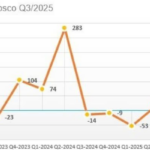

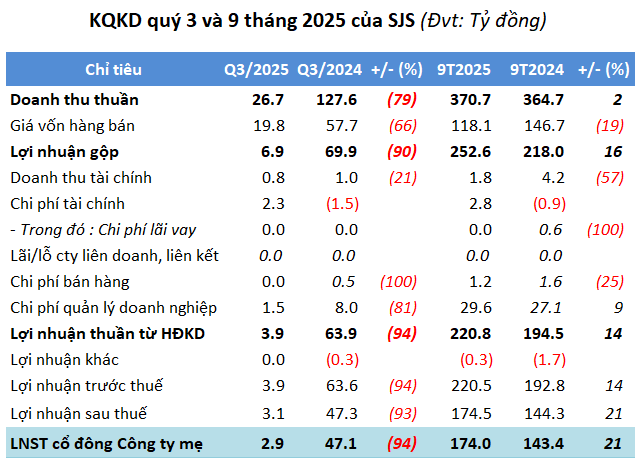

SJ Group Corporation (HOSE: SJS) has released its Q3 business results, revealing a lackluster performance. The company reported a net revenue of just under VND 27 billion, a 79% decline and the lowest in nine quarters (since Q3/2023). This drop is attributed to the absence of revenue from real estate transfers, which contributed over VND 108 billion in the same period last year. After deducting the cost of goods sold, gross profit stood at nearly VND 7 billion, a 90% decrease. The gross profit margin also plummeted from 55% to 26%.

Despite a 46% reduction in financial and management expenses to VND 4 billion, SJS recorded its lowest profit in 12 quarters (since Q4/2022), with nearly VND 3 billion, a 94% drop.

SJS explained that the focus on investment and construction of new projects has delayed revenue recognition, leading to the profit decline.

| SJS Business Results from Q1/2022 to Q3/2025 |

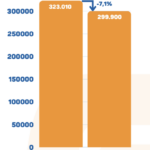

For the first nine months, cumulative net revenue reached nearly VND 371 billion, with after-tax profit at VND 174 billion, up 2% and 21% respectively. Against the annual plan, SJS has achieved only 31% of its revenue target and 29% of its profit goal after three quarters.

Source: VietstockFinance

|

As of the end of Q3, SJS‘s total assets exceeded VND 8,045 billion, a 3% increase from the beginning of the year. The majority of this is in inventory, amounting to nearly VND 4,352 billion, up 4%, primarily consisting of work-in-progress costs for the Nam An Khanh New Urban Area project (over VND 4,280 billion) and the Southeast Expansion – North Tran Hung Dao Residential Area project (over VND 57 billion).

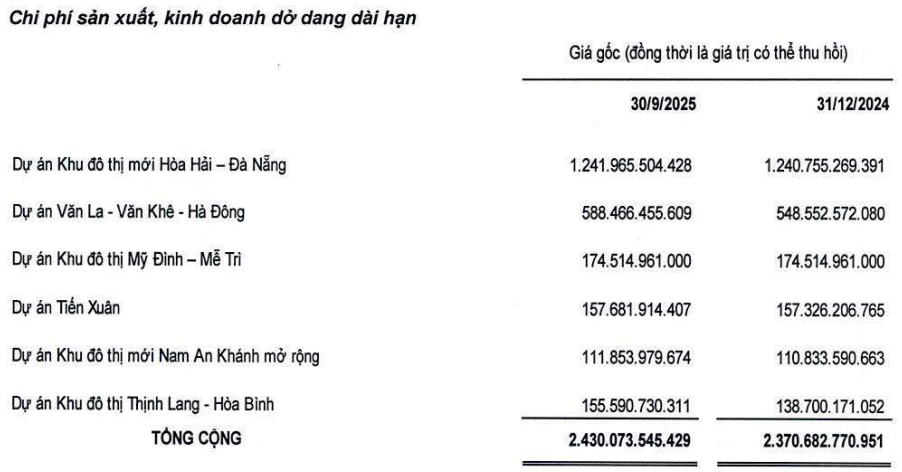

Long-term work-in-progress costs reached nearly VND 2,444 billion, a 3% increase, with a significant portion allocated to the Hoa Hai New Urban Area project in Da Nang (nearly VND 1,242 billion).

Source: SJS

|

Total liabilities stood at nearly VND 4,789 billion, a 1% decrease, with financial debt exceeding VND 955 billion, up 58% and accounting for 20% of total liabilities.

– 11:38 25/10/2025

Industrial Real Estate Firm Reports 70% Drop in Q3/2025 Profits, Stock Plummets to Daily Limit

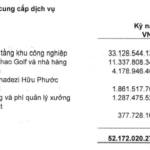

The primary cause stems from the company’s core revenue pillar—industrial zone infrastructure leasing—plummeting by 76%, now standing at a mere 33 billion.

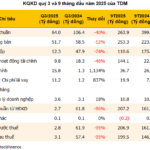

Record-Low Quarterly Profit for TDM as Financial Costs Surge Over 1,100%

Plummeting revenue, shrinking gross margins, and soaring financial expenses pushed Thu Dau Mot Water JSC (HOSE: TDM) into a quarter of record-low profits. However, a hefty dividend from Biwase, totaling hundreds of billions of dong, propelled TDM’s nine-month net profit up 36%, reaching nearly 200 billion dong.