Recently Released Q3/2025 Financial Reports as of October 24, 2025:

Duc Giang (DGC) reported a 13% increase in Q3 pre-tax profit to VND 901 billion, with a 13% rise in the first nine months to VND 2,866 billion.

FPT’s Q3 pre-tax profit reached VND 3,375 billion, up 16% year-on-year, and accumulated nine-month profit hit VND 9,540 billion, a 18% increase.

PVI Holdings (PVI) recorded a Q3 pre-tax profit of VND 564 billion, surging 189%.

EVN Genco1 announced Q3 pre-tax profit of VND 1,190 billion, up 72% year-on-year, with nine-month profit reaching VND 1,685 billion, a 463% increase.

Vinh Phuc Infrastructure (IDV) reported Q3 pre-tax profit of VND 92 billion, up 128%, and nine-month profit of VND 157 billion, a 2% rise.

Vinahud (VHD) became the first real estate company to report a Q3 loss, with a pre-tax loss of VND 22 billion, and a nine-month loss of VND 79 billion.

Apatit Phosphate (PAT) reported Q3 pre-tax profit of VND 116 billion, up 64%, and nine-month profit of VND 296 billion, a 53% increase.

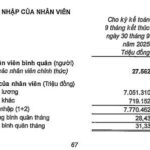

Largest Private Bank in the System Announces Significant Salary Increase for Employees

As of the end of September, this bank employs 27,696 personnel across its entire system. On average, each employee earns a monthly income of 31.33 million VND, marking a 13.6% increase compared to the same period in 2024.

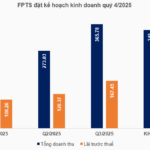

FPTS Targets 10% Profit Growth Above 2025 Plan

FPT Securities Corporation (FPTS, HOSE: FTS) has set an ambitious pre-tax profit target of VND 160 billion for Q4/2025, aiming to achieve a cumulative annual profit of VND 548 billion, surpassing its initial plan by 10%.

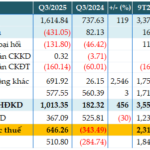

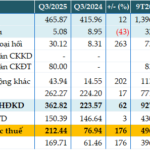

PGBank’s Q3 Pre-Tax Profit Surges 2.8x Year-Over-Year

Prosperity and Development Commercial Joint Stock Bank (PGBank, UPCoM: PGB) has released its Q3 2025 financial report, revealing a pre-tax profit of over 212 billion VND, a 2.8-fold increase compared to the same period last year. However, the bank’s non-performing loan ratio to outstanding loans edged closer to 4% by the end of Q3.