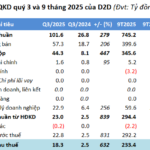

| SMB’s Quarterly Business Results for 2022-2025 |

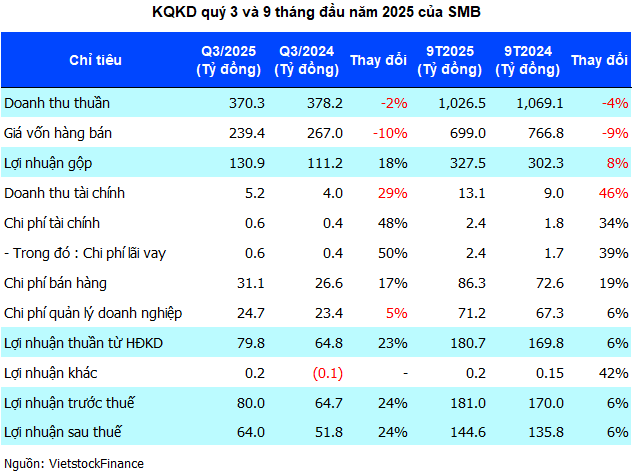

Specifically, SMB recorded a gross profit margin of 35.35% in Q3/2025, the highest in its history, surpassing the 29.4% of the same period last year and 33% of the previous quarter. This result helped SMB achieve a net profit of nearly 64 billion VND, a 24% increase year-over-year, despite a slight 2% decline in revenue to over 370 billion VND. This is also the highest quarterly profit in the past three years, second only to the record 73 billion VND in Q2/2022.

According to SMB, the improved profit margin is attributed to a 10% reduction in production costs compared to the same period last year, as the company effectively managed raw material quotas, reduced production expenses, and benefited from declining input prices. As a result, despite a slight revenue decrease, profits grew significantly.

|

In the first nine months of the year, SMB achieved nearly 1,027 billion VND in revenue, a 4% decrease year-over-year, but net profit increased by 6% to nearly 145 billion VND, fulfilling 72% of the annual revenue target and exceeding the profit goal by 18%.

By the end of September 2025, SMB held 447 billion VND in bank deposits, an 18% increase from the beginning of the year, while inventory decreased by 16% to under 200 billion VND. Short-term debt also dropped by 21% to 103 billion VND, primarily with Agribank at 73 billion VND.

SMB recently announced the second interim dividend payment for 2025 in cash at a rate of 20% (2,000 VND/share), totaling nearly 60 billion VND. The ex-dividend date is November 13, with payment scheduled for November 26. Previously, the company distributed the first interim dividend at the same rate, bringing the total dividend payout for 2025 to 40%, in line with the plan approved by the shareholders’ meeting.

The largest shareholder of SMB is Saigon Beer – Alcohol – Beverage Corporation (Sabeco, HOSE: SAB), holding 32.22% of the capital, and will be the primary beneficiary of this dividend distribution.

On the HOSE market, SMB shares have increased by over 20% in the past year, currently trading at around 41,500 VND/share, with an average liquidity of approximately 18,000 shares per session.

| SMB Stock Price Trends Over the Past Year |

– 14:13 24/10/2025

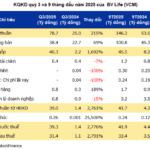

D2D Surpasses Annual Plan, Reporting Over 230 Billion VND in Profit After 9 Months

Industrial Urban Development Corporation No. 2 (HOSE: D2D) has reported a stellar Q3 performance, with both revenue and profit doubling year-over-year. This remarkable growth is attributed to the successful land transfer in Chau Duc Industrial Park, surpassing the annual plan after just nine months.

BV Life Q3 Profits Surge by Nearly 2,800%, Stock Hits Ceiling for 3 Sessions Before Cooling Down

The sale of the 5th-floor office space in Tower 25T1 propelled BV Life JSC (HNX: VCM) to a remarkable Q3 net profit of over 31 billion VND, a staggering 28.5-fold increase year-on-year. This stellar performance fueled a three-session ceiling rally in the company’s stock, before a modest 3% correction on October 24th.

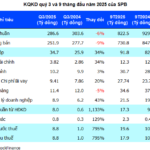

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.

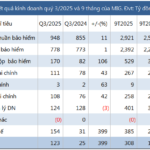

PRE Reports Record-Breaking Quarterly Profits in Company History

Hanoi Reinsurance Corporation (Hanoi Pre, HNX: PRE), a subsidiary of PVI, reported a remarkable 3.5-fold increase in net profit for Q3 2025, reaching 91 billion VND. This quarterly earnings figure stands as the highest in the company’s history since its establishment in the reinsurance industry.