According to VPBank’s newly released Q3/2025 financial report, the bank boasts a workforce of 27,696 employees across its entire system as of September’s end, marking an increase of 268 individuals since the year’s start. Among these, the parent bank employs 16,426 staff members, a rise of 1,423 compared to the beginning of the year.

With this workforce scale, VPBank stands as the private bank with the largest number of employees, second only to BIDV within Vietnam’s entire banking system.

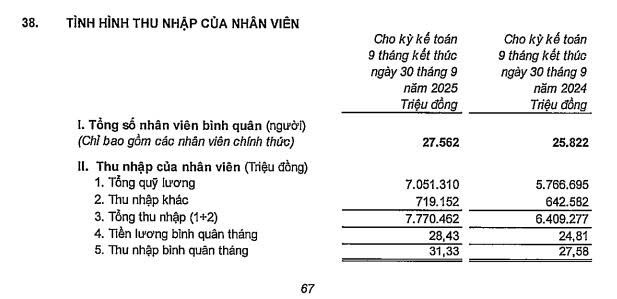

In the first nine months of 2025, VPBank allocated over 7.77 trillion VND for its employees, reflecting a 21% increase from the same period in 2024. The average monthly income per employee across the VPBank system reached 31.33 million VND, a 13.6% rise compared to the same period in 2024. Specifically, the average monthly salary per employee was 28.43 million VND, up by 16.6%.

Source: VPBank’s Q3/2025 Consolidated Financial Report

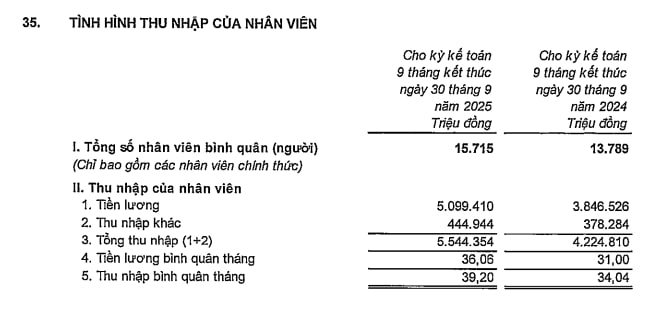

At the parent bank, the average monthly income per employee in the first nine months reached 39.2 million VND, a 15.2% increase. The average monthly salary was 36.06 million VND per person, up by 16.3%.

Source: VPBank’s Q3/2025 Standalone Financial Report

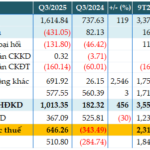

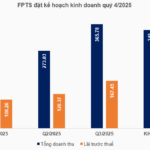

By the end of the first nine months, VPBank’s consolidated pre-tax profit reached 20.396 trillion VND, 47.1% higher than the same period in 2024. In Q3/2025 alone, the profit hit 9.166 trillion VND, a 76.7% growth and the highest in the last 15 quarters. Accumulated over nine months, VPBank’s profit has surpassed the entire year of 2024 and achieved 81% of the 2025 annual plan.

As of the end of September 2025, VPBank’s consolidated total assets exceeded the target set at the Shareholders’ Meeting, reaching 1.18 quadrillion VND, a 27.5% increase from the beginning of the year; standalone total assets surpassed 1.1 quadrillion VND. With this asset scale, VPBank is currently the private bank with the largest total assets in the system.

VPBank’s consolidated credit balance as of September’s end was nearly 912 trillion VND, up by 28.4%. The standalone bank’s credit stood at 813 trillion VND.

As of Q3/2025’s end, the consolidated non-performing loan (NPL) ratio under Circular 31 fell below 3%; the standalone NPL ratio continued to improve, standing at 2.23%.

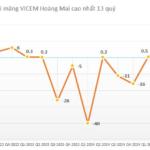

Cement Companies Report Highest Profits in 13 Quarters, Stocks Hit Upper Limit

Compared to the 2025 plan, VICEM Hoang Mai Cement has achieved 78% of its revenue target and surpassed its profit goal by 7%.