HD Securities JSC (HDS) recently announced a transaction involving the transfer of over 10% of its charter capital.

On October 20th, Vietory JSC transferred 16.5 million shares, equivalent to 11.3% of HDS’s charter capital, to Vina Dai Phuoc JSC.

Following the transaction, Vietory JSC’s ownership decreased from 25.57 million shares (17.5% of capital) to 9.075 million shares (6.2% of capital).

Conversely, Vina Dai Phuoc JSC, previously holding no shares, now owns 11.3% of HDS’s charter capital, becoming a major shareholder.

As of June 30, 2025, HDS has five other major shareholders: HDBank (30%), Huynh Phat Investment LLC (17.5%), Blue Sky Vietnam Investment LLC (13.78%), Dynamic & Development Investment JSC (10.61%), and Huy Phong Investment & Trading Services LLC (7.99%).

Collectively, these five shareholders, along with Vietory JSC and Vina Dai Phuoc JSC, hold over 97.3% of HDS’s charter capital.

Established in 2007, Vina Dai Phuoc JSC specializes in real estate. As of January 2023, its charter capital increased to nearly VND 1,654 billion. The company is legally represented by Mr. Vu Hoai (CEO) and Mr. Nguyen Khanh Trung (Chairman).

Vina Dai Phuoc JSC is the developer of the SwanBay eco-tourism urban area in Nhon Trach District, Dong Nai Province.

By the end of Q2/2025, DIC Corp (HoSE: DIG) held only 0.1% of Vina Dai Phuoc JSC’s charter capital, equivalent to VND 1.6 billion.

In other developments, HDS will finalize its shareholder list on October 28, 2025, for written opinions. The consultation period runs from October to November 2025, focusing on approving a stock dividend issuance plan.

Previously, on October 15th, HDS completed a written shareholder consultation, approving the issuance of 365 million shares to existing shareholders. This is expected to increase charter capital from VND 1,461 billion to VND 5,115 billion, a 250% rise.

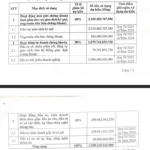

With an offering price of VND 20,000 per share, HDS anticipates raising VND 7,307 billion. This capital will fund key business activities: VND 1,827 billion for margin lending, VND 731 billion for advance payment activities, VND 4,603 billion for proprietary trading, and VND 146 billion for fixed asset and software investments.

Notably, within the proprietary trading allocation, HDS plans to invest VND 1,470 billion in HD Crypto Asset Exchange JSC, as part of its VND 10,000 billion capital increase.

What Will TPS Do with the Anticipated 3.6 Trillion VND from Its Share Offering?

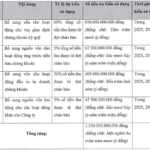

With nearly VND 3.6 trillion raised from its IPO, TPS plans to allocate the funds towards securities brokerage, proprietary trading, and other strategic initiatives.

VPS Securities Boosts Capital to VND 12,800 Billion Following Bonus Share Issuance

On October 10th, VPS successfully distributed 710 million shares to 13 shareholders, increasing its chartered capital to 12.8 trillion VND.