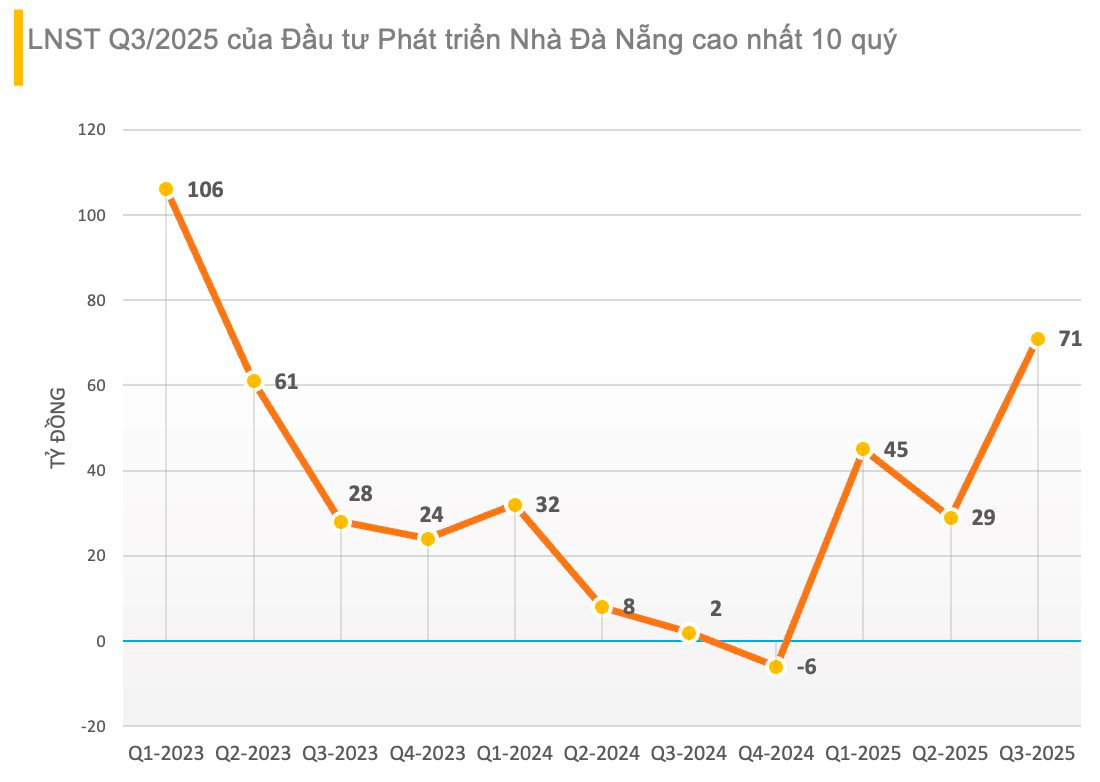

Da Nang Housing Development Investment Corporation (stock code: NDN) has released its Q3/2025 consolidated financial report, revealing a total revenue of VND 106 billion, doubling the figure from the same period last year.

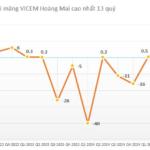

Total expenses decreased by 55% to VND 20 billion, while post-tax profit surged to VND 71 billion, a 36-fold increase from the VND 2 billion recorded in the same quarter last year. This marks the highest profit in 10 quarters since Q2/2023.

The company attributes the significant profit growth in Q3/2025 to positive shifts in the stock market and increased financial activity profits.

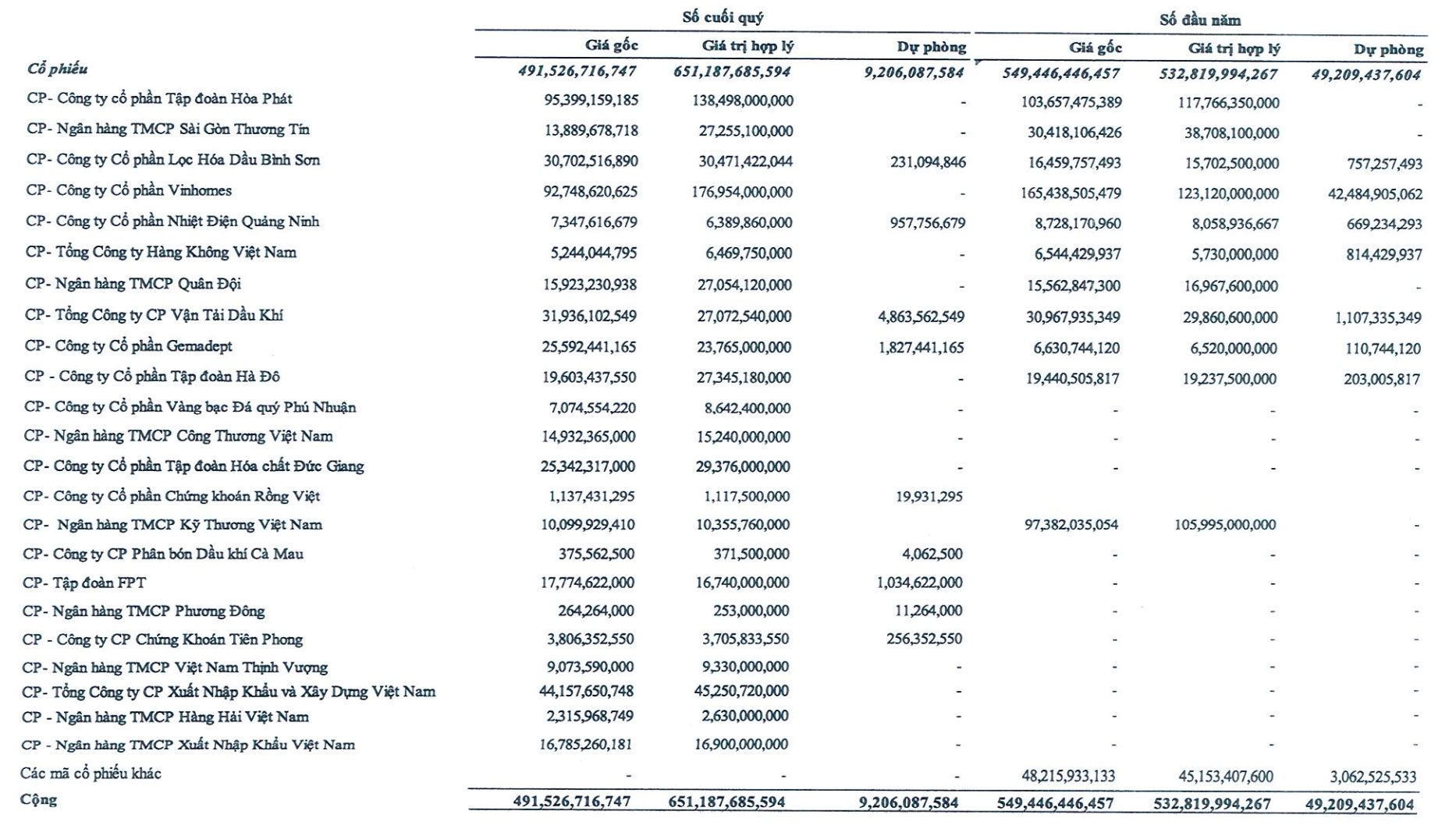

As of September 30, the market value of the trading securities portfolio reached VND 651 billion, 32% higher than the original cost, equivalent to a provisional profit of VND 159 billion. Most investments are profitable, with a depreciation provision of only VND 9 billion.

NDN realized partial profits from Vinhomes (VHM) shares, reducing the original cost from VND 131 billion to VND 93 billion, while the market value remains at VND 177 billion, double the capital cost due to VHM’s rising stock price.

Additionally, the company reduced its holdings in Gemadept (GMD) from VND 61 billion to VND 26 billion, currently incurring a loss of nearly VND 2 billion. Meanwhile, the investment in Idico (IDC), originally valued at VND 44 billion in Q2, has been removed from the portfolio, likely sold. Conversely, NDN added Vinaconex (VCG) with an original cost of VND 44 billion.

By partially realizing its portfolio, particularly VHM shares, the company achieved remarkable profits, despite sluggish core business performance.

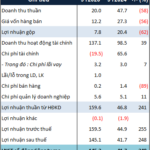

Over the first nine months, net revenue reached nearly VND 20 billion, a 58% decrease year-on-year, with real estate transfer revenue at a mere VND 2.5 billion. Financial activity revenue, however, increased by 40% to VND 137 billion, primarily from stock investment gains. Financial expenses decreased to VND 19 billion from VND 66 billion in the same period last year due to the reversal of trading securities depreciation provisions.

Nine-month post-tax profit reached VND 145 billion, a 253% increase from the VND 41 billion recorded in the same period last year.

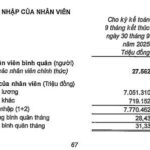

Largest Private Bank in the System Announces Significant Salary Increase for Employees

As of the end of September, this bank employs 27,696 personnel across its entire system. On average, each employee earns a monthly income of 31.33 million VND, marking a 13.6% increase compared to the same period in 2024.

Real Estate Firm Sees 36x Profit Surge in Q3 Amid Bullish Stock Market

Financial revenue soared in Q3/2025 as CTCP Đầu tư Phát triển Nhà Đà Nẵng (HNX: NDN) capitalized on a buoyant stock market. The company reported consolidated revenue and after-tax profit of nearly VND 106 billion and VND 71 billion, respectively—a 2.1x and 36x surge compared to the same period last year. This marks NDN’s most profitable quarter since Q2/2023, with the VND 71 billion profit standing as a record high.

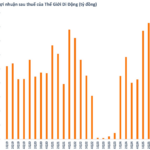

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.