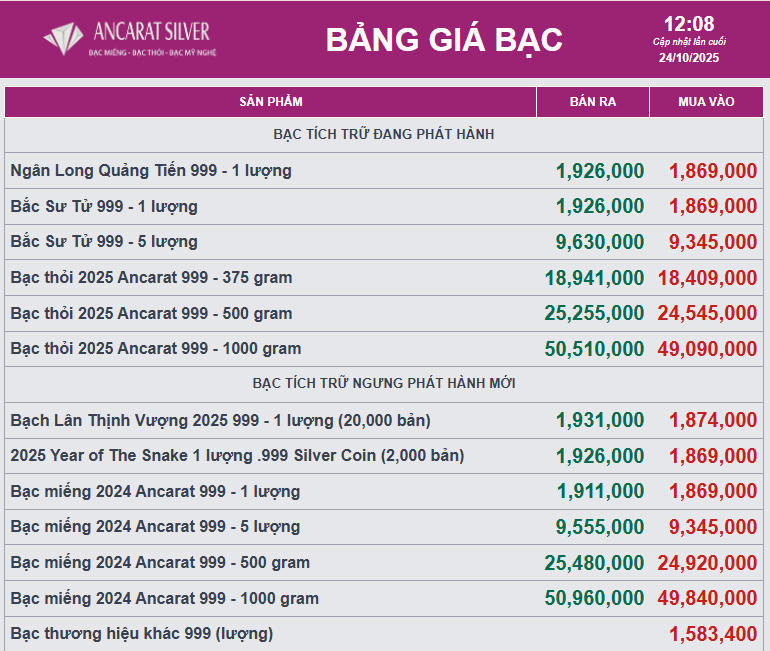

At Ancarat Vietnam Joint Stock Company, silver prices remain stable today, listed at VND 1,869,000 per tael (buy) and VND 1,926,000 per tael (sell) in Hanoi. This reflects an increase of VND 14,000 per tael on the buying side and VND 29,000 per tael compared to yesterday morning’s session. However, over the past week, silver has lost 10% of its value, erasing the previous strong gains.

Meanwhile, 1kg 999 fine silver bars are priced at VND 49,090,000 per bar (buy) and VND 50,510,000 per bar (sell), updated on October 24.

Globally, silver is trading at $48.5 per ounce.

The silver market attracted renewed investment on Thursday (October 24), despite a recent sharp sell-off. According to precious metals analyst Christopher Lewis, this recovery offers a glimmer of hope but comes with significant risks.

“Silver prices dipped slightly before rebounding. However, investors should exercise caution before interpreting this as a trend reversal. The market has experienced a deep decline over several days, and heightened volatility has nearly eliminated stability,” he noted.

Christopher Lewis highlights that the $47 per ounce level currently acts as a critical resistance point. If prices fail to hold above this threshold, the trend may quickly turn negative again.

“Conversely, the $50 per ounce mark will be a significant barrier for silver to overcome if it aims to resume an upward trajectory,” he added.

The analyst cautions that sharp declines rarely occur randomly. Therefore, the current recovery is likely short-lived. In the most optimistic scenario, silver prices may need additional time to stabilize before establishing a new trend.

“In reality, if silver fails to surpass $50 per ounce, it could signal the end of the upward trend and indicate that the market is entering a deeper correction phase,” Christopher Lewis concluded.

Expert Insights: Silver Transcends Ornamental Value, Emerging as a Strategic Investment Avenue Alongside Gold

Silver is emerging as a compelling investment avenue, capturing the attention of investors seeking long-term growth and portfolio diversification. Renowned experts highlight its dual appeal as both a defensive asset and a store of value, mirroring gold’s traditional role. Additionally, silver’s critical role as a raw material in green energy production ensures its demand will continue to rise, solidifying its position as a forward-looking investment opportunity.