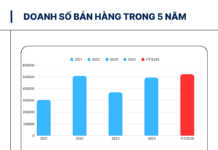

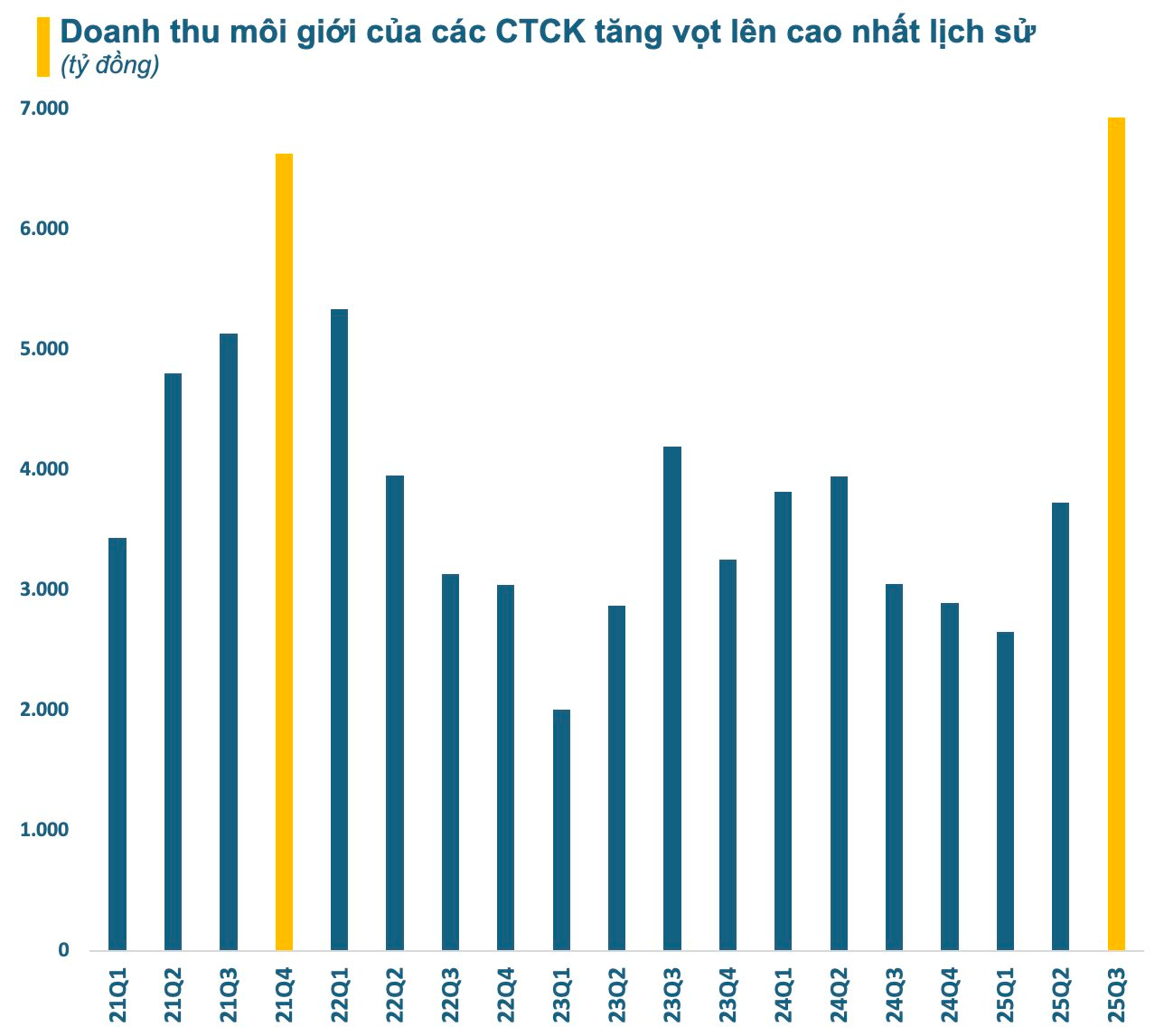

According to the Q3/2025 financial reports, the total brokerage revenue of Vietnamese securities companies reached a staggering VND 7,000 billion, more than doubling the figure from the same period in 2024 and nearly 90% higher than the previous quarter. This marks a historic high, surpassing the previous peak recorded in late 2021 during another vibrant market phase.

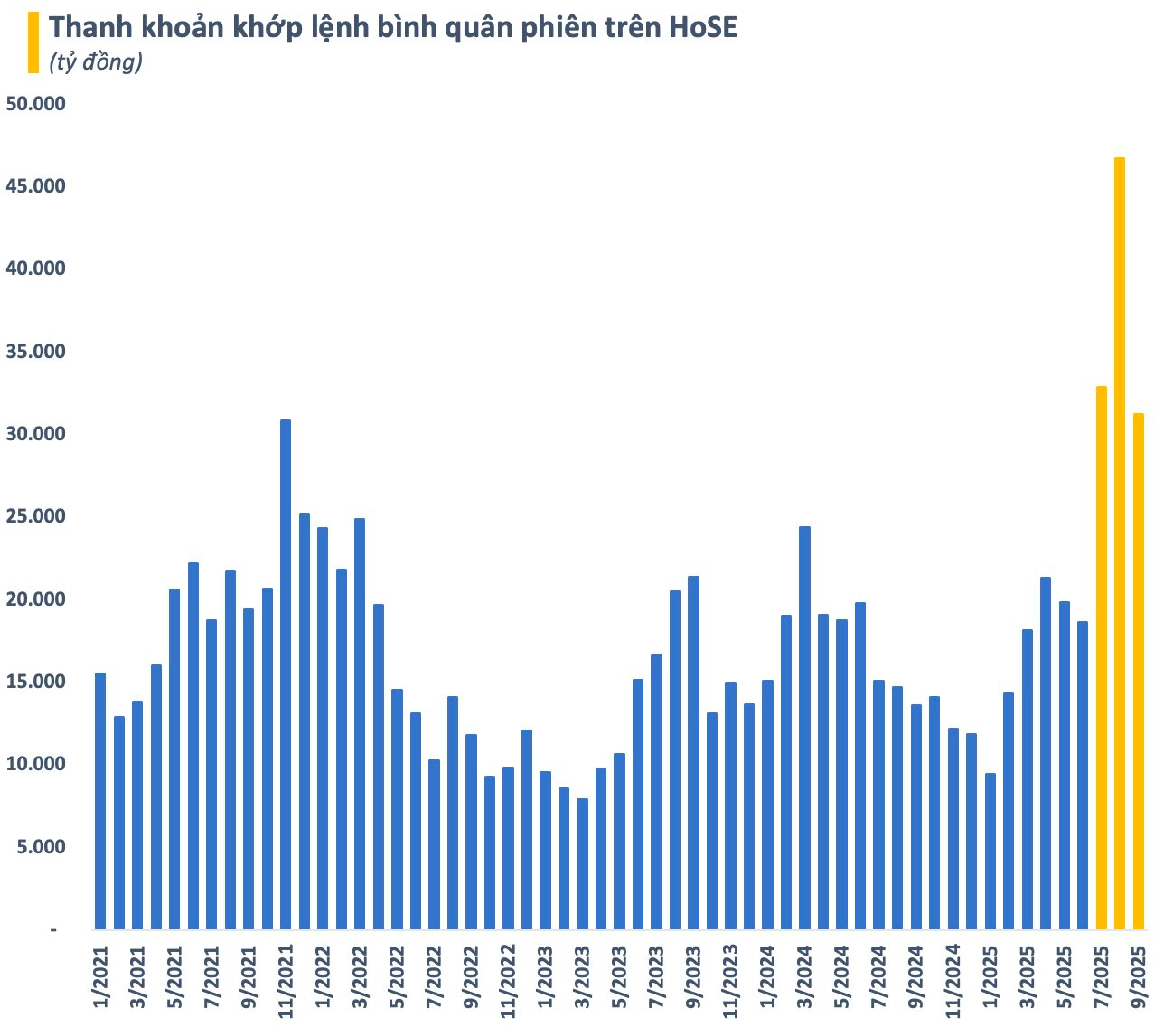

The third quarter witnessed unprecedented activity in Vietnam’s stock market. Average daily trading value on the Ho Chi Minh Stock Exchange (HoSE) consistently exceeded VND 30,000 billion per session, with several sessions reaching $2-3 billion USD. These figures far surpass those seen in late 2021 and early 2022.

Despite the remarkable liquidity, the total brokerage revenue in Q3/2025 was only 6% higher than the peak in late 2021. This highlights the intense competition among securities companies. To capture market share, firms aggressively rolled out margin interest rate incentives and fee waivers or reductions for clients.

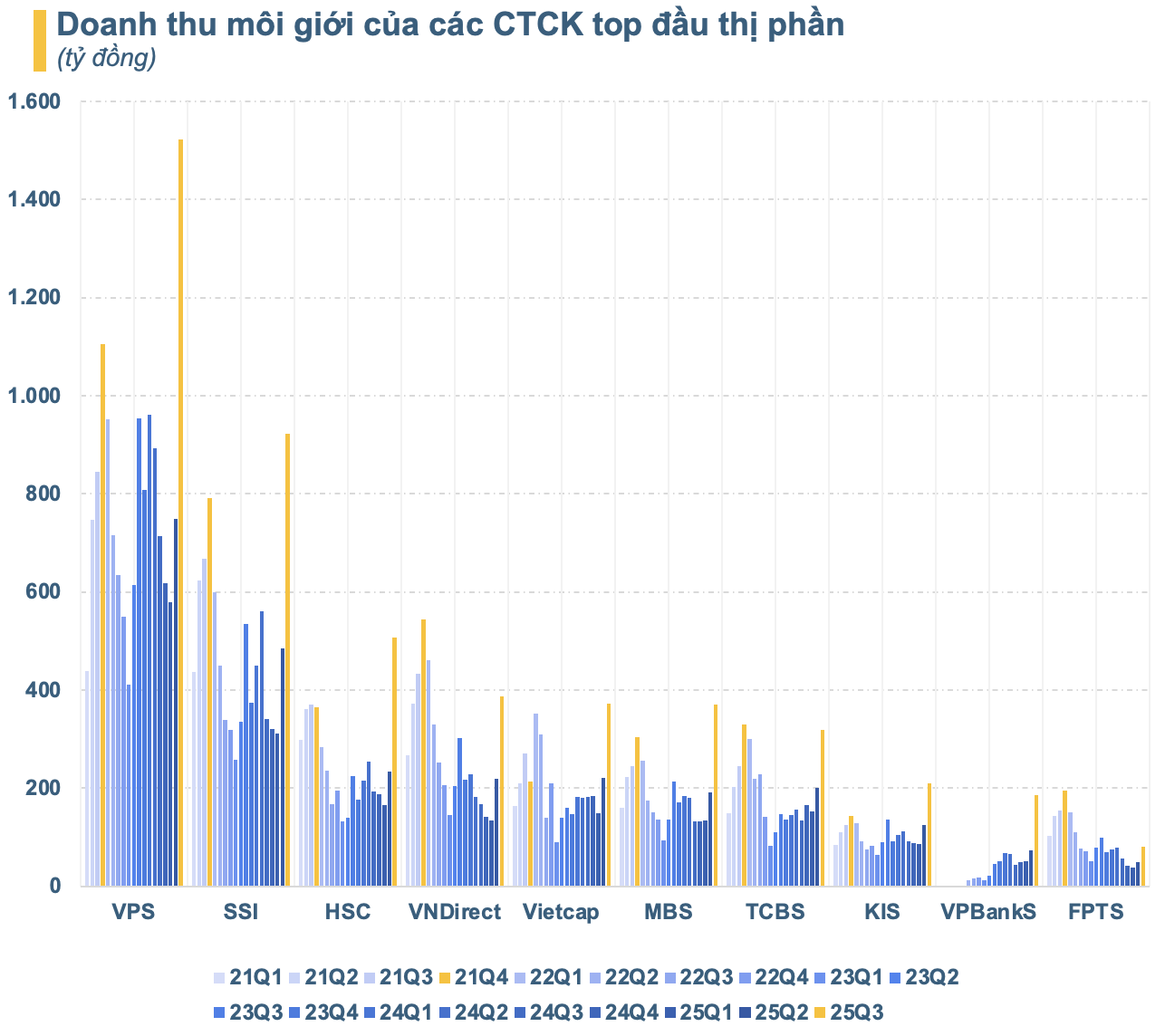

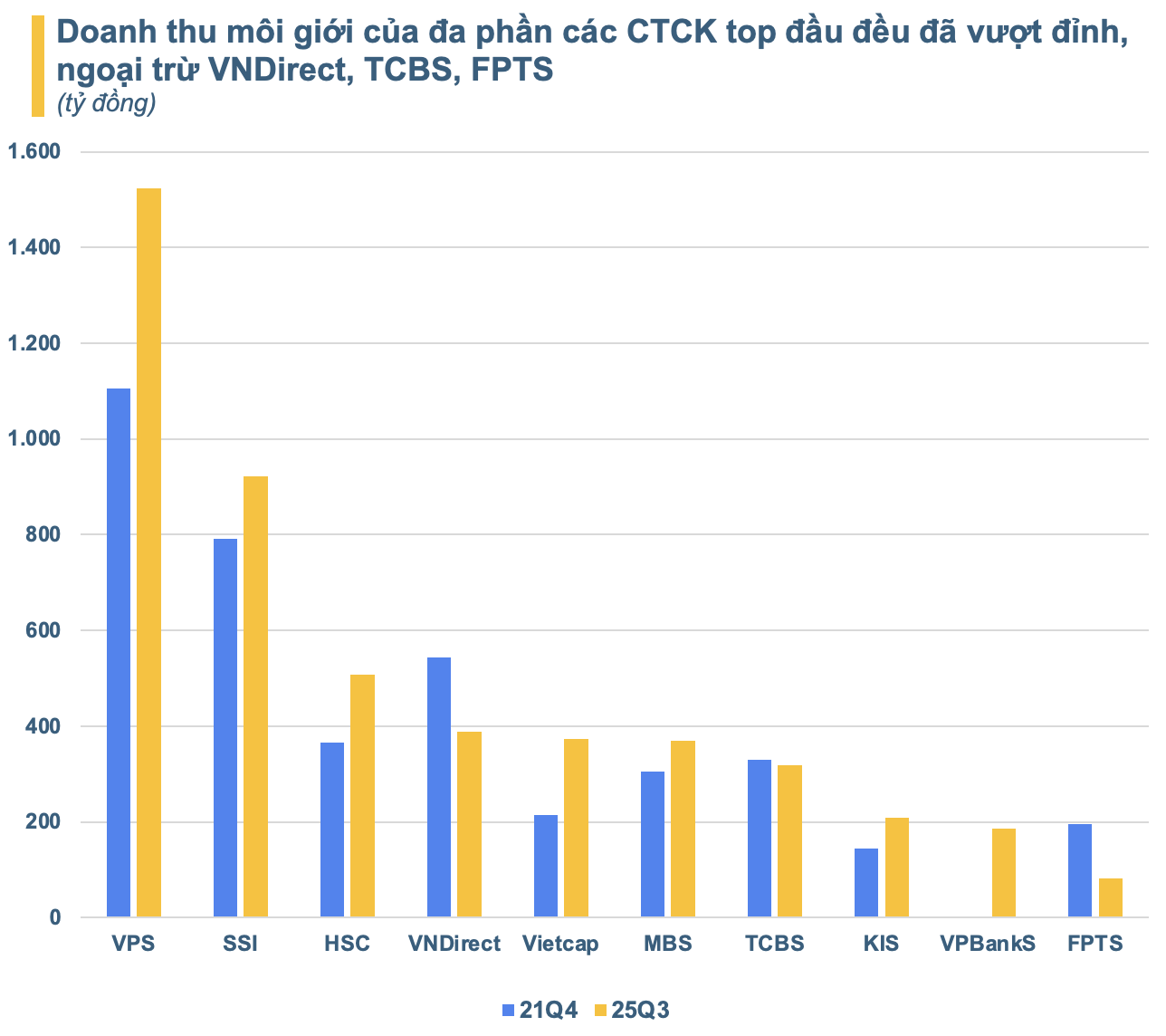

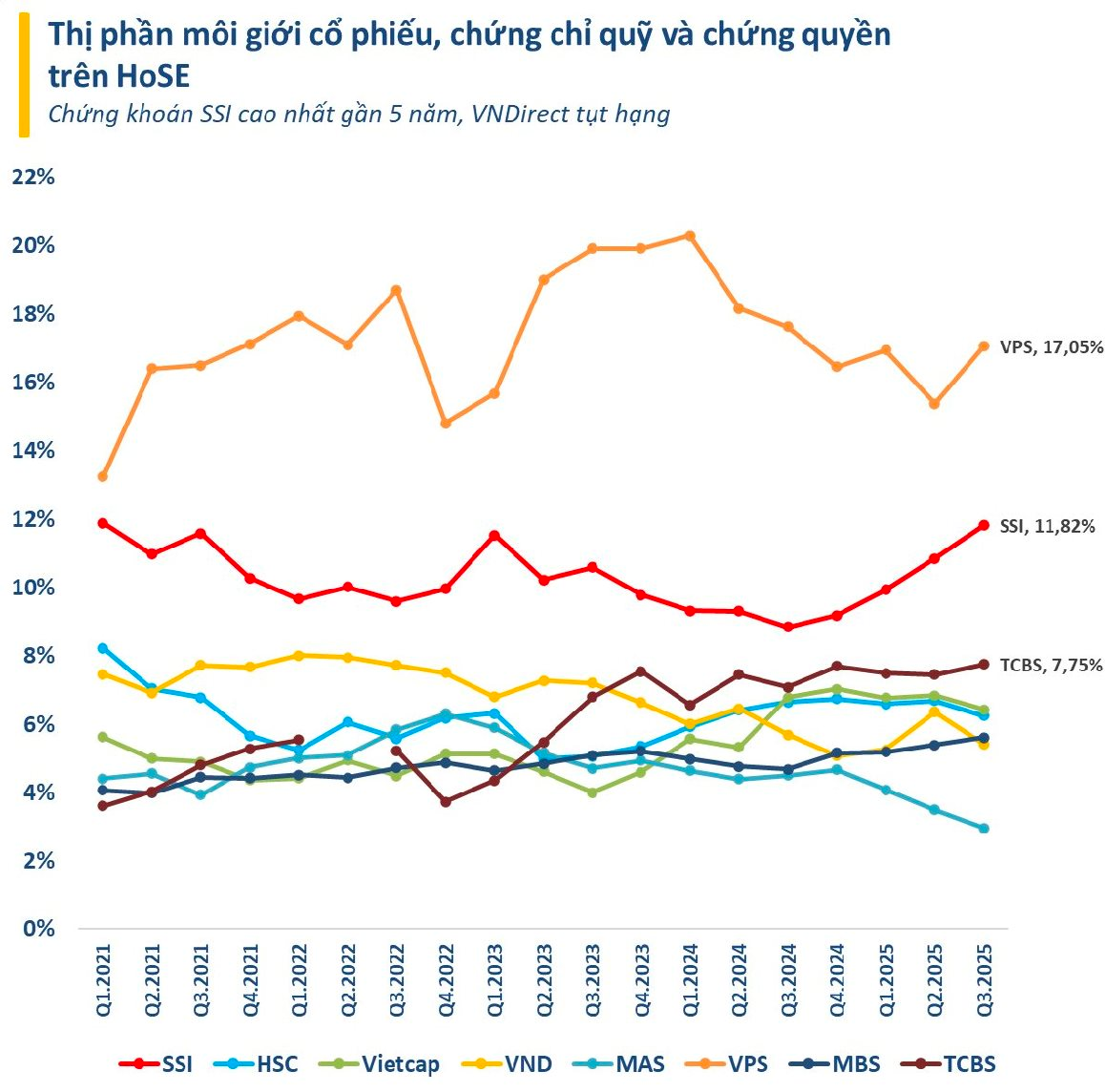

With the expanding market, most securities companies capitalized on the opportunity to boost brokerage revenue. Notably, VPS and SSI stood out. VPS became the first securities company to achieve quarterly brokerage revenue exceeding VND 1,000 billion (in Q4/2021) and surpassed VND 1,500 billion in Q3/2025. SSI’s Q3/2025 brokerage revenue also surged past VND 900 billion, positioning it as a strong contender to join the VND 1,000 billion club.

Additionally, newcomer VPBankS is rapidly gaining momentum, while established players like HSC, Vietcap, and MBS also recorded brokerage revenues well above previous peaks. Conversely, some top-tier firms such as VNDirect, TCBS, and FPTS reported significantly lower brokerage revenues compared to late 2021, despite strong growth in recent quarters.

Several factors contributed to the decline in brokerage revenue for some firms, despite the market’s explosive growth. TCBS’s “Zero fee” policy, implemented since early 2023, may explain its slightly lower revenue compared to the peak, though it has expanded its customer base. VNDirect, once a top-three brokerage firm, has lost ground due to its reluctance to engage in fee reductions or commission increases. Additionally, a cyberattack on its trading system in late March 2024 may have had an impact.

Overall, the brokerage sector is thriving alongside the market’s resurgence. Beyond revenue, brokerage activities offer significant benefits to securities companies, including expanded customer bases and cross-selling opportunities. As competition intensifies, especially with Vietnam’s market upgrade, the battle for market share will only escalate.

Margin lending capacity, alongside fees and interest rates, has become a critical factor for investors when choosing a securities company. To secure market share, firms must continuously strengthen their capital base to meet the growing demands of both domestic and international investors (Non Pre-funding).

The race to increase capital among securities companies is expected to continue vigorously. SSI, VPBankS, VPS, MBS, and others have announced plans to raise capital in the near future.

Bank Stocks Braced for Potential Sell-Off as Whales Eye $10 Billion Exit in October

ETF fund groups will initiate portfolio rebalancing starting from October 27th, culminating on the final restructuring date of October 31st.

October 23rd Session: Foreign Investors Net Sell Nearly VND 1.5 Trillion – Which Stocks Were Hit Hardest?

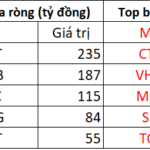

In the afternoon trading session, foreign investors aggressively accumulated FPT shares, making it the most heavily bought stock on the market with a total value of 235 billion VND. HDB and VJC also saw significant net buying, with values of 187 billion VND and 115 billion VND, respectively.