Incomplete Legal Framework Hinders LNG Power Projects

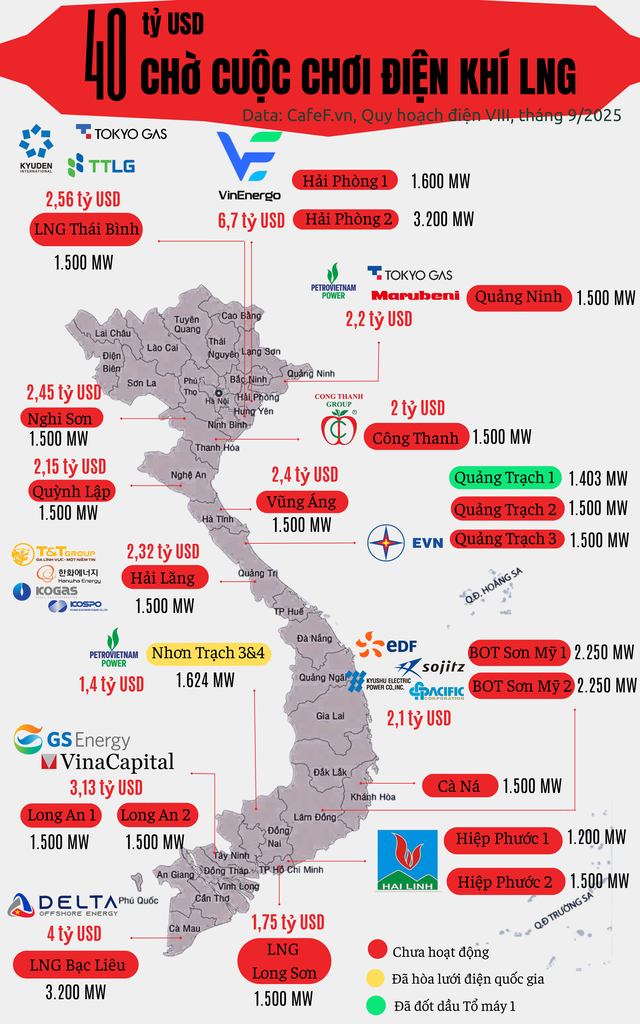

Despite Resolution 55-NQ/TW (2020) and Power Development Plan VIII aiming to boost LNG-powered electricity to replace coal-fired plants, only two projects—Nhơn Trạch 3 and 4—are on track for completion by mid-2025.

Major projects like LNG Hải Lăng, Quảng Ninh, Long An, Hiệp Phước, Thái Bình, and Ô Môn 2 remain stalled in negotiations over Power Purchase Agreements (PPAs), Gas Sales Agreements (GSAs), and financing arrangements.

Investors warn these delays not only prevent LNG from balancing renewable energy sources like wind and solar but also threaten the feasibility of the adjusted Power Development Plan VIII, which targets 22.5 GW of imported LNG and 16 GW of domestic gas-fired power by 2030.

What Are Investors Proposing?

(1) Capacity Payments:

Investors advocate for a two-part tariff (energy + capacity) to ensure recovery of fixed costs (FC) and fixed operation and maintenance costs (FOMC). The current mechanism does not allow this for IPP projects, potentially creating inequality among plants.

(2) Shifting Gas Take-or-Pay Obligations to PPAs:

Investors propose transferring take-or-pay obligations from LNG Sales and Purchase Agreements (LNGSPAs) or GSAs to PPAs, ensuring EVN bears the risk if the National System Operator (NSMO) fails to procure sufficient output.

(3) Project Termination and Buyback:

If a project is terminated without investor fault, the government should buy back the plant at its residual value, including outstanding loans, unrecovered equity, and unpaid fuel commitments.

(4) Currency Payments and Adjustments:

USD-denominated costs in PPAs should be settled at actual exchange rates or include a mechanism to offset currency fluctuations. LNG projects rely heavily on USD payments for fuel, maintenance, debt servicing, and equity returns. Investors and lenders require these payments to be USD-indexed or VND-pegged to USD.

(5) Applicable Law and Dispute Resolution:

Vietnamese law should apply, but allow reference to English or international law where Vietnamese law is insufficient.

Investors urge amending Article 11 to include specific mechanisms for LNG projects:

– Guaranteed minimum contract electricity volume of at least 90% of long-term average output, applicable throughout the project lifecycle.

– Capacity payments (Fixed Cost + O&M) for unused capacity, regardless of actual generation.

– Transfer fuel take-or-pay obligations to EVN, ensuring payment for shortfalls.

– USD-based electricity pricing, settled in VND with periodic currency adjustments.

In force majeure or legal changes, maintain capacity payments and extend contract terms.

Upon termination without investor fault, the government buys back the plant at residual value, including debt, interest, equity, and unpaid fuel commitments.

– Allow collateralization of land-attached assets and recognize lender intervention rights.

– Implicit COD mechanism: Delays due to external factors do not affect commercial operation date for capacity payments.

– Recognize LNG projects as transition energy sources, enabling future integration of hydrogen and ammonia.

11 Legal Bottlenecks Stifling LNG Financing

Businesses pledge long-term investment, compliance with Vietnamese law, and readiness to engage with Congress and the government in October 2025 for detailed clarifications.

“These proposals are grounded in practical challenges, ensuring project viability and access to international financing,” the document emphasizes.

Empowering Private Sector Growth: Prioritizing Legal Support Resources for Breakthrough Success

Unlocking the full potential of the private sector requires prioritizing legal support to ensure a robust framework. This includes establishing a solid legal foundation that enables efficient access to critical resources such as capital, land, advanced technology, and high-quality human resources. Achieving this balance demands legislative reforms that not only meet state regulatory requirements but also foster an environment where businesses can thrive and grow.

Secure Your Future: Effortless Living & Smart Investing with The Aspira

At The Aspira, clients are granted exclusive access to a suite of rare financial policies, making both homeownership and investment effortlessly attainable. Notably, the project is set to launch in early October, accompanied by a host of enticing promotional programs.