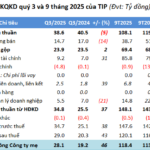

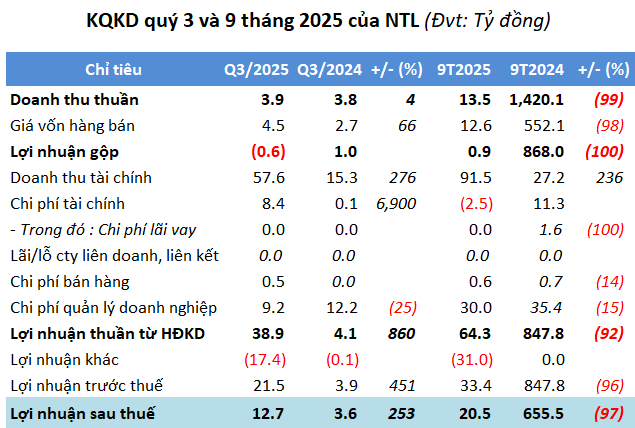

In Q3, NTL reported a modest net revenue of nearly VND 4 billion, marking a 4% increase compared to the same period last year. This revenue was entirely derived from service provision, with no contributions from real estate sales. A significant rise in production costs led to a gross loss of over VND 600 million.

A bright spot in this quarter was the financial revenue of nearly VND 58 billion, a 3.8-fold increase year-on-year, attributed to interest from deposits and securities investments. Despite a 47% surge in financial, selling, and administrative expenses to VND 18 billion, NTL achieved a net profit of nearly VND 13 billion, 3.5 times higher than the previous year.

However, the cash flow statement revealed a negative operating cash flow of nearly VND 93 billion, a stark contrast to the positive VND 208 billion in the same period last year. This was primarily due to substantial expenditures on business operations and corporate income tax.

Source: VietstockFinance

|

For the first nine months, cumulative net revenue reached nearly VND 14 billion, with after-tax profit exceeding VND 20 billion, representing a sharp decline of 99% and 97%, respectively. In the same period last year, NTL experienced a significant boost in business results due to additional revenue and profit recognition from the sale of land in the Bai Muoi urban area project in Ha Long City, Quang Ninh Province.

For 2025, NTL set a target of VND 80 billion in total revenue and VND 24 billion in after-tax profit. With these results, the company has already surpassed its revenue target by 31% and achieved 85% of its profit goal after nine months.

As of the end of Q3, NTL’s total assets stood at nearly VND 1,978 billion, a 9% decrease from the beginning of the year. Cash and cash equivalents amounted to nearly VND 515 billion, down 11%, accounting for 26% of total assets.

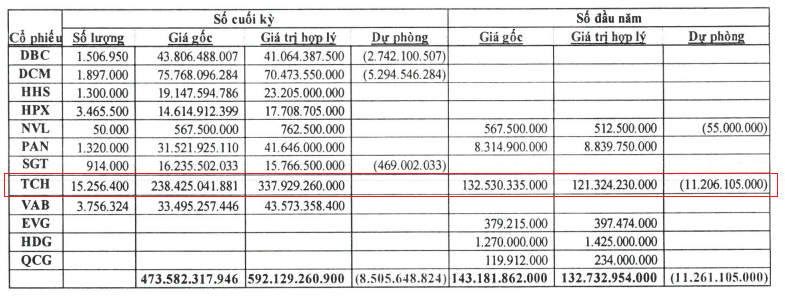

Short-term financial investments totaled nearly VND 775 billion, a 17% decrease. Trading securities accounted for VND 474 billion, 3.3 times higher than at the beginning of the year, making up 24% of total assets. NTL’s largest investment was in TCH shares of Hoang Huy Financial Services Investment Corporation, with an original value of over VND 238 billion. As of the end of September, this investment had a fair value of nearly VND 338 billion.

|

NTL’s securities investments as of September 30, 2025

Source: NTL

|

Inventory stood at nearly VND 506 billion, a slight 1% increase, primarily concentrated in the Dich Vong project at over VND 470 billion.

Total liabilities decreased by 42% to nearly VND 243 billion, mainly due to a significant reduction in tax and fee payments to the state, from over VND 195 billion to nearly VND 12 billion. The company has no recorded financial loans.

|

The Dich Vong new urban area project spans 22.5 hectares in Cau Giay District, Hanoi. NTL has been pursuing this project for nearly 30 years since 1997, with an initial investment of nearly VND 795 billion and a planned implementation period from 2003 to 2007. On August 7, 2018, the Hanoi People’s Committee approved an adjusted investment policy, increasing the total investment to nearly VND 4,920 billion, with a completion date set for Q4/2022. On May 30, 2025, another adjustment raised the investment to nearly VND 5,125 billion, extending the completion date to Q1/2029. On August 11, NTL’s Board of Directors approved the investment in a high-rise residential building on the NO11 land plot, covering over 4.6 thousand square meters within the Dich Vong new urban area project. The building will feature 32 floors and 2 basements, offering approximately 364 apartments, with a scheduled completion in Q1/2029. The total investment is approximately VND 1,500 billion, with VND 1,000 billion expected to be raised externally. Land clearance for the project is complete, and construction is slated to begin this year. |

– 3:13 PM, October 24, 2025

Real Estate Firm Sees 36x Profit Surge in Q3 Amid Bullish Stock Market

Financial revenue soared in Q3/2025 as CTCP Đầu tư Phát triển Nhà Đà Nẵng (HNX: NDN) capitalized on a buoyant stock market. The company reported consolidated revenue and after-tax profit of nearly VND 106 billion and VND 71 billion, respectively—a 2.1x and 36x surge compared to the same period last year. This marks NDN’s most profitable quarter since Q2/2023, with the VND 71 billion profit standing as a record high.

Spectacular Turnaround: Real Estate Firm Escapes Losses Through Strategic Stock Market Investments as Property Sector Stalls

In Q3/2025, Lideco recorded nearly VND 58 billion in financial activity revenue, entirely from deposit interest and securities investment. This propelled the company to report a post-tax profit of nearly VND 13 billion, a 3.5-fold increase year-over-year.