Gold and silver prices continue to face pressure following Tuesday’s (October 22) sharp sell-off, marking their fastest decline in 4–5 years. However, analysts suggest this correction could benefit the overheated precious metals market.

In an interview with Kitco News, Robert Minter, ETF Investment Strategy Director at abrdn, noted that the recent price drop helps cool excessive buying in gold and silver.

Minter advised investors to brace for heightened volatility, especially in silver, which faces severe supply shortages. Silver markets have recorded deficits for four consecutive years due to surging industrial demand and dwindling global inventories.

“Silver’s supply deficit has persisted for years, but prices are only now reflecting this reality,” he said. “Rapid price increases are understandable, and profit-taking at high levels is a natural response.”

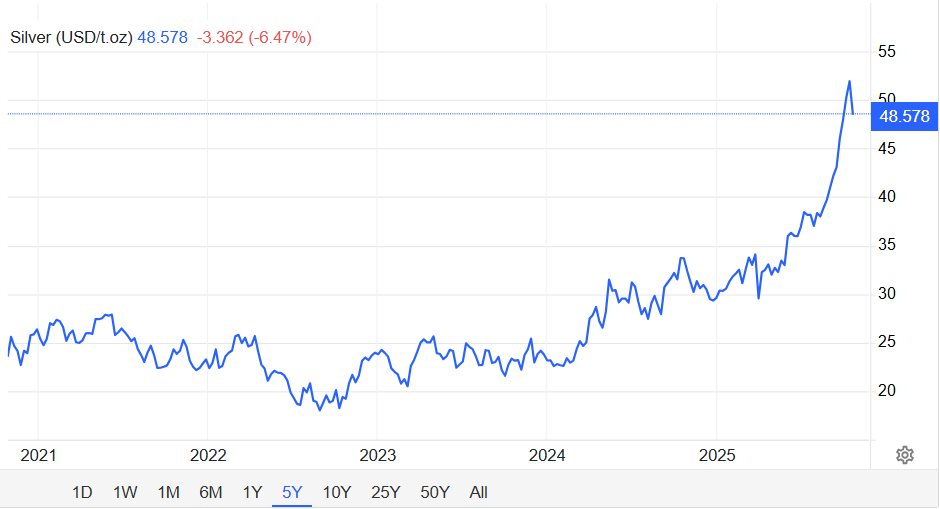

Silver price trends over the past 5 years (Source: Trading Economics)

Silver’s volatility occurs amid global metal market pressures from trade tensions and U.S. tariff threats. Since early 2025, silver inflows into the U.S. have surged as investors and bullion dealers stockpile to hedge against tariff risks.

This has caused severe physical shortages in London, driving storage costs and spot-futures spreads to record highs.

Minter emphasized that current silver supply falls short of global demand, a trend unlikely to reverse soon. Since 2016, silver production has dropped 8.8%, while demand has risen, particularly in solar energy and high-tech sectors.

“No company is unwilling to boost output, but they face constraints. Developing a new silver mine takes at least a decade,” he stressed.

Minter attributed silver’s instability to supply-demand imbalances, trade tensions, and speculative sentiment, despite the current correction making the market healthier than its previous overheated phase.

Vietnamese experts also predict rising silver demand. At the 2026 Business Forum themed “New Growth Spaces: Opportunities and Strategies,” Huynh Minh Tuan, Founder of FIDT and Vice Chairman of APG Securities, noted silver’s recent surge in interest. Prices have risen 64% year-to-date, outpacing gold’s 56% increase.

Tuan highlighted that major precious metals companies like Phu Quy Group now offer silver storage products, partnering with Bao Tin Minh Chau to distribute silver bars and coins.

“With limited gold supply, silver may gradually rise. Globally, under President Donald Trump’s cycle, gold and silver prices moved in tandem. Silver is a viable defensive asset for accumulation,” Tuan stated.

Huynh Minh Tuan, Founder of FIDT and Vice Chairman of APG Securities

Nguyen Quang Huy, CEO of Banking and Finance at Nguyen Trai University, noted that global and Vietnamese Net Zero goals will drive silver demand over the next 30–40 years, making silver accumulation a new growth trend.

Assoc. Prof. Ngo Tri Long agreed, stating silver’s monetary nature and price correlation with gold make it a novel but challenging investment. “Investors must research thoroughly, choose reputable platforms, remain patient, and avoid leveraging for silver investments,” he advised.

Silver Surge Follows Gold Rush in Asian Nation: Dealers Declare, ‘The Market Has Never Been This Frenetic’

Silver is poised to become the next precious metal to surge in value, following in the footsteps of gold. With growing market confidence, silver is increasingly viewed as a lucrative investment opportunity, ready to shine in the global financial landscape.