Civil Construction Contractors Poised for Direct Benefits

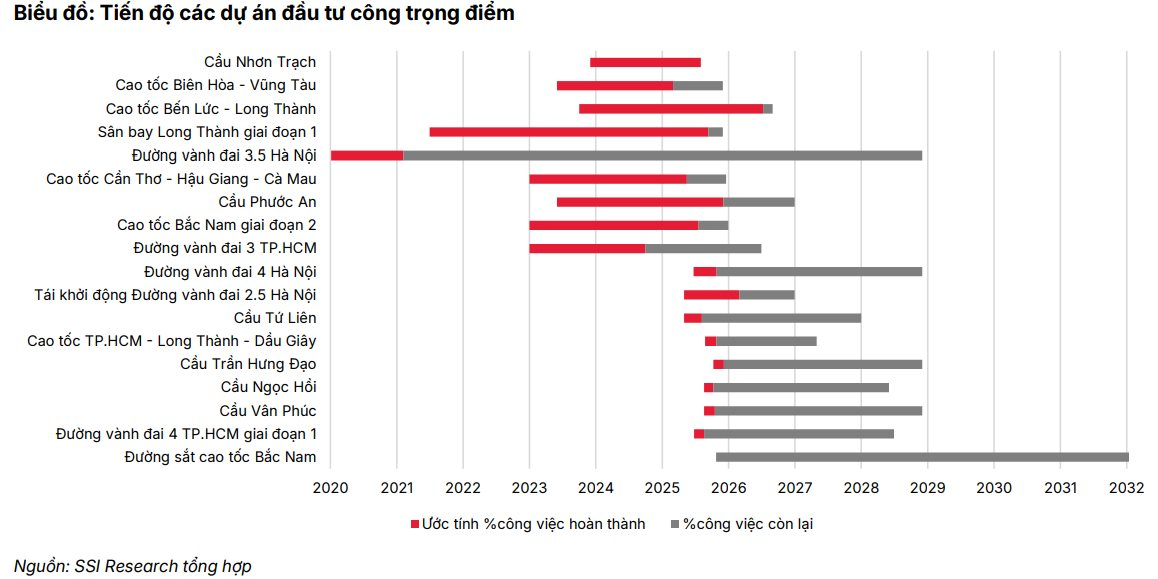

In a newly released report, SSI Securities Corporation (SSI Research) anticipates that public investment disbursement will sustain its growth momentum in 2026.

According to the Ministry of Finance’s estimates, the total planned public investment capital for 2026 is expected to reach 1.08 trillion VND, marking a 12% increase compared to the previous year. This capital will primarily be allocated to key national infrastructure projects and North-South connectivity routes.

Vietnam aims to expand its expressway network to over 5,000 km during the 2026-2030 period, up from approximately 3,300 km by the end of 2025. Based on the average investment cost estimated by the Ministry of Transport at 14 million USD/km (excluding inflation), the additional 1,200 km of expressways will require a total investment of over 400 trillion VND (equivalent to ~16 billion USD).

SSI Research expects the robust public investment disbursement, particularly in large-scale infrastructure projects, to remain a key growth driver for listed civil construction contractors. Companies such as VCG, LCG, HHV, and C4G are projected to directly benefit from this trend.

Building Materials Sector Forecast for Positive Growth

Resolution 66.4/2025, issued in September, aims to alleviate material shortages in public investment projects and support disbursement growth in 2026.

Specifically, the resolution introduces relaxed conditions for mineral and construction material exploitation in national infrastructure projects, including simplified procedures, decentralized licensing, exemption from bidding for mining rights, and flexibility in extending existing permits.

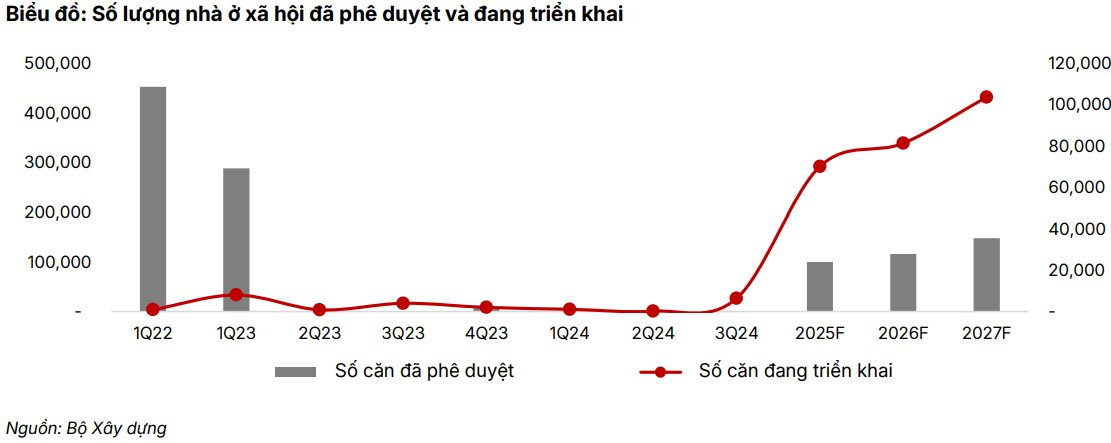

SSI Research highlights that easing legal bottlenecks and expanding the national social housing program will significantly boost housing construction demand in 2026. National Assembly Resolution 170/2024/QH15 provides a specialized legal framework to address prolonged procedural issues in the real estate sector.

Notably, this policy proposes a nationwide support mechanism to resolve issues related to 1,533 stalled projects. Additionally, the amended Housing Law offers incentives for developers to accelerate social housing supply, alongside enhanced administrative transparency and support measures.

The Prime Minister has set a target of completing 995,445 social housing units nationwide during the 2025–2030 period (with approximately 633,000 units currently under construction). The plan for 2025 is 100,275 units, and for 2026, it is 116,347 units.

SSI identifies material price fluctuations as a key factor impacting construction companies’ profit margins in 2026. “Input prices for key building materials, including steel bars, cement, sand, and construction stones, are projected to pressure project costs and gross margins for contractors in the second half of 2025,” the report states.

According to the Vietnam Construction Materials Association, cement prices in the southern market are expected to rise by 1-2% year-on-year in 2026. Sand prices are forecast to increase by 5-10%, reaching 150,000-440,000 VND/m², while construction stone prices will rise by 5-8% year-on-year. Overall, total construction costs are anticipated to increase by 5-8% in 2026.

Consequently, the building materials sector is expected to experience positive growth. SSI anticipates that with rising demand and selling prices in 2026, coupled with lower input costs, gross margins for building material companies like construction stones and cement will remain high at 28% (+3% year-on-year) and 12.6% (+0.5% year-on-year), respectively. Therefore, analysts believe that stocks such as PLC, HT1, BMP, VLB, and KSB will continue to demonstrate strong growth in 2026.

Estimates suggest that net profits for listed construction companies will increase by 8.8% year-on-year in 2026, supported by an improved project environment and stable public investment momentum. For the tracked building material companies, SSI forecasts net profits to reach 2.116 trillion VND in 2026, reflecting a 7.6% year-on-year growth.

The SSI Research team maintains a positive outlook on building material stocks like PLC, VLB, HT1, and BMP, driven by stable demand growth in 2026, higher selling prices, reduced input costs due to low oil prices, and sustained high profit margins.

Unusual Trends in Hanoi’s Villa and Townhouse Market

According to CBRE, the majority of new land-attached real estate supply in Q3 was concentrated in projects located farther from city centers. This shift resulted in an average primary market selling price of approximately VND 186 million per square meter of land during the quarter—a 19% decrease from the previous quarter and 21% lower than the same period last year.

Central Government Urged to Allocate $36 Million for Erosion Control in Dong Thap

During a meeting with Deputy Prime Minister Mai Văn Chính, the People’s Committee of Đồng Tháp Province requested the Government to consider and provide approximately 830 billion VND in support for urgent measures to address two critically severe landslide areas along the Tiền River, located in Thường Phước Commune and Cao Lãnh Ward.