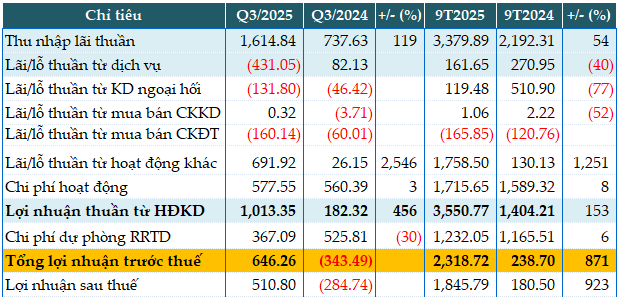

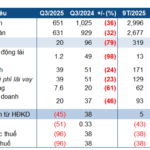

In Q3 alone, ABBank’s net interest income reached nearly VND 1.615 trillion, a 2.1-fold increase compared to the same period last year.

Conversely, non-interest income segments reported losses, including foreign exchange and investment securities. Notably, other operating income surged to nearly VND 692 billion, a significant rise from the mere VND 26 billion recorded in the same quarter last year.

Furthermore, operating expenses increased by only 3%, amounting to VND 577 billion. As a result, net profit from business operations exceeded VND 1.013 trillion, a 5.6-fold increase year-over-year.

Additionally, ABBank reduced its credit risk provisioning costs by 30%, down to over VND 367 billion. Key efficiency metrics showed substantial improvement compared to the same period last year, with a return on equity (ROE) of 16.5% and a cost-to-income ratio (CIR) decreasing to 33%. Consequently, pre-tax profit reached over VND 646 billion, a stark contrast to the loss reported in the same period last year.

For the first nine months, ABBank’s pre-tax profit totaled nearly VND 2.319 trillion, a 9.7-fold increase compared to the same period last year. Thus, after nine months, the bank has already surpassed nearly 30% of its annual profit target of VND 1.8 trillion.

|

Q3 and 9-month 2025 business results of ABB. Unit: Billion VND

Source: VietstockFinance

|

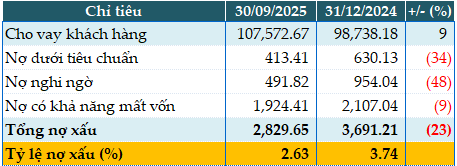

As of the end of Q3, ABBank’s total assets increased by 16% from the beginning of the year, reaching VND 204,576 billion. Customer deposits rose by 31% to VND 118,712 billion, while customer loans increased by 9% to VND 107,572 billion.

As of September 30, 2025, ABBank’s loan quality improved compared to the beginning of the year, with total non-performing loans decreasing by 23% to VND 2,830 billion. Consequently, the non-performing loan ratio to outstanding loans decreased from 3.74% at the beginning of the year to 2.63%. The non-performing loan ratio as per Circular No. 31/2024/TT-NHNN stood at 1.7%.

|

Loan quality of ABB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

In other developments, the State Bank of Vietnam (SBV) has approved ABBank’s request to increase its charter capital by VND 3,622 billion, a 35% increase from the current level. This includes VND 3,105 billion through a rights issue to existing shareholders and VND 518 billion through an employee stock ownership program. The total expected charter capital of ABBank after the increase will be VND 13,973 billion.

Mr. Phạm Duy Hiếu, CEO of ABBank, commented: “The positive business results in the first nine months demonstrate the development strategy that ABBank consistently pursues, balancing efficiency, sustainability, and creating value for customers, shareholders, and the community. The SBV’s approval to increase the charter capital by over VND 3,600 billion is a significant milestone, enabling the bank to strengthen its financial capacity, expand its operations, and develop new customer-centric products and services. This will further support our customers and shareholders in their long-term and sustainable growth journey.”

– 10:13 25/10/2025

BV Life Q3 Profits Surge by Nearly 2,800%, Stock Hits Ceiling for 3 Sessions Before Cooling Down

The sale of the 5th-floor office space in Tower 25T1 propelled BV Life JSC (HNX: VCM) to a remarkable Q3 net profit of over 31 billion VND, a staggering 28.5-fold increase year-on-year. This stellar performance fueled a three-session ceiling rally in the company’s stock, before a modest 3% correction on October 24th.

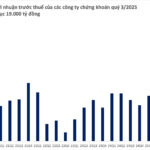

Unprecedented Milestone: Stock Group Achieves Record-Breaking $810 Million Pre-Tax Profit in Q3

The third quarter of 2025 marks a historic milestone as the stock market’s profits surged by 171%, fueled by vibrant liquidity and record-high margin debt levels.

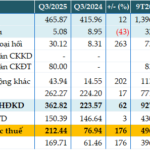

PGBank’s Q3 Pre-Tax Profit Surges 2.8x Year-Over-Year

Prosperity and Development Commercial Joint Stock Bank (PGBank, UPCoM: PGB) has released its Q3 2025 financial report, revealing a pre-tax profit of over 212 billion VND, a 2.8-fold increase compared to the same period last year. However, the bank’s non-performing loan ratio to outstanding loans edged closer to 4% by the end of Q3.