Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 916 million shares, equivalent to a value of more than 28.7 trillion VND; the HNX-Index reached over 104.1 million shares, equivalent to a value of more than 2.4 trillion VND.

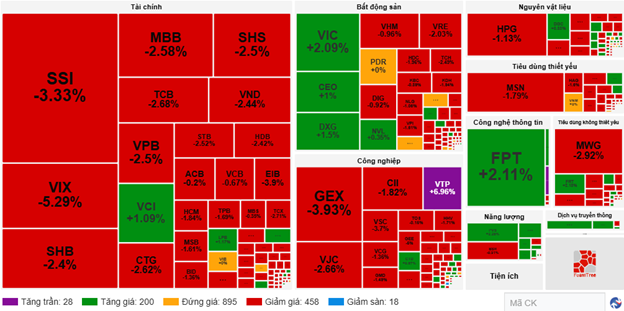

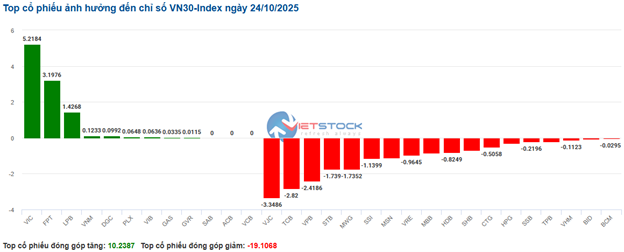

The VN-Index opened the afternoon session with buyers re-emerging, helping the index gradually recover close to the reference mark. However, selling pressure remained dominant, causing the VN-Index to close in the red. In terms of impact, TCB, MBB, VPB, and VIX were the most negatively influential stocks on the VN-Index, contributing to a decrease of over 5.2 points. Conversely, VIC, FPT, VNM, and VPL maintained their green status, contributing over 6 points to the index.

| Top 10 Stocks Most Impacting the VN-Index on October 24, 2025 (Calculated by Points) |

In contrast, the HNX-Index showed a more optimistic trend, with positive contributions from stocks like HUT (+4.35%), THD (+6.21%), CEO (+2.67%), and PVS (+1.63%).

| Top 10 Stocks Most Impacting the HNX-Index on October 24, 2025 (Calculated by Points) |

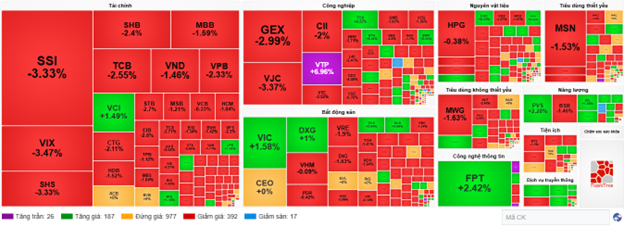

At the close, the finance sector saw the most significant decline, dropping by 1.14%, primarily due to stocks like SSI (-4%), VIX (-6.5%), MBB (-3.17%), and SHB (-2.4%). The industrial and healthcare sectors followed with declines of 1.06% and 0.44%, respectively. Conversely, the communication services sector recorded the strongest gain, rising by 3.37%, mainly driven by CTR (+6.94%), VGI (+4.26%), and VNZ (+1.73%).

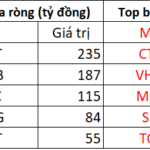

In terms of foreign trading, foreign investors continued to net sell over 1.849 trillion VND on the HOSE, focusing on stocks like SSI (758.61 billion VND), MBB (345.94 billion VND), VCI (199.31 billion VND), and VIX (143.51 billion VND). On the HNX, foreign investors net sold over 98 billion VND, concentrating on SHS (87.05 billion VND), IDC (14.23 billion VND), MBS (4.25 billion VND), and CEO (4.05 billion VND).

| Foreign Net Buying and Selling Trends |

Morning Session: Fluctuations Around 1,670 Points, Foreign Investors Sell SSI Heavily

The VN-Index fluctuated around the 1,670-point mark during the late morning session. By the midday break, the VN-Index had decreased by over 14 points (-0.85%), settling at 1,672.72 points; the HNX-Index also dropped by 0.37%, closing at 265.78 points. Market breadth showed 476 declining stocks, 228 advancing stocks, and 895 unchanged stocks.

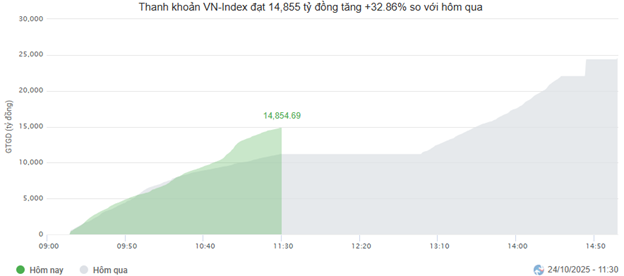

Market liquidity surged in the late morning session, but selling pressure dominated. The trading value on the HOSE reached nearly 15 trillion VND, up 32.86% from the previous day. The HNX also recorded a nearly 55% increase, equivalent to over 1.2 trillion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, TCB and CTG were the most negatively impactful, each deducting 1.5 points from the index. Following closely were VPB, MBB, and VHM, which collectively pulled the index down by over 3.5 points. Conversely, VIC stood out as the most positive contributor, adding 4 points to the index.

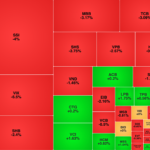

| Top 10 Stocks Most Impacting the VN-Index on October 24, 2025 (Calculated by Points) |

By sector, red dominated most stock groups. The two largest market capitalization sectors, finance and industry, exerted significant pressure on the overall index, both declining by over 1%. Most stocks were in the red, notably those adjusting by more than 2%, including CTG, TCB, VPB, MBB, TCX, STB, SSI, SHB, HDB, VIX, VND, OCB; VJC, HVN, GEE, VEF, GEX, and VSC.

In contrast, the communication services and information technology sectors temporarily led the market with gains of 3.28% and 2.1%, respectively, primarily due to positive contributions from leading stocks like VGI (+4.26%), VNZ (+0.96%), CTR (+5.29%); FPT (+2.11%), CMG (+2.53%), and VEC, which hit its ceiling.

Source: VietstockFinance

|

Foreign investors continued their net selling, with a value exceeding 2.1 trillion VND across all three exchanges. Selling pressure was concentrated on SSI, with a value of 405.12 billion VND, far surpassing other stocks. Meanwhile, the top net buyers were FPT, ACB, and VJC, with values ranging from 55 to 65 billion VND.

| Top 10 Stocks with the Strongest Foreign Net Buying and Selling in the Morning Session of October 24, 2025 |

10:30 AM: Selling Pressure Persists

Cautious trading sentiment caused major indices to fluctuate around the reference mark. As of 10:30 AM, the VN-Index decreased by 10.65 points, trading around 1,676 points. The HNX-Index dropped by 1.24 points, trading around 265 points.

Banking stocks like TCB, VPB, STB, and MBB negatively impacted the VN30-Index, deducting 2.82 points, 2.41 points, 1.73 points, and 0.85 points, respectively. Conversely, VIC, FPT, and LPB were the pillar stocks helping the VN30 retain over 9.8 points.

Source: VietstockFinance

|

The finance sector remained lackluster, with red dominating most leading securities stocks like SSI (+3.33%), VIX (+3.63%), SHS (+3.75%), and VND (+1.95%). Banking stocks also followed this trend, with TCB down 2.55%, HDB down 1.36%, and STB down 2.52%.

The real estate sector continued to face challenges, with most stocks in the red. Specifically, CEO decreased by 0.33%, DPR by 0.21%, DIG by 2.06%, and VRE by 2.03%. Only a few stocks showed slight recovery, such as VIC (+1.49%), DXG (+1.25%), and NLG (+0.53%).

Similarly, the industrial sector recorded widespread red, with stocks under strong selling pressure like GEX (-2.99%), VJC (-3.48%), CII (-1.82%), and VSC (-2.92%).

Compared to the opening, sellers still held a significant advantage. There were 392 declining stocks and 187 advancing stocks.

Source: VietstockFinance

|

Opening: Red Dominates Finance and Industry Sectors at the Start

Red prevailed at the opening, indicating continued investor caution. Major indices declined slightly and fluctuated around the reference mark. The VN-Index dropped by over 8 points, trading around 1,678 points; the HNX-Index hovered around 265 points.

The VN30 basket showed a balanced mix of green and red. TCB, STB, MSN, and VPB were the most negatively impactful stocks on the index. Conversely, VHM, LPB, and FPT provided strong support, with VIC contributing over 5 points to the VN30-Index.

The finance sector was overwhelmingly red at the start, with selling pressure concentrated on securities stocks like SSI, VIX, SHS, and VND, all declining by over 2.5%.

The industrial sector also opened in the red, primarily due to leading stocks like GEX (-2.62%), CII (-2.36%), VJC (-1.36%), and VSC (-1.95%).

– 15:30 24/10/2025

Stock Market Week 20-24/10/2025: Challenges Persist

The VN-Index paused its recovery in the final session of the week, failing to offset the sharp decline earlier and closing the week 48 points lower than the previous one. With liquidity yet to show significant improvement and foreign investors maintaining their net selling trend, downward pressure on the index is likely to persist in the near term.

Short-Term Stock Market Declines: What You Need to Know

The stock market’s growth prospects remain robust, fueled by strong domestic investor inflows and improving corporate earnings.

Why Many Stock Traders’ Accounts Are Bleeding Red

The VN-Index closed the final trading session of the week (October 24) with a nearly 4-point decline, leaving many investors’ portfolios in the red. Sellers dominated the market, with a staggering 190 stocks on the HoSE exchange experiencing price drops.