Following two sessions of recovery, the stock market continued its upward trend for the third consecutive session, driven by the positive influence of a few large-cap stocks. At the close, the VN-Index rose by 8.56 points (+0.51%) to reach 1,687.06 points, inching closer to the 1,700-point resistance level. Foreign trading remained a downside, with a strong net sell-off of 1,451 billion VND across the market.

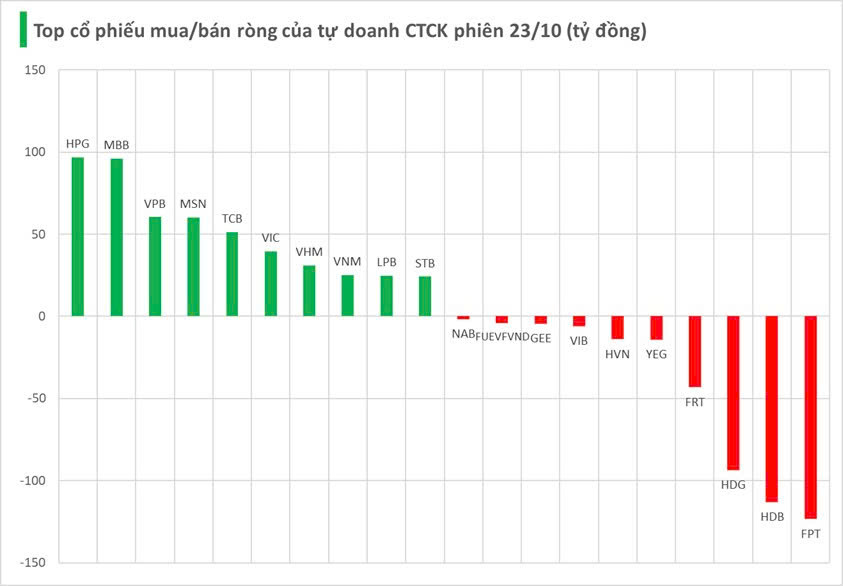

Securities companies’ proprietary trading desks resumed net buying of 225 billion VND on HOSE.

Specifically, HPG and MBB saw the strongest net buying, with values of 97 billion VND and 96 billion VND, respectively. They were followed by VPB and MSN, both at 60 billion VND, TCB (51 billion VND), VIC (40 billion VND), VHM (31 billion VND), VNM (25 billion VND), LPB (25 billion VND), and STB (24 billion VND) – all recording significant net buying from securities companies’ proprietary trading desks.

Conversely, securities companies sold off most heavily in FPT, with a value of -123 billion VND, followed by HDB (-113 billion VND), HDG (-93 billion VND), FRT (-43 billion VND), and YEG (-14 billion VND). Other notable net sell-offs included HVN (-14 billion VND), VIB (-6 billion VND), GEE (-4 billion VND), FUEVFVND (-4 billion VND), and NAB (-2 billion VND).

Securities Firms Group Sets Record with Over 15 Trillion VND in Profits

The robust wave in the stock market during Q3 2025 has painted a rosy picture for securities companies, delivering a stellar quarter of performance. This surge has even reshuffled the rankings at the top, redefining the profit landscape for the entire sector.

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

Market Rally: Stocks Surge on Q3 Earnings Anticipation, While One HOSE Stock Plunges Despite Profit Surge

Numerous companies have reported profits doubling, becoming the focal point for investment flows and driving their stock prices to surge dramatically.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.