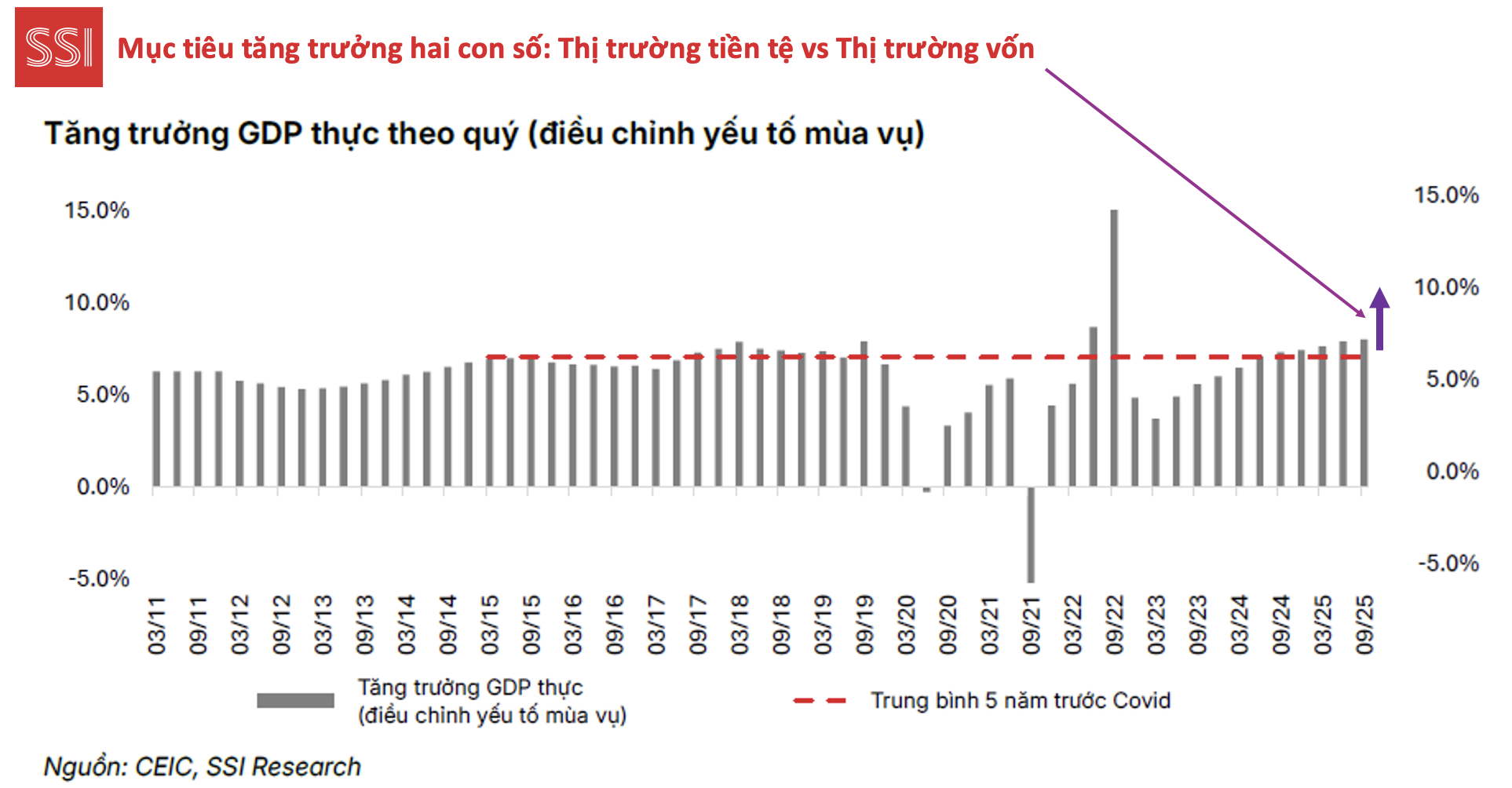

At the Dialogue event themed “New Money, New Goods, and Opportunities in Emerging Markets,” organized by the Vietnam Stock Journalists Club on the morning of October 23, Mr. Pham Luu Hung, Chief Economist and Director of the Analysis and Investment Advisory Center at SSI Securities Corporation (SSI Research), assessed that Vietnam’s GDP growth rate has surpassed the COVID-19 period.

A 10% GDP Growth Target Requires Greater Momentum from the Capital Market

Regarding the 10% GDP growth target for 2026, if achieved, it should be carefully examined for its true driving force. Data shows that credit growth is currently high, far exceeding the same period last year, and could reach around 150% by 2026. If this expansion continues to rely on the banking system, liquidity pressure and risks will grow.

Mr. Hung also noted that the amount of money the State Bank has injected into the market has increased significantly, but this cannot be sustained indefinitely as policy room narrows. Meanwhile, exchange rates and foreign exchange reserves are also concerns, as Vietnam’s foreign reserves have dropped to a low since 2024, and regulators have had to intervene this year to stabilize the market.

“In short, to achieve double-digit GDP growth, this momentum cannot rely solely on bank credit but should come from the capital market, which accepts higher risk appetite and can create more sustainable breakthroughs for the economy,” Mr. Hung emphasized.

Regarding the market upgrade, Mr. Pham Luu Hung clarified the misconception about Vietnam’s recent upgrade to a “secondary emerging market.” According to him, “secondary” is not “less prestigious,” as this group includes leading regional markets like China, India, and Indonesia. Thus, Vietnam’s secondary status does not affect investment allocation ratios of funds.

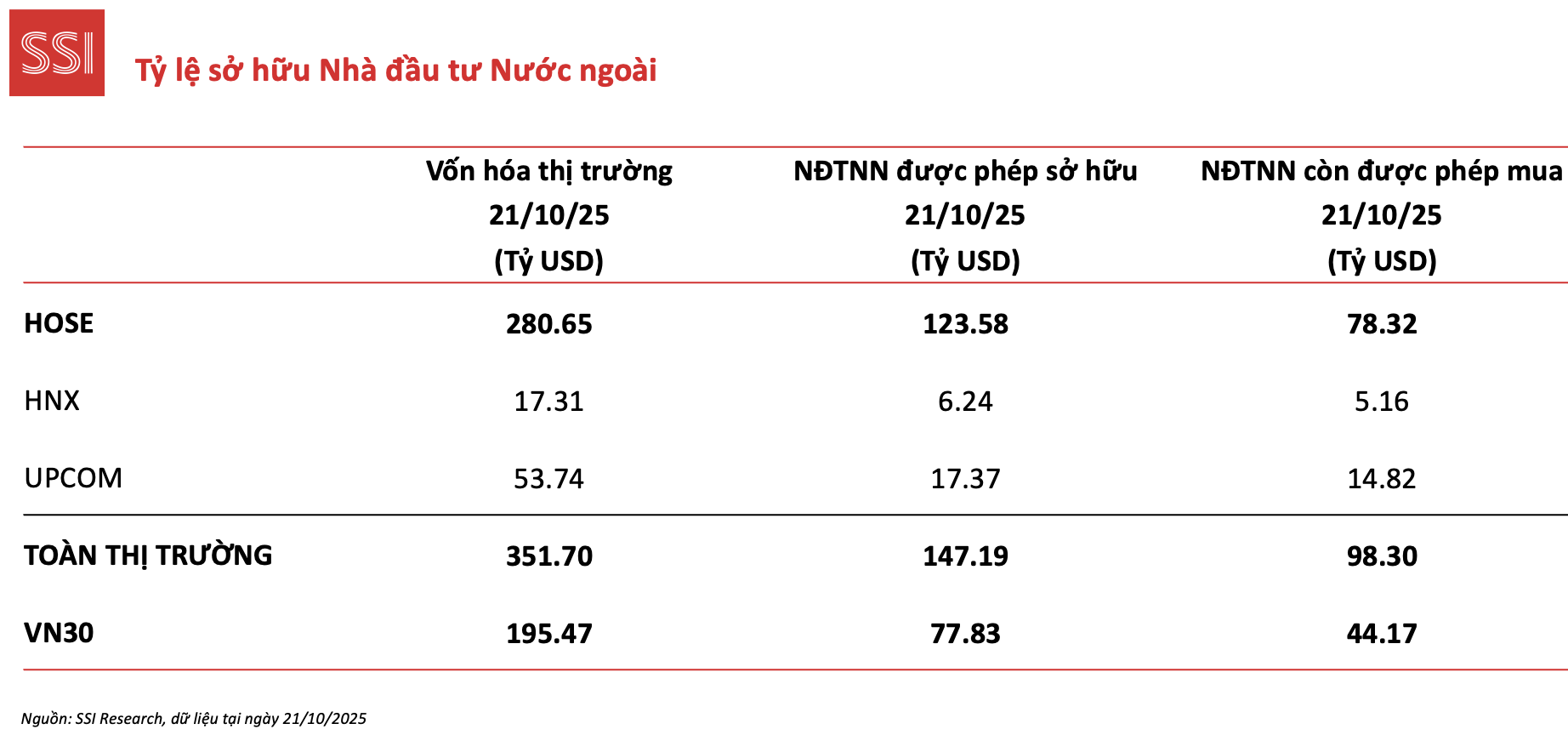

Additionally, expectations of $1-2 billion in passive fund inflows into Vietnam post-upgrade are only a small fraction. If Vietnam builds trust, expands its product portfolio, and improves infrastructure and legal frameworks, long-term capital inflows could be more robust, especially with an estimated $80 billion in remaining foreign ownership room.

Despite the upgrade news, foreign investors continue to net sell, a trend Mr. Hung attributes to regional dynamics, particularly China’s market recovery attracting global funds.

“To my knowledge, Brunei Investment Authority (BIA), an $80 billion fund owning Bridgewater Associates, has shown interest in Vietnam but shifted capital to China as its market rebounded. This isn’t due to Vietnam’s lack of appeal but because of China’s larger market size and liquidity,” Mr. Hung shared.

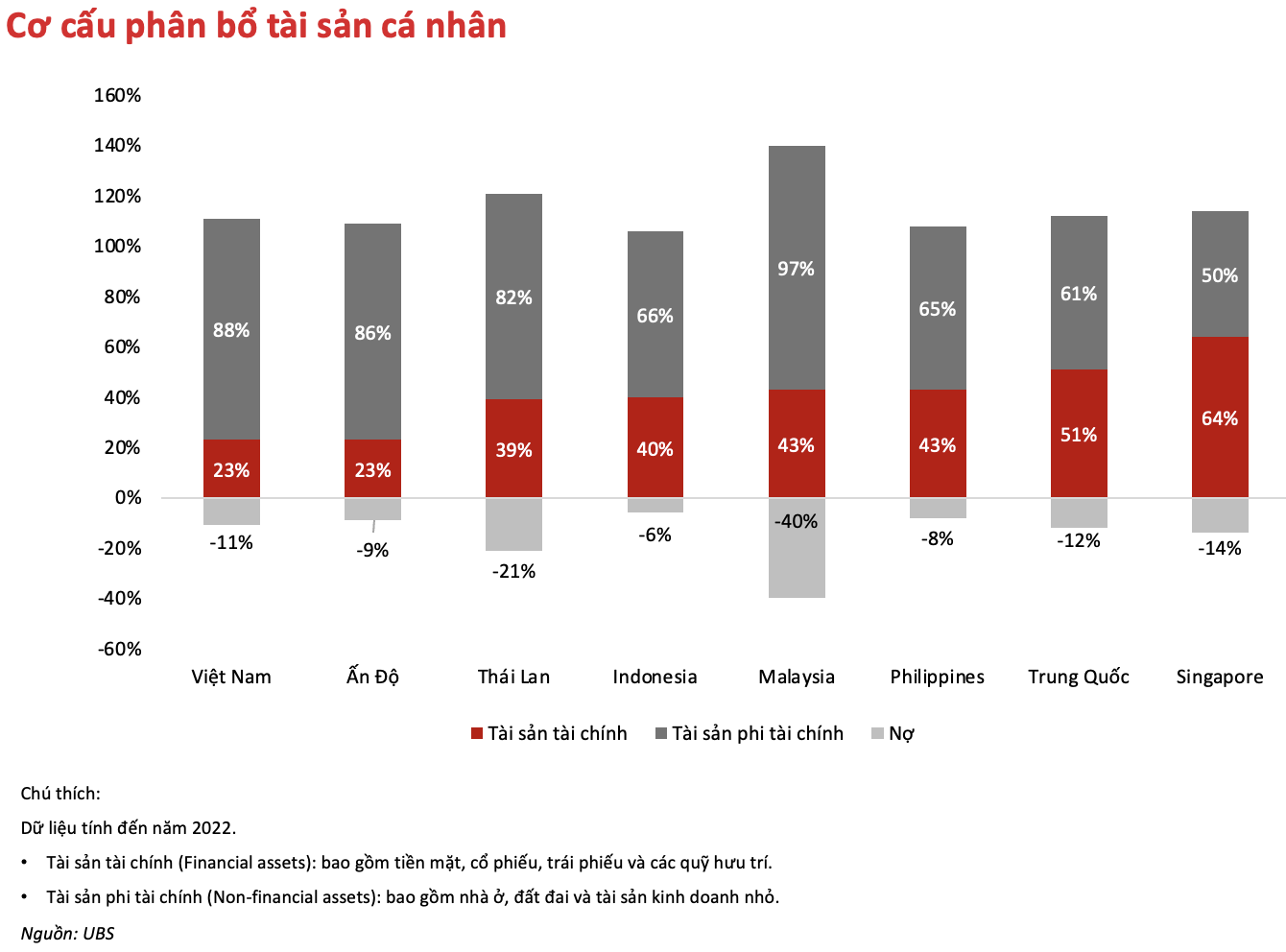

Experts suggest focusing less on ETF inflows and more on unlocking domestic capital. Vietnam’s long-term growth must come from within. Domestic investors are key to driving the stock market. Currently, individuals allocate little to stocks, preferring savings. With $300 billion in deposits, just 5% shifting to stocks would mean $15 billion, far exceeding expected foreign inflows.

Expanding Both Supply and Demand in the Capital Market

On solutions, Mr. Hung stressed restructuring the investor base by developing the investment fund sector. More institutional and intermediary funds would reduce volatility and speculation. Tax and fee incentives are needed to encourage new fund types and shift individual investors from direct to fund-based investing.

Legal frameworks should allow foreign investors to place orders directly with global brokerages, alongside exchange rate hedging tools, to attract stable foreign capital.

Modern trading systems will improve stock pricing. Quantitative and hedge funds will act as buffers against individual speculation, stabilizing the market. A transparent, robust infrastructure will attract high-quality capital and reduce volatility over time.

To expand the market, Mr. Hung advocated accelerating IPOs and relaxing listing conditions, enabling tech and innovative startups to access the stock market. Beyond equities, the bond and derivatives markets offer growth potential, with opportunities in infrastructure bonds and local currency government bond indices.

Diversifying investment products, such as crypto or gold-linked ETFs, will meet risk management and portfolio diversification needs. Finally, accelerating state-owned enterprise equitization will enhance market quality, transparency, and resource allocation efficiency.

New Exchange for Innovative Enterprises

SSI Securities CEO Nguyen Duc Thong supported relaxed listing criteria for tech companies, noting that profit requirements could hinder the emergence of giants like Tencent or Alibaba. Startups often need capital before profitability. Flexible mechanisms would improve their access to funding.

However, he emphasized that “relaxation” should be within a reasonable risk management framework, possibly through sandboxes or financial centers for flexible regulation testing.

SSI Securities CEO Nguyen Duc Thong

State Securities Commission Vice Chairman Bui Hoang Hai noted that removing the two-year profit requirement could have uncertain impacts. However, the new Science, Technology, and Innovation Law has paved the way for a specialized exchange for innovative startups. The Ministry of Finance is collaborating with the Ministry of Science and Technology to establish this platform.

According to Mr. Hai, the exchange could have two boards with different listing criteria, suited to high-tech innovative enterprises. Profit requirements might be replaced with revenue or user-based criteria.

“We are exploring this approach to allow listings without traditional financial requirements, better aligning with these companies’ development characteristics,” Mr. Hai emphasized.

International ‘Hawks’ Eye Vietnam’s Stock Market for a Compelling Reason

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), revealed that following the market upgrade announcement, numerous international investors who previously showed no interest in Vietnam are now actively seeking information. Many of these investors, managing capital ranging from hundreds of billions to trillions of USD, are expressing significant interest in Vietnam’s stock market.

Vietnam’s Stock Market Post-Upgrade: New Opportunities, New Challenges

Following its official upgrade by FTSE Russell, Vietnam’s stock market is entering a transformative phase, marked by heightened expectations for foreign capital inflows, improved asset quality, and enhanced trading infrastructure. However, this evolution also brings new demands for transparency and governance capabilities.

Proprietary Trading Firms Unexpectedly Turn Net Buyers of Stocks on October 23rd, Contrasting Massive Sell-Offs in Two Key Stocks

Proprietary trading by securities companies has rebounded with a net buying value of VND 225 billion on the Ho Chi Minh City Stock Exchange (HOSE).