Corporate Debt Repayment and Refinancing Accelerate

In Q3/2025, as the coupon rates for newly issued bonds by real estate and other sector issuers declined, market trends showed an increase in coupon rates for banks.

Simultaneously, businesses continued to accelerate debt restructuring through early bond buybacks, alongside new issuances.

According to S&I Ratings, Q3/2025 saw 155 corporate bond issuances, including 154 domestic issuances totaling 156.1 trillion VND and one international issuance by VPBank valued at 300 million USD. The total issuance value decreased by 33% compared to Q2 but remained consistent with the same period last year. Issuance activity cooled after a highly active Q2, when major banks like Techcombank, ACB, BIDV, and VPBank intensified bond fundraising to bolster capital.

“While private placements still dominated (86%), public issuances showed positive momentum with 20.4 trillion VND across 10 issuances in Q3. Beyond financial institutions, manufacturing firms like CII and SBT also successfully participated in this issuance format,” noted S&I Ratings.

In terms of issuance structure, banks and real estate firms continued to dominate, accounting for 72% and 19% of Q3 bond issuance value, respectively. Notable issuers included Agribank (17.5 trillion VND), OCB Bank (16.2 trillion VND), Vinhomes (15 trillion VND), and MB Bank (12.1 trillion VND).

New Fundraising Rates Decline

The Business Trend Survey of Credit Institutions by the Monetary Statistics and Forecasting Department (State Bank of Vietnam) revealed reduced coupon rates for many real estate and manufacturing firms. In the real estate sector, despite less frequent issuances compared to banks, S&I Ratings observed a clear downward trend in coupon rates over the past year, with reductions ranging from 50 to 150 basis points.

Notable examples include VinGroup and Vinhomes (from 12.5% to 11%), TCO Real Estate (from 9.6% to 9%), AAC (from 10% to 9.1%), and Van Phu Invest (from 11% to 10%). This trend also appeared among non-bank financial institutions like KIS Securities (from 7.92% to 7%), Bao Minh Securities (from 10% to 8.5%), and F88 (from 11% to 10%). Additionally, manufacturing firms like Vietjet and Thanh Thanh Cong – Bien Hoa recorded positive rate reductions.

“Improved business conditions and a warming real estate market, supported by new legal frameworks promoting market health, have significantly enhanced the credit risk assessment of these firms this year,” experts explained.

Outlook Remains Challenging

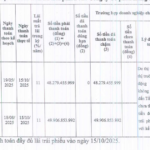

In Q3/2025, early buybacks surged to a record 112 trillion VND as issuers restructured debt amid low interest rates. Bond maturities also rose sharply to 72 trillion VND (compared to 50.7 trillion VND in the first half of the year).

In the first nine months of 2025, 122.8 trillion VND in bonds matured, and 235.6 trillion VND were bought back early, equivalent to 84% of new issuance value. Many issuers also extended bond tenures, with 9.7 trillion VND extended in Q3 and 35 trillion VND in the first nine months.

S&I Ratings experts noted that several issuers still face challenges in timely repayments. Approximately 62 trillion VND in bonds (5% of total market debt) are in default. In Q3 alone, 37 bond lots from major issuers like Novaland, BCG, Hung Thinh, Bitexco, Van Thinh Phat, and Hoang Anh Gia Lai announced payment delays.

Despite significant debt restructuring efforts, major developers, who are also large issuers, need time for the real estate market to fully recover, projects to generate revenue, and debt to be settled with bondholders.

S&I Ratings forecasts that Q4/2025 bond maturities will remain high at 62 trillion VND. However, pressure on the real estate sector will ease, with maturities dropping 49% to 19.3 trillion VND.

In 2026, maturity pressure will subside in the first quarter before rising again by year-end, totaling 233 trillion VND, a 26% increase from 2025. Notably, 2026 will be particularly challenging for real estate firms, with a record 141 trillion VND in bonds maturing in the final three months, an 81% increase from 2025.

Consequently, bond issuance activity is expected to remain robust in 2026, especially within the real estate sector.

Emerging Real Estate Hotspot: East Side of Ho Chi Minh City

East of Ho Chi Minh City, a series of landmark projects with a total investment of billions of dollars are nearing completion, poised to transform the real estate landscape into a vibrant new era.