Saigon General Service Corporation (Savico, Stock Code: SVC, HoSE) has submitted an official statement to the State Securities Commission (SSC) and Ho Chi Minh City Stock Exchange (HoSE) regarding the consecutive ceiling price increase of its shares over five sessions.

According to Savico, the ceiling price surge of SVC shares from October 16, 2025, to October 22, 2025, is entirely driven by market dynamics and supply-demand factors. The company emphasizes that investors’ decisions regarding SVC shares are beyond its control.

Additionally, the company’s robust third-quarter 2025 performance may have influenced investors’ assessments and investment considerations.

Illustrative image

Savico further clarifies that it has not exerted any influence on the trading of its shares and remains committed to complying with all applicable legal regulations for public companies.

Previously, HoSE issued Official Dispatch No. 1598/SGDHCM-GS, requesting Savico to report and disclose information related to the company’s impact on the consecutive ceiling price increase of VSC shares from October 16, 2025, to October 22, 2025.

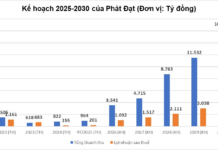

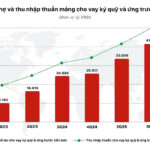

In terms of business performance, Savico’s Q3 2025 consolidated financial report reveals a net revenue of over VND 8,217 billion, marking a 21.3% year-on-year increase. After deducting the cost of goods sold, gross profit reached more than VND 480.3 billion, up 5.9%.

During the period, the company generated nearly VND 668.7 billion in financial revenue, a 32.9-fold increase compared to the same period last year. Concurrently, financial expenses rose from VND 60.4 billion to VND 219.1 billion; selling expenses increased by 35.2% to VND 325.1 billion; and administrative expenses reached over VND 202.4 billion, a 31% increase.

As a result, after tax and fee deductions, Savico reported a net profit of over VND 344.5 billion, 13.6 times higher than the VND 25.4 billion net profit in Q3 2024.

For the first nine months of 2025, Savico achieved a net revenue of over VND 20,547 billion, a 26.6% increase compared to the same period in 2024. Corporate income tax-adjusted profit reached nearly VND 492.9 billion, 4.1 times higher year-on-year.

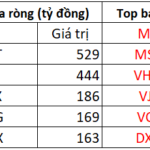

As of September 30, 2025, Savico’s total assets increased by 34.6% since the beginning of the year, reaching nearly VND 12,067 billion. This includes short-term receivables of over VND 4,268 billion, accounting for 35.4% of total assets, and inventory of nearly VND 2,343 billion, representing 19.4% of total assets.

On the liabilities side, total payables stood at over VND 9,055 billion, a 37.4% increase since the beginning of the year. Of this, total loans and finance leases amounted to nearly VND 4,748 billion, constituting 52.4% of total liabilities.

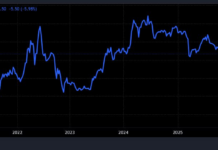

How Long After Listing Can TCX Shares Be Traded on Margin?

Following its listing, many investors are eagerly anticipating when TCX shares of Technocom Securities (TCBS) will be eligible for margin trading.