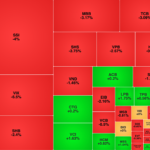

The VN-Index experienced a volatile morning session before rebounding in the afternoon. The benchmark index’s gains were primarily driven by the Vingroup family of stocks, which collectively contributed 12 points to the uptrend. By the close of the October 23 session, the VN-Index rose nearly 9 points, reaching 1,687 points. Trading liquidity on the Ho Chi Minh Stock Exchange (HoSE) significantly declined, with order-matching value totaling a mere VND 22.76 trillion.

Amid this backdrop, foreign trading activity remained a drag, with net selling of VND 1.451 trillion across the market. Key details include:

On HoSE, foreign investors net sold approximately VND 1.257 trillion.

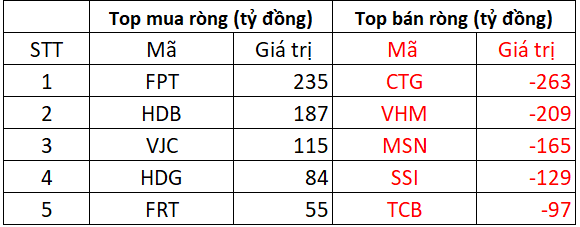

On the buying side, FPT led the market with foreign purchases totaling VND 235 billion, followed by HDB and VJC with net buys of VND 187 billion and VND 115 billion, respectively. HDG and FRT were next in line, with net purchases of VND 55-84 billion each.

Conversely, foreign investors heavily offloaded CTG, with net sales of VND 263 billion. VHM, MSN, and SSI followed, with net selling of VND 209 billion, VND 165 billion, and VND 129 billion, respectively. TCB also saw net selling of approximately VND 97 billion.

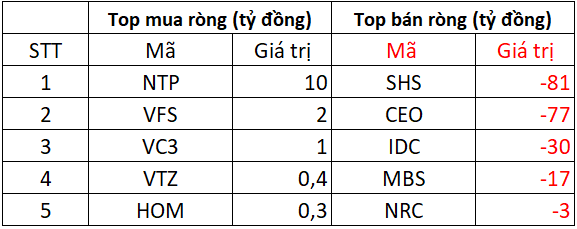

On HNX, foreign investors net sold around VND 204 billion.

On the buying side, NTP saw the strongest foreign inflows at VND 10 billion, while VC3 and VFS attracted net purchases of VND 1-2 billion each.

On the selling side, SHS and CEO topped the net selling list with VND 81 billion and VND 77 billion, respectively. IDC and MBS also faced net selling of VND 17-30 billion, while NRC saw a modest net sell of VND 3 billion.

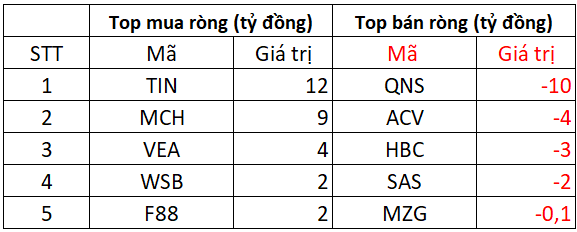

On UPCOM, foreign investors net bought approximately VND 11 billion.

On the buying side, stocks like TIN, MCH, and VEA saw net purchases of VND 4-12 billion, while WSB and F88 each attracted VND 2 billion in net buying.

Conversely, QNS, ACV, HBC, and SAS faced net selling of VND 2-10 billion. MZG also experienced modest net selling.

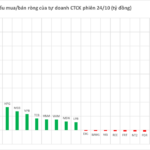

Proprietary Trading Firms Unexpectedly Turn Net Buyers of Stocks on October 23rd, Contrasting Massive Sell-Offs in Two Key Stocks

Proprietary trading by securities companies has rebounded with a net buying value of VND 225 billion on the Ho Chi Minh City Stock Exchange (HOSE).