Upgrading the Market is Just the Beginning

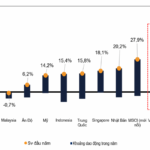

Vietnam’s stock market has been upgraded from Frontier to Secondary Emerging by FTSE Russell, marking a significant milestone in its 25-year development journey. Before and after this event, numerous investment funds—managing portfolios worth hundreds to thousands of billions of USD—have expressed keen interest in Vietnam’s market.

“Many investors, including both passive and active funds, who previously showed no interest in Vietnam, are now actively exploring opportunities,” stated Mr. Hai during a dialogue themed “New Money, New Stocks, and Opportunities in Emerging Markets.”

Vietnam’s stock market officially upgraded from Frontier to Secondary Emerging. Photo: LÊ VŨ |

In reality, the news of Vietnam’s market upgrade has brought about positive changes, notably improving investor sentiment and boosting overall market liquidity. However, representatives from the State Securities Commission (SSC) emphasize that this upgrade is merely the starting point of a new journey, with much work ahead.

Macroeconomically, the Party and Government aim for a minimum annual economic growth rate of 10% from 2026 to 2030, requiring substantial investment capital estimated at approximately 270 billion USD annually. Effective capital mobilization solutions are essential to reduce pressure on the banking system, which has been strained, as evidenced by a credit growth rate exceeding deposit growth by 3.5% in the first seven months of 2025.

Previously, in 2024, the banking system supplied up to 50% of the total capital in the economy, while stock market mobilization—including equities and corporate bonds—accounted for only 14%.

For Vietnam’s stock market, the lack of diverse and high-quality products has persisted for years.

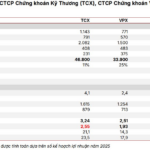

Mr. Nguyễn Thế Minh, Director of the Research and Retail Development Division at Yuanta Securities Vietnam, noted that Vietnam’s stock market has over 1,600 listed stocks with a total market capitalization of around 300 billion USD, averaging approximately 187.5 million USD per company.

In contrast, Thailand has over 600 listed stocks with a total market capitalization nearing 400 billion USD, averaging around 700 million USD per company.

“This indicates that most stocks on Vietnam’s market are mid-cap and small-cap,” Mr. Thế Minh assessed.

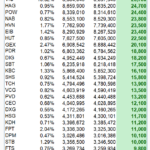

Regarding listings, the IPO wave resurfaced in the second quarter of 2025, with several major companies initiating the process. However, the number of completed deals remains lower than in other countries during the same period and significantly lower than during the 2016-2017 boom.

Furthermore, most IPOs are from financial companies, a phase long surpassed globally, according to Mr. Phạm Lưu Hưng, Chief Economist at SSI Securities.

Currently, financial and real estate stocks account for over 50% of Vietnam’s total market capitalization, while industrial, manufacturing, and IT stocks represent only 10.6% and 2.1%, respectively.

Conversely, technology stocks constitute 34% of the S&P 500 index, which tracks the 500 largest U.S. public companies, while financial and real estate stocks account for just over 15%.

Enhancing Market Quality and Economic Contribution

As Vietnam’s stock market enters a new phase with heightened expectations, regulators have introduced policies encouraging IPOs and listings to address the shortage of tradable securities.

The stock market may continue to consolidate and accumulate in October. Photo: LÊ VŨ

|

Mr. Phạm Lưu Hưng suggests focusing on digital consumer technology IPOs. Attracting more foreign investment could be achieved by increasing listings from consumer sectors and foreign-invested enterprises (FIEs).

“Relaxing listing requirements, such as removing the condition of two consecutive years without accumulated losses, could enable tech startups and innovative companies to access capital markets,” Mr. Hưng recommended.

Additionally, the SSC representative mentioned that the recently passed Law on Science, Technology, and Innovation includes provisions for establishing a trading platform for innovative entities. The SSC and the Ministry of Science and Technology are designing this platform, featuring both trading and listing boards.

“Listing conditions will be adjusted to suit high-tech innovative entities, such as removing profit requirements and focusing on revenue and user metrics,” Mr. Hai explained, adding that efforts will ensure these entities can list without meeting traditional financial criteria.

Regarding FIEs, he confirmed that plans to list these companies have gained inter-ministerial consensus, with anticipated IPOs and listings in the near future.

Beyond the equity market, the bond and derivatives markets are also key focus areas for capital mobilization.

Mr. Nguyễn Anh Phong, Chairman of the Hanoi Stock Exchange (HNX), announced collaboration with the State Treasury to develop a technological infrastructure for the bond market, supporting government resource mobilization. Additionally, refining the yield curve to reflect market risks will provide investors with reliable benchmarks.

For derivatives, HNX plans to propose equity index options to the SSC, aligning with the strategy of progressing from simple to complex products to enhance liquidity and attract international capital.

“The bond and derivatives markets are expanding, offering investors more choices and portfolio protection tools,” noted Chairman Phong.

Experts and officials also emphasize expanding investment funds, particularly open-ended funds, and adopting International Financial Reporting Standards (IFRS) to enhance financial transparency and standardization.

Vân Phong

– 19:00 24/10/2025

Foreign ETFs Rebound with Net Buying Surge in Upgrade Week

During the week of October 6–10, the VanEck Vectors Vietnam ETF (VNM ETF) reversed its net selling trend, pivoting to robust buying of Vietnamese stocks. This shift coincided with FTSE Russell’s official announcement on October 8, upgrading Vietnam’s market classification from Frontier to Secondary Emerging status.

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

Foreign Capital Poised to Return to Vietnam’s Stock Market Following Upgrade Catalyst

FTSE’s updates could spark an immediate market response, but VNDirect anticipates a subsequent shift back to fundamentals as the driving force.