|

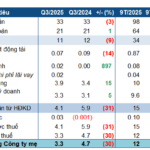

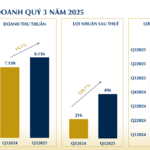

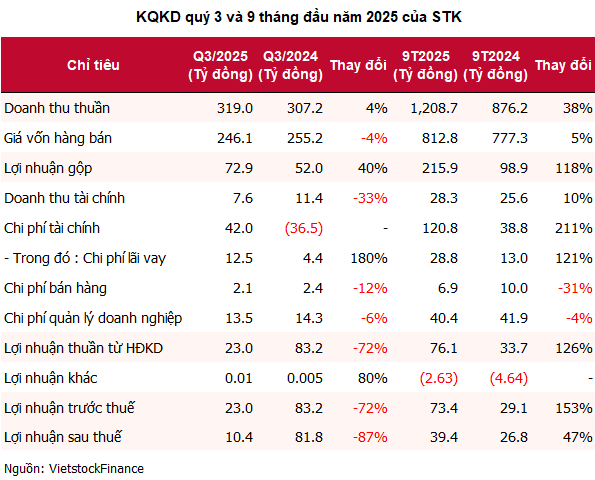

The Century Fiber Corporation recorded a net profit of over 10 billion VND in Q3/2025, an 87% decline compared to the same period last year. However, this result is still more favorable than the 6 billion VND loss reported in Q2/2025. Notably, Q3/2024 was a record-breaking quarter for STK, with a profit of 82 billion VND primarily due to foreign exchange gains, setting a high benchmark that significantly narrowed this year’s results.

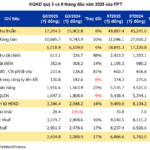

| STK’s Quarterly Business Results for 2023-2025 |

Despite the sharp profit decline, STK’s core operations showed resilience, with a Q3 gross margin of nearly 23%, the highest in over a decade, surpassing the 17% recorded in the same period last year. Revenue increased by 4% to 319 billion VND, while the cost of goods sold decreased by 4%, significantly improving operational efficiency.

However, financial expenses of 42 billion VND eroded profits, with interest expenses alone rising 180% to 12.5 billion VND, accounting for 30% of total financial costs. Financial revenue also dropped by 33% to below 8 billion VND, adding further pressure to the overall results, despite the company’s efforts to reduce selling expenses (down 12%) and administrative costs (down 6%).

Escalating Financial Costs, Debt Surpassing Equity

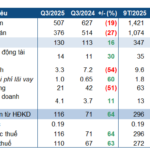

For the first nine months of 2025, STK’s revenue reached nearly 1,209 billion VND, up 38% year-on-year, with a net profit of over 39 billion VND, a 47% increase. However, this improvement is largely due to the low base effect, as the company reported a net loss of nearly 56 billion VND in the same period in 2024, attributed to production halts and foreign exchange losses.

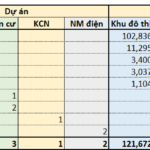

| STK’s Business Results for 2016-9M2025 |

Financial pressure remains a significant challenge, with nine-month financial expenses reaching 121 billion VND, up 211% year-on-year. This includes realized foreign exchange losses of over 87 billion VND, 3.4 times higher than the previous year, and interest expenses of over 28 billion VND, more than double the previous year. As of September 2025, STK’s total debt stood at approximately 1,900 billion VND, accounting for 46% of total capital and exceeding equity (1,746 billion VND). Compared to the beginning of the year, debt increased by 14%, including 1,046 billion VND in short-term debt and 836 billion VND in long-term debt, primarily borrowed from OCB’s Tan Binh branch.

Following the failed private placement of 13.5 million shares in early September 2025, STK approved a credit limit of 1,413 billion VND for its subsidiary, Unitex Yarn Dyeing Company, at OCB to refinance a previous 993 billion VND loan from foreign banks and allocate an additional 420 billion VND for the Unitex plant project. The loan is secured by property rights from land lease contracts, construction, and equipment in Tay Ninh, with STK guaranteeing all loan obligations.

Weakening Cash Flow, Inventory, and Unitex Investment Continue to Drain Capital

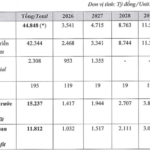

Despite being profitable after nine months, STK has only achieved 37% of its revenue target and 13% of its profit goal for 2025. The company set an ambitious target of 310 billion VND in net profit for the year, banking on the Unitex project as a key growth driver. However, the plant has yet to commence commercial operations, despite completing trial runs in Q2.

Financial strain is further evidenced by a negative operating cash flow of over 227 billion VND, reversing from a positive 450 billion VND in the same period in 2024, primarily due to a sharp increase in inventory. As of Q3/2025, STK’s inventory reached nearly 930 billion VND, up 50% from the beginning of the year, with finished goods accounting for 726 billion VND, a 75% increase. Bank deposits stood at only 56.5 billion VND, down 46% from the start of the year.

Unitex Plant, located in Thanh Thanh Cong Industrial Park, Tay Ninh Province

|

Additionally, the company continues to invest heavily in unfinished construction costs, primarily for the Unitex plant, totaling over 2,195 billion VND, which represents more than 53% of total assets. The delay in bringing this project online (construction began in 2021) is a significant drag on business performance.

Stock Price Struggles to Recover

On the HOSE, STK closed at 24,750 VND/share on October 24, down nearly 5% over the past year, with average liquidity of around 50,000 shares/session. Compared to its peak of 35,000 VND/share in July 2024, the stock has lost approximately 29% of its value, though it remains 35% above its April 2025 low, which was influenced by tariff factors.

| STK’s Stock Price Performance Over the Past Year |

– 12:58 25/10/2025

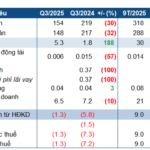

Phuong Phu Pharmaceutical’s Q3 Performance: A Step Back

Amidst declining revenues and rising production costs, Phong Phu Pharmaceutical JSC (HNX: PPP) experienced a downturn in profits during Q3 2025.

PNJ Surpasses 25 Trillion VND in 9 Months, Profit Growth Sustained Despite Weak Consumer Demand

Amidst a challenging market where jewelry demand has waned due to soaring gold prices, Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ) has impressively sustained its profit growth over the first nine months. This resilience is primarily attributed to its core retail jewelry segment, which continues to deliver robust profit margins.

Revenue Plummets, Yet Duc Giang Chemical’s Subsidiary Surges 63% in Profit

Apatit Vietnam Phosphorus Joint Stock Company (UPCoM: PAT), a subsidiary indirectly owned by Duc Giang Chemicals (HOSE: DGC) through its wholly-owned subsidiary Duc Giang Chemicals – Lao Cai Co., Ltd., has released its Q3/2025 financial report. Despite declines in revenue and sales volume, the company reported a significant year-over-year increase in profits.

Routine Maintenance Plunges Ninh Binh Thermal Power into Loss After Two Consecutive Profitable Quarters

Ninh Binh Thermal Power Joint Stock Company (HNX: NBP) has released its Q3/2025 financial report, revealing a net loss despite profitable results in the previous two quarters. However, the situation shows significant improvement compared to the same period last year.