I. VIETNAMESE STOCK MARKET OVERVIEW FOR THE WEEK OF OCTOBER 20-24, 2025

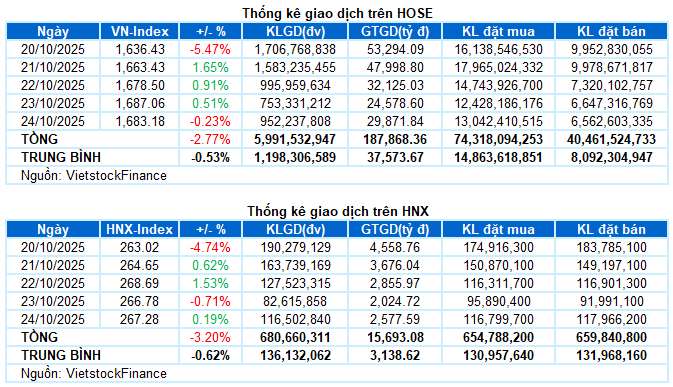

Trading Activity: Key indices showed mixed movements during the October 24 session. The VN-Index closed the week at 1,683.18 points, down 0.23% from the previous session. Meanwhile, the HNX-Index edged up 0.19% to 267.28 points. For the full week, the VN-Index lost 48.01 points (-2.77%), while the HNX-Index declined by 8.83 points (-3.2%) compared to the prior week.

Vietnam’s stock market endured another volatile week, marked by a sharp decline early on. Despite efforts to recover losses in subsequent sessions, the VN-Index struggled to gain traction amid heightened investor caution. Persistent net selling by foreign investors further pressured the market, culminating in the VN-Index ending the week at 1,683.18 points, a 2.77% weekly decline.

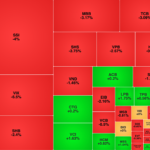

The financial sector was the primary drag in the final session, accounting for 8 out of the top 10 negatively impacting stocks, erasing nearly 7.5 points from the VN-Index. Conversely, VIC and FPT managed to retain 4.6 points, though insufficient to lift the overall index.

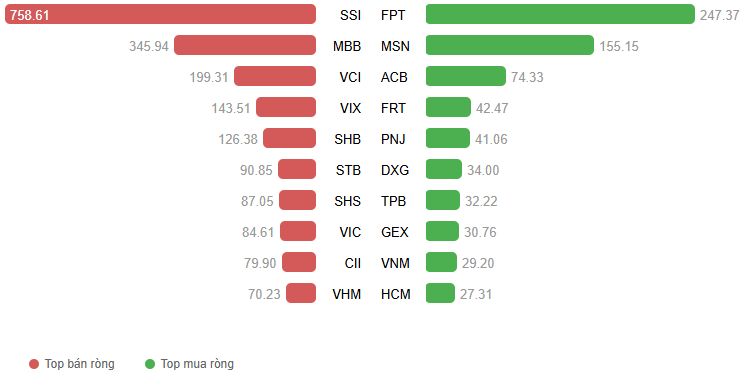

Sector performance was polarized. The financial sector led losses with a 1.14% drop, as heavy selling hit stocks like SSI (-4%), VIX (-6.5%), SHB (-2.4%), MBB (-3.17%), TCB (-3.09%), SHS (-3.75%), VPB (-2.67%), VND (-1.46%), and EIB (-2.16%).

The industrial sector also weighed on the index, with stocks such as VJC, GEE, MVN, VEF, GEX, CII, and VSC falling over 2%. Notable exceptions included VTP, which hit its upper limit, along with BMP (+5.45%), TLG (+1.52%), and VGC (+1.2%).

On the positive side, the media services and IT sectors led gains, rising 3.37% and 2.84%, respectively. Key contributors were CTR (upper limit), VGI (+4.26%), VNZ (+1.73%), TTN (+5.23%), FPT (+2.84%), CMG (+3.06%), and VEC, POT, and SMT, all reaching their maximum daily gains.

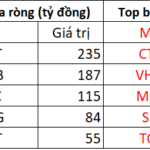

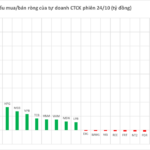

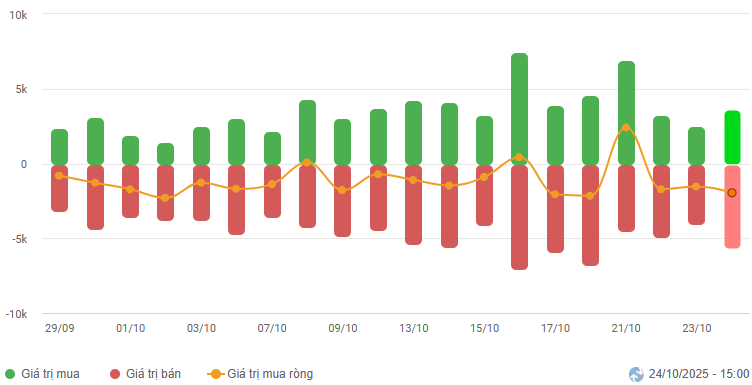

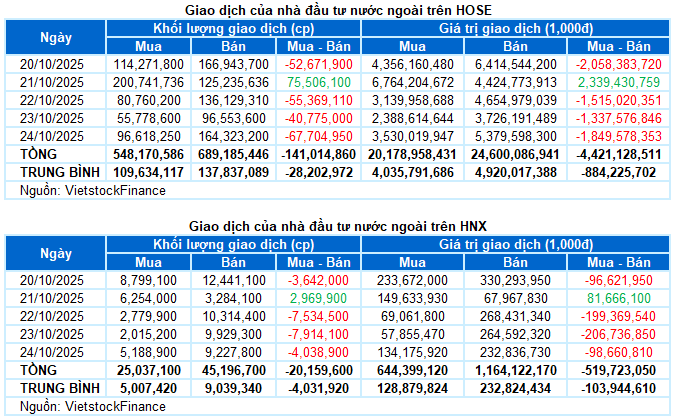

Foreign investors continued net selling, totaling over VND 4.9 trillion across both exchanges. Specifically, they net sold VND 4.4 trillion on the HOSE and nearly VND 520 billion on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

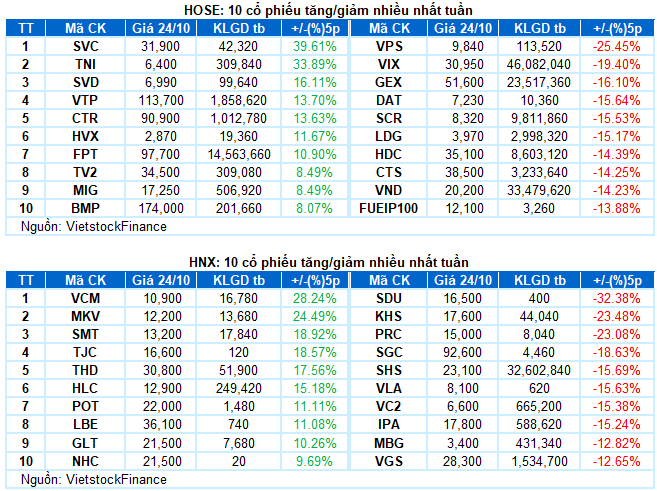

Top Performing Stock of the Week: VTP

VTP +13.7%: This week, VTP continued its recovery after successfully breaking its medium-term downtrend. The stock price consistently traded near the Upper Band of the Bollinger Bands, accompanied by improved trading volume, reflecting investor optimism.

Additionally, the MACD and Stochastic Oscillator indicators maintained their upward trajectory following buy signals, further bolstering the stock’s short-term outlook.

Worst Performing Stock of the Week: VIX

VIX -19.4%: VIX experienced a challenging week, with 4 out of 5 sessions closing lower. The stock price fell below its 50-day SMA and is currently trading near the Lower Band of the Bollinger Bands.

The MACD indicator continues to weaken after issuing a sell signal, even dropping below the zero line, indicating a less favorable short-term outlook.

II. WEEKLY MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:16 24/10/2025

Short-Term Stock Market Declines: What You Need to Know

The stock market’s growth prospects remain robust, fueled by strong domestic investor inflows and improving corporate earnings.

Why Many Stock Traders’ Accounts Are Bleeding Red

The VN-Index closed the final trading session of the week (October 24) with a nearly 4-point decline, leaving many investors’ portfolios in the red. Sellers dominated the market, with a staggering 190 stocks on the HoSE exchange experiencing price drops.