|

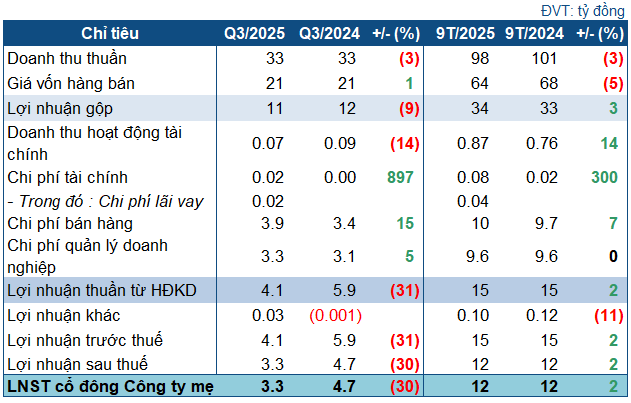

PPP’s Q3/2025 Business Targets

Source: VietstockFinance

|

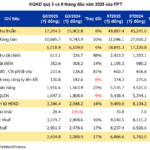

In Q3, PPP recorded a net revenue of VND 33 billion, a 3% decrease compared to the same period last year. Conversely, the cost of goods sold saw a slight increase, resulting in a gross profit of VND 11 billion, 9% lower than the previous year.

Both selling expenses and administrative costs rose during the quarter, by 15% and 5%, respectively. The company attributed these increases to maintaining promotional programs to sustain sales, alongside higher production costs than the previous year. Ultimately, the company reported a net profit of VND 3.3 billion, 30% lower than the same period last year.

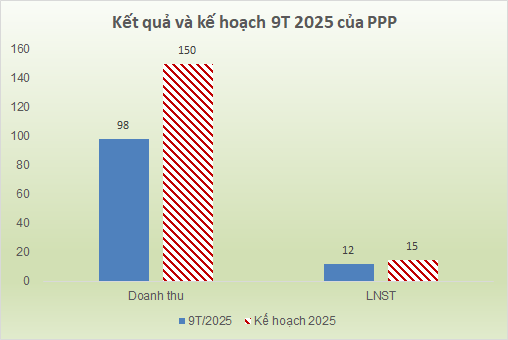

For the first nine months, PPP achieved a net revenue of VND 98 billion, a slight 3% decrease year-on-year, yet still managed a net profit of approximately VND 12 billion, a minor increase. The company fulfilled 66% of its revenue target and nearly 81% of the post-tax profit plan approved by the 2025 Annual General Meeting.

By the end of Q3, PPP‘s total assets reached VND 163 billion, a slight decrease from the beginning of the year. Cash and cash equivalents dropped by 19% to over VND 32 billion, while inventory increased by 9% to more than VND 40 billion.

On the capital side, total liabilities decreased slightly to over VND 30 billion, primarily short-term debt. Notably, loans amounted to only VND 824 million, compared to none recorded at the beginning of the year.

– 13:28 25/10/2025

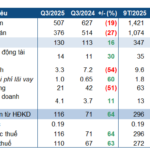

PNJ Surpasses 25 Trillion VND in 9 Months, Profit Growth Sustained Despite Weak Consumer Demand

Amidst a challenging market where jewelry demand has waned due to soaring gold prices, Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ) has impressively sustained its profit growth over the first nine months. This resilience is primarily attributed to its core retail jewelry segment, which continues to deliver robust profit margins.

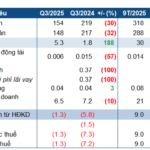

Revenue Plummets, Yet Duc Giang Chemical’s Subsidiary Surges 63% in Profit

Apatit Vietnam Phosphorus Joint Stock Company (UPCoM: PAT), a subsidiary indirectly owned by Duc Giang Chemicals (HOSE: DGC) through its wholly-owned subsidiary Duc Giang Chemicals – Lao Cai Co., Ltd., has released its Q3/2025 financial report. Despite declines in revenue and sales volume, the company reported a significant year-over-year increase in profits.

Securities Firms Group Sets Record with Over 15 Trillion VND in Profits

The robust wave in the stock market during Q3 2025 has painted a rosy picture for securities companies, delivering a stellar quarter of performance. This surge has even reshuffled the rankings at the top, redefining the profit landscape for the entire sector.