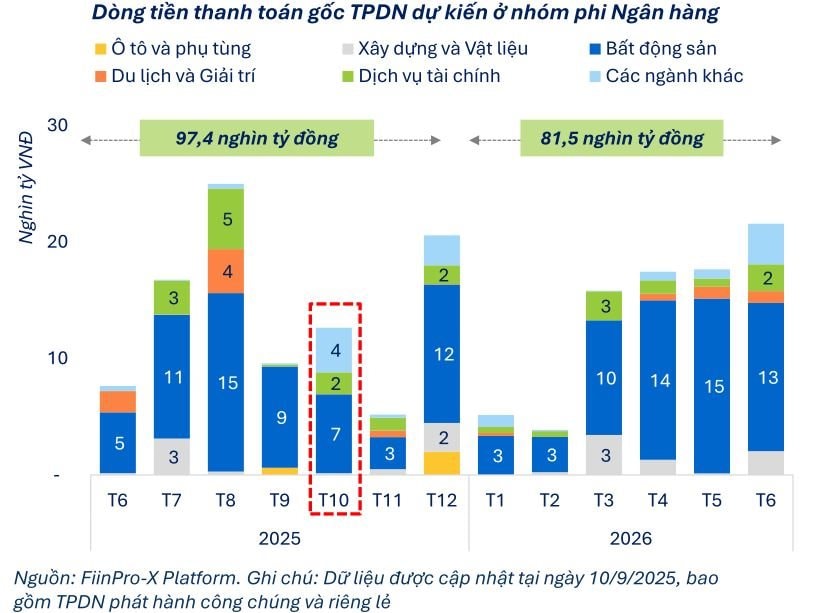

In October 2025, the total face value of maturing corporate bonds (TPDN) in the non-banking sector is estimated at VND 12.6 trillion, a 32% increase from September, with real estate remaining the focal point.

Real estate accounts for 53.5% of the non-banking sector’s total maturing principal, with approximately VND 6.8 trillion in bonds maturing in October, a 22% decrease from September.

Notable real estate companies with significant bond maturities in October 2025 include VHM (VND 3.5 trillion), Phu My Hung Development (VND 1.9 trillion), and Century Real Estate Development (VND 650 billion). This downward trend is expected to continue into November before rebounding in December, with VND 11.9 trillion in bonds maturing from Sun Valley Investment, TCO Real Estate, VHM, Newco JSC, and Phu Tho Land.

Additionally, over VND 2.2 trillion in TPDN is expected to mature in October in the Utilities sector, and nearly VND 1.9 trillion in the Financial Services sector.

Over the last four months of 2025, the non-banking sector’s maturing principal is estimated at VND 48 trillion. Real estate alone accounts for nearly 63%, highlighting the sector’s ongoing repayment pressure. In the first half of 2026, the non-banking sector is expected to have approximately VND 81.5 trillion in maturing bonds, with real estate continuing to dominate at 71%, equivalent to VND 57.7 trillion.

Bond Interest Payment Pressure

According to FiinRatings, interest payments remain concentrated in the non-banking sector. In October 2025, the non-banking sector’s interest payments are projected to reach VND 3.3 trillion, a 37.4% decrease from the previous month, marking the second consecutive month of decline.

The real estate sector’s share has dropped to 34% of the total, with expected interest obligations of around VND 1.1 trillion.

Other sectors recorded significantly lower values, including Utilities (VND 574 billion), Construction & Materials (VND 545 billion), and Tourism & Entertainment (VND 364 billion).

For the last four months of the year, the non-banking sector’s total interest payments are estimated at VND 21.9 trillion, with real estate accounting for nearly 54%, indicating persistent financial strain in this sector.

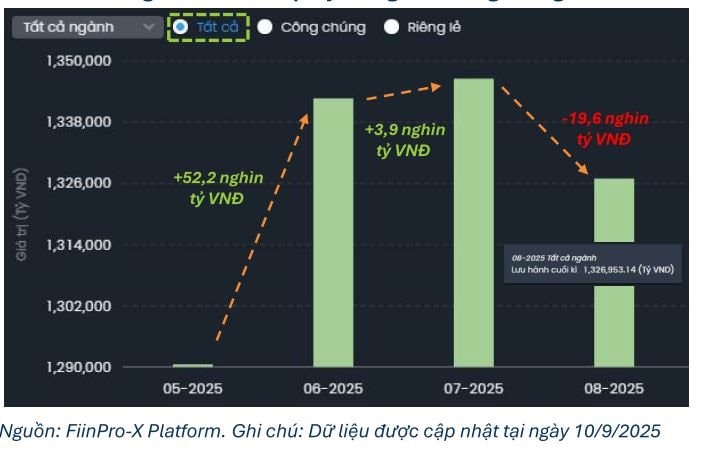

Decline in TPDN Market Size

FiinRatings data shows that the outstanding TPDN value decreased after a four-month growth streak. As of August 2025, the outstanding TPDN value reached approximately VND 1,330 trillion, up 7.1% YoY but down 1.5% MoM, breaking the consecutive growth since April. This decline is primarily due to increased buybacks and higher maturities (+84% and +102.8% MoM). New issuances rose only 33.1% MoM, insufficient to offset the bonds exiting the market.

Total outstanding TPDN value declined in August 2025

In terms of issuance type, the decrease was observed in private TPDN, with outstanding debt as of August 2025 at approximately VND 1,160 trillion (-1.9% MoM), representing 87.4% of the total market. Conversely, public TPDN increased slightly by 1.7% MoM. Notably, aside from bank issuances, the market saw a VND 2 trillion bond from a construction company.

Total TPDN issuance in August 2025 reached VND 60.6 trillion (+33% MoM), rebounding from July’s decline, with private issuances still dominant.

However, issuance volume remains 9% lower than the same period last year.

A highlight is the sustained activity in public issuances. Besides bank issuances, the market recorded a VND 2 trillion bond from CII, with a 10-year term and an average interest rate of 8.3% per annum.

In the first eight months of 2025, total issuance reached VND 374.6 trillion (+43% YoY), with public issuances surging 67% YoY.

In August, issuance structure was more balanced between banking and non-banking sectors. Specifically, banks accounted for 56.5% of total issuance, equivalent to VND 34.2 trillion, down 12.6% MoM and 35% YoY. In the first eight months of 2025, credit institutions raised over VND 272.6 trillion (+50% YoY), equivalent to 89.4% of the total issuance in 2024.

Real Estate Firms Face $6 Billion Bond Repayment Deadline in 2026

The total value of bonds issued by real estate companies set to mature in 2026 is projected to reach 141 trillion VND, marking an 81% surge compared to 2025.

Emerging Real Estate Hotspot: East Side of Ho Chi Minh City

East of Ho Chi Minh City, a series of landmark projects with a total investment of billions of dollars are nearing completion, poised to transform the real estate landscape into a vibrant new era.