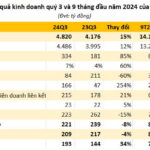

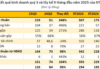

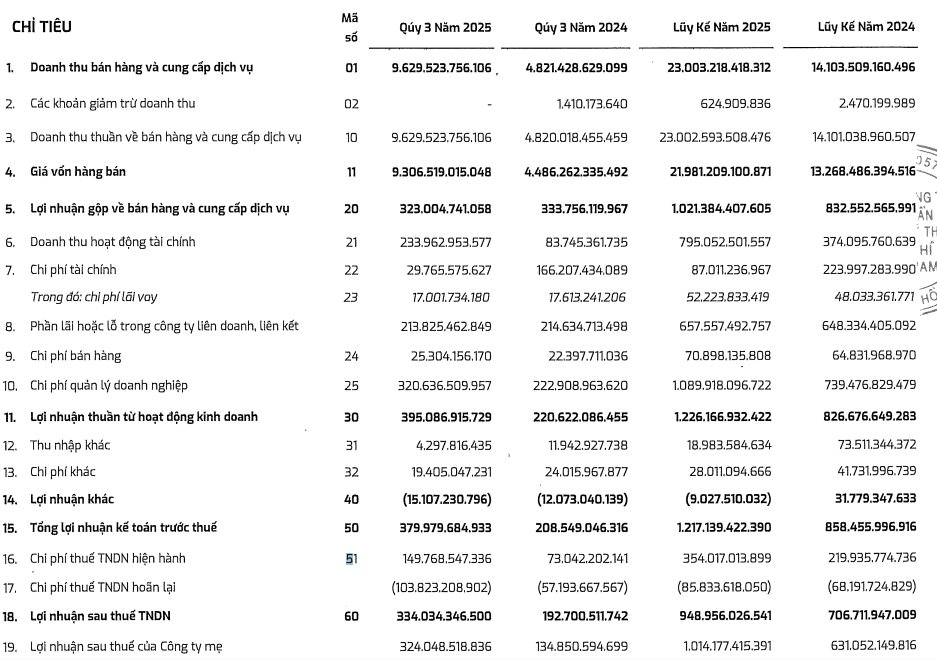

PetroVietnam Technical Services Corporation (PVS) has released its Q3/2025 financial report, showcasing a remarkable 100% year-on-year surge in net revenue to VND 9.63 trillion. Despite a slight dip in gross profit to VND 323 billion compared to the previous quarter, the company’s financial performance remains robust.

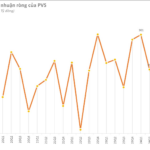

PVS’s financial income skyrocketed by 177% to VND 234 billion, while financial expenses plummeted from VND 166 billion to just VND 30 billion. After accounting for all expenses, the company reported a post-tax profit of VND 334 billion, a 73% increase year-on-year. Net profit attributable to the parent company’s shareholders (net income) soared by 140% to VND 324 billion.

In the first nine months of 2025, PVS’s cumulative net revenue surpassed VND 23 trillion, a 63% increase year-on-year, with net income rising by 34% to VND 949 billion. For 2025, PTSC aims to achieve consolidated revenue of VND 22.5 trillion, pre-tax profit of VND 1 trillion, post-tax profit of VND 780 billion, and state budget contributions of VND 720 billion. Remarkably, the company has already exceeded its annual revenue and profit targets within just nine months.

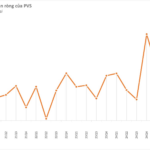

As of Q3/2025, PVS’s total assets reached over VND 28.7 trillion, an increase of nearly VND 4.9 trillion since the beginning of the year. Notably, the oil and gas giant holds nearly VND 16.8 trillion in cash and cash equivalents, accounting for almost 60% of its total assets. This substantial cash reserve generates hundreds of billions of dong in interest income annually, significantly contributing to the company’s profitability.

Poised to Benefit from a $12 Billion Mega Project

As a subsidiary of Vietnam Oil and Gas Group (PVN), PVS is the only domestic company offering a full suite of oil and gas technical services (excluding drilling). PVS dominates key sectors with market shares of 97% in oil and gas technical vessel services, 100% in port base services, and 60% in floating storage and offloading (FSO/FPSO) services. The company owns and operates a fleet of 21 service vessels, 3 FSO units, and 2 FPSO units.

BVSC Securities highlights that the Lot B – O Mon project is central to PVS’s growth strategy for 2025-2027. PVS has secured three EPCI contracts with a total backlog exceeding $1 billion for this project. Implementation is progressing smoothly, with the goal of achieving “first gas” by Q4/2027. This project is expected to drive a 66% growth in PVS’s construction and installation (M&C) segment in 2025 and 67% in 2026.

BVSC believes the Lot B – O Mon project not only strengthens PVS’s construction and installation capabilities but also solidifies its position in Vietnam’s key oil and gas projects, expanding its potential for energy sector collaborations.

Additionally, PVS is accelerating its offshore wind power projects with a total backlog of approximately $2 billion, expected to contribute stable revenue from 2025 to 2030. The company is also capitalizing on the energy transition trend by developing industrial construction projects, particularly LNG storage facilities, to meet growing demand.

The FSO/FPSO leasing segment is highly promising, with the Lac Da Vang and Lot B projects set to commence operations in 2026 and 2027, respectively. These projects are projected to generate approximately VND 180 billion in annual profit for PVS through its subsidiaries. Leasing rates have remained stable since 2022 and are expected to continue in the near future.

Furthermore, PVS is expanding its international footprint in renewable energy, having secured two contracts to export wind power to Singapore and Malaysia. These projects are slated for commercial operation in 2033 and are anticipated to provide long-term profits over 30-50 years, offering sustainable growth opportunities for PVS.

“Energy Giants Reap Rewards from the $12 Billion Offshore Mega-Project: Preparing to Dish Out Dividends, Cash Reserves Soar Past the Trillion Mark, and Profits Surpass Targets in Just 9 Months”

With a tax relief of over 57 billion VND, the company posted an impressive 34% year-on-year increase in net profit, reaching 193 billion VND.

Sure, I can assist with that.

## Securing Vietnam’s Energy Future: Exploring Small-Scale Nuclear Power Options

The Ministry of Industry and Trade is exploring strategies to boost solar energy development and investigate modular small-scale nuclear power solutions, including floating nuclear power plants. This forward-thinking approach aims to harness the potential of renewable and alternative energy sources, ensuring a sustainable and resilient energy future for all.