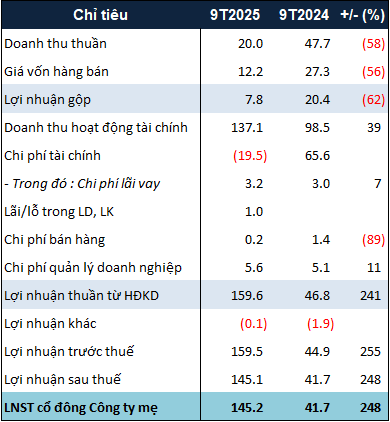

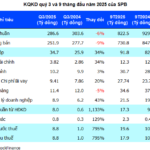

For the first nine months of the year, NDN’s net revenue reached 20 billion VND, a 58% decrease compared to the same period last year. However, financial revenue surged to over 137 billion VND, marking a 39% increase, with more than 128 billion VND attributed to profits from securities investments.

Additionally, NDN benefited from a provision reversal of over 53 billion VND for trading securities and investment depreciation, exceeding the total of other financial expenses combined.

Thanks to profits from securities investments, NDN achieved a net profit of more than 145 billion VND in the first nine months, 3.5 times higher than the same period last year.

|

NDN’s 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

Compared to the post-tax profit target of 44.3 billion VND set for 2025, NDN’s 9-month result has surpassed the target by nearly 228%.

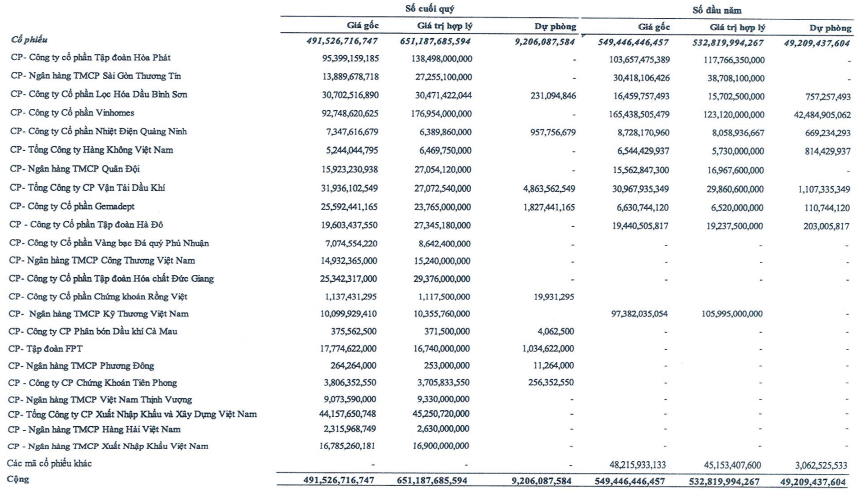

As of September 30, 2025, NDN’s total assets exceeded 1.3 trillion VND, a 2% increase from the beginning of the year. Short-term cash rose by 6% to 295 billion VND. Meanwhile, the value of trading securities decreased by 11% to nearly 492 billion VND, but positively, the provision for this category dropped significantly from 49 billion VND to 9 billion VND.

|

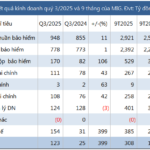

NDN’s trading securities portfolio as of September 30, 2025

Source: Q3/2025 Consolidated Financial Report

|

According to the trading securities portfolio in the explanatory notes, VHM is the largest holding in NDN’s investment portfolio. Notably, the original cost of this stock decreased from over 165 billion VND to nearly 93 billion VND, while the fair value increased from 123 billion VND to 177 billion VND, indicating that NDN took profits when VHM’s price rose.

The company’s liabilities have halved since the beginning of the year, standing at 94 billion VND. Other short-term payables decreased by 85% to nearly 18 billion VND, primarily due to the absence of a 43 billion VND maintenance fee payable for the Monarchy B apartment project.

– 1:14 PM, October 24, 2025

Sài Gòn Beer Central Region Sets Profit Margin Peak, 9-Month Earnings Surpass 18% of Annual Plan

Revised Introduction:

Saigon Beer Corporation – Central Region (HOSE: SMB) reported a record-breaking gross profit margin of 35.35% in Q3, the highest in its history, driving a 24% year-on-year surge in net profit. Over the first nine months, the company has already surpassed its full-year profit target by 18%.

BV Life Q3 Profits Surge by Nearly 2,800%, Stock Hits Ceiling for 3 Sessions Before Cooling Down

The sale of the 5th-floor office space in Tower 25T1 propelled BV Life JSC (HNX: VCM) to a remarkable Q3 net profit of over 31 billion VND, a staggering 28.5-fold increase year-on-year. This stellar performance fueled a three-session ceiling rally in the company’s stock, before a modest 3% correction on October 24th.

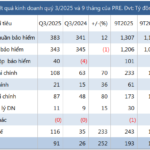

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.