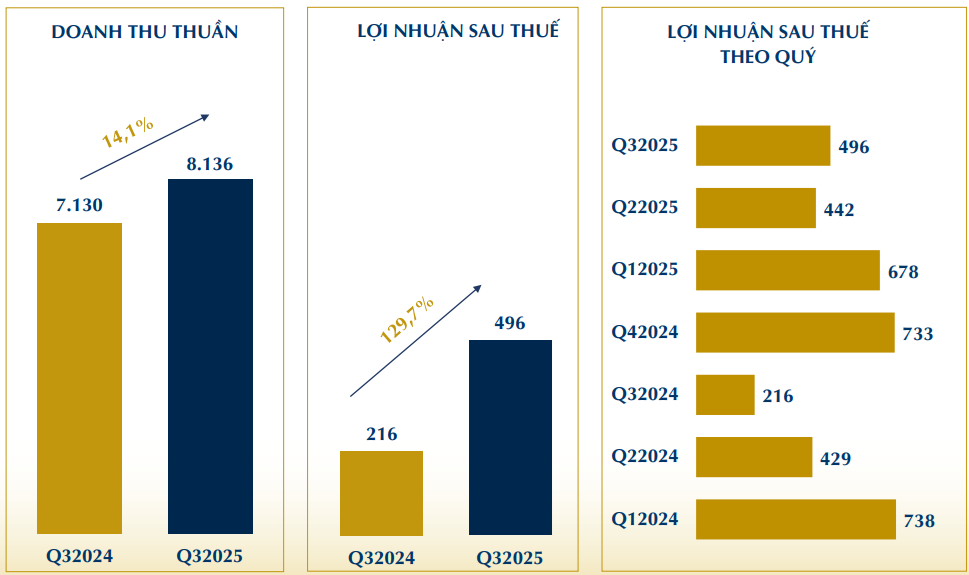

Phu Nhuan Jewelry Joint Stock Company (PNJ) has released its Q3 business report, recording net revenue of VND 8,136 billion and post-tax profit of VND 496 billion, marking a 14% and 130% increase year-over-year, respectively. The gross profit margin improved from 17.5% to 19.8%, reflecting effective cost control.

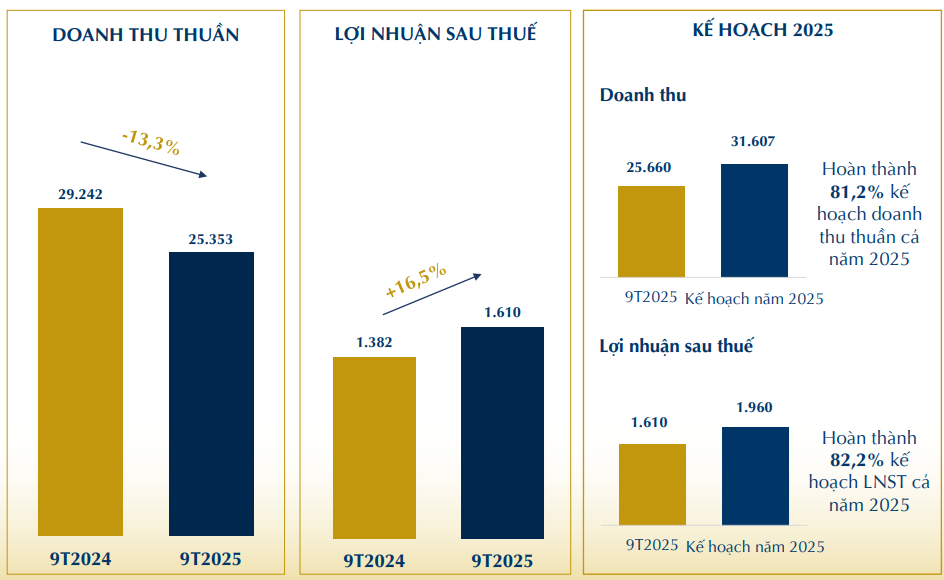

For the first nine months of 2025, PNJ achieved VND 25,353 billion in net revenue, a 13% decrease year-over-year. However, post-tax profit grew by 17% to VND 1,610 billion, completing 82.2% of the 2025 annual profit plan. The average gross profit margin for the nine months improved from 16.7% to 20.8%, primarily due to changes in revenue structure.

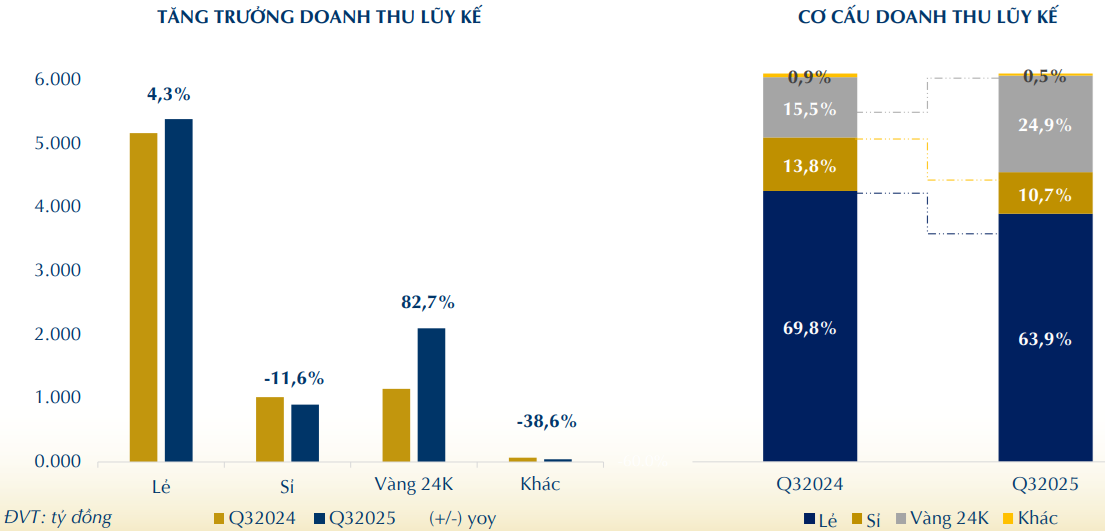

In terms of specific business channels, retail jewelry revenue for the nine months still recorded a 5.1% growth year-over-year, despite reduced purchasing power due to soaring gold prices. The revenue share from retail jewelry reached 65.6%, up from 54.5% in the same period in 2024. This result stems from various factors, including an increased number of stores compared to the first nine months of the previous year, coupled with effective marketing programs that successfully attracted new customers. Product strategy and inventory have been flexibly adjusted to align with evolving market trends and demands, while PNJ continuously enhances customer experience and service quality.

Wholesale jewelry revenue in the first nine months of 2025 increased by 5.3%; the wholesale segment accounted for 11.5% of PNJ’s total revenue. Amid a declining market, PNJ maintained high customer trust, particularly as the market increasingly prioritizes transparency and product traceability.

24K gold revenue for the nine months of 2025 decreased by 44.4% year-over-year. Facing challenges in raw material sourcing and prolonged supply constraints of 24K products from late 2024 to early 2025, PNJ prioritized resource allocation to its core retail jewelry business. Limiting the quantity of 24K gold products significantly reduced revenue from this segment. In Q3 2025, the 24K gold segment showed improvement compared to the first two quarters of the year.

As of September 2025, PNJ operates 429 stores nationwide, including 422 PNJ stores, 3 Style by PNJ stores, 3 CAO Fine Jewellery stores, and 1 wholesale center.

PNJ Surpasses 25 Trillion VND in 9 Months, Profit Growth Sustained Despite Weak Consumer Demand

Amidst a challenging market where jewelry demand has waned due to soaring gold prices, Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ) has impressively sustained its profit growth over the first nine months. This resilience is primarily attributed to its core retail jewelry segment, which continues to deliver robust profit margins.

PNJ Ranked Among Vietnam’s Top 50 Most Efficient Companies

PNJ stands as the sole jewelry and lifestyle retailer to secure a spot in Vietnam’s Top 50 Most Effective Business Companies, achieving this distinction through remarkable enhancements in its core financial metrics.