Illustrative Image

According to CNBC, new U.S. sanctions targeting Russia’s two largest oil giants, Rosneft and Lukoil, are expected to disrupt crude oil supplies to major Asian customers, including China and India.

Specifically, the U.S. Treasury Department announced on October 23 that it would impose sanctions on Rosneft and Lukoil, citing Moscow’s “lack of serious commitment” to ending the conflict in Ukraine. These measures aim to weaken the Kremlin’s military funding and signal further punitive actions. The U.S. government has set a November 21 deadline for companies to terminate or adjust existing contracts with Rosneft and Lukoil.

Analysts suggest that these sanctions are designed to avoid immediate market chaos while exerting significant pressure on Russia. Bob McNally, Chairman of Rapidan Energy Group, stated: “These sanctions will force buyers to seek new solutions for shipping and payments, increasing costs and complexity—which is precisely what the U.S. aims to achieve to reduce Moscow’s profits without halting exports entirely.”

Rosneft and Lukoil account for approximately half of Russia’s total daily crude oil exports, exceeding 4 million barrels. Data from Vanda Insights indicates that Russian crude oil has found a stable market in Asia since Western nations imposed a $60 per barrel price cap in late 2022. In September, China imported around 2 million barrels daily from Russia, while India imported approximately 1.6 million barrels.

In India, the sanctions are expected to significantly impact both state-owned and private refineries, including Indian Oil, Bharat Petroleum, Hindustan Petroleum, Reliance Industries, HPCL-Mittal Energy Ltd., and ONGC. Rosneft also owns nearly 50% of Nayara Energy Ltd., which operates the Vadinar refinery in Gujarat, potentially facing challenges in selling refined products. Indian refineries are currently scrutinizing Russian oil transactions to ensure no direct involvement with Rosneft or Lukoil.

Meanwhile, China is anticipated to be less affected due to its pipeline crude oil supply. However, state-owned enterprises remain cautious about shipments linked to Rosneft and Lukoil. According to Vortexa, China National Petroleum Corporation (CNPC) has a pipeline supply contract with Rosneft but no long-term agreements for seaborne crude oil.

Muyu Xu, an analyst at Kpler, noted: “A complete halt to Russian oil supplies is unlikely, but short-term disruptions are inevitable.” John Kilduff, partner at Again Capital, echoed this sentiment, suggesting that countries like China and India will increasingly rely on oil from the U.S. and OPEC nations, with Saudi Arabia still holding surplus capacity. However, high global demand could drive oil prices upward.

In response to the news, global oil prices surged. Brent crude rose 3.71% to $64.91 per barrel, while WTI crude increased 3.93% to $60.80 per barrel. Vandana Hari of Vanda Insights suggested that Middle Eastern crude oil would be the primary alternative for China and India.

The new U.S. measures differ from the previous price cap mechanism, which allowed Russian crude oil to flow as long as it remained below $60 per barrel. According to Kilduff, the current sanctions amount to a “near-total ban” on Russian oil.

Vandana Hari remarked: “This is the most pressing issue. However, the key question is whether these sanctions will be sustained, as a single phone call between Trump and Putin could shift the entire dynamic.”

Source: CNBC

Russia’s Oil Dilemma: Record 16-Month Exports Amid Plummeting Revenues—What’s Driving the Paradox?

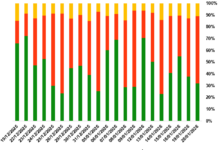

Russia’s oil export activities indicate that U.S. efforts to curb Russian crude oil exports have yet to yield the intended impact.