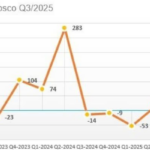

| VFG’s Quarterly Business Results for 2023-2025 |

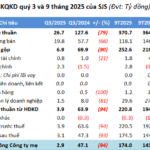

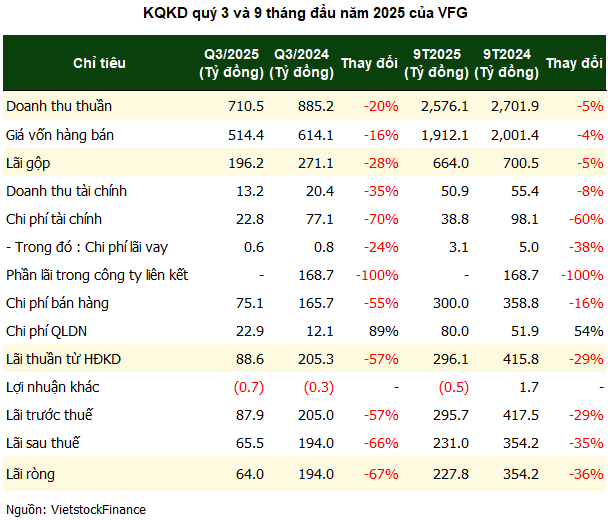

VFG concluded Q3/2025 with its weakest quarterly performance since Q3/2023, as both revenue and profit hit two-year lows. Specifically, revenue reached only 710.5 billion VND, a 20% decline year-over-year, while net profit plummeted 67% to 64 billion VND. Gross margin narrowed to 27.6%, down from 30.6% in the same period last year, as cost of goods sold decreased at a slower rate than revenue.

Beyond its core operations, other segments of VFG also contracted. Financial revenue dropped 35% to just over 13 billion VND, and the nearly 169 billion VND in profit from associated companies recorded in the same period last year was absent. Despite the company’s efforts to slash financial expenses by 70% and selling expenses by 50%, administrative costs surged 89% to nearly 23 billion VND, becoming a significant drag on overall profitability.

|

According to the company’s explanation, four key factors were identified. First, adverse weather conditions in Q3, including prolonged rainfall and storms, reduced demand for pest control, particularly in key rice and fruit-producing regions. Second, a sharp decline in prices of staple agricultural products like rice and durian led farmers to cut back on investments, decreasing the use of plant protection products.

Third, the absence of a one-time financial income of 94.6 billion VND from resolving a capital dispute at Hai Yen LLC, recorded in 2024, significantly reduced this year’s profit. Lastly, while hotel service revenue increased, challenging economic conditions and pricing pressures prevented a corresponding rise in profit.

Nine-Month Profit Falls by Over One-Third, Achieving 63% of Annual Plan

For the first nine months of 2025, VFG generated revenue of over 2,576 billion VND, a slight 5% decrease year-over-year, while net profit fell 36% to under 228 billion VND. The company achieved only 65% of its revenue target and 63% of its profit goal for the year.

| VFG’s Business Results for 2016-9M2025 |

Despite the decline in business performance, a positive note is the 60% reduction in financial expenses to under 39 billion VND, as the company fully repaid its short-term loans of over 172 billion VND. As of September 2025, VFG is debt-free, though total liabilities rose 16% year-to-date, exceeding 1,034 billion VND.

This increase stems from a surge in short-term payables to suppliers, reaching 601 billion VND, nearly five times the year’s start, primarily due to a new payable of nearly 510 billion VND to Syngenta Vietnam LLC. A strategic partner since 2022, Syngenta has been pivotal in VFG’s shift from disinfection to agricultural chemical distribution. VFG’s leadership has emphasized the partnership’s upgrade, focusing on high-quality products to boost market share.

Weak Cash Flow, Rising Inventory

Alongside revenue pressures, VFG’s cash position weakened, with bank deposits falling 67% year-to-date to just over 267 billion VND. Conversely, inventory soared 34% to nearly 1,275 billion VND, with goods inventory alone rising 47% to 1,011 billion VND.

The increase in inventory and decrease in cash reserves indicate VFG is reallocating resources amid weak market demand while maintaining supply for its distribution channel with Syngenta.

On the HOSE, VFG shares closed at 55,900 VND on October 24, down 25% over the past year. Trading volume remains low, at around 33,500 shares per session. After peaking at over 85,000 VND in November 2024, the stock has corrected, losing more than 34% of its value.

| VFG Stock Price Performance Over the Past Year |

– 11:01 25/10/2025

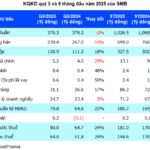

Sài Gòn Beer Central Region Sets Profit Margin Peak, 9-Month Earnings Surpass 18% of Annual Plan

Revised Introduction:

Saigon Beer Corporation – Central Region (HOSE: SMB) reported a record-breaking gross profit margin of 35.35% in Q3, the highest in its history, driving a 24% year-on-year surge in net profit. Over the first nine months, the company has already surpassed its full-year profit target by 18%.

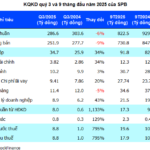

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.

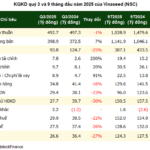

Vinaseed’s Gross Profit Hits Historic Low as Inventory Surges Past 1 Trillion VND

Amidst seasonal fluctuations and escalating financial costs, Vinaseed Group (HOSE: NSC) reported its weakest quarterly performance since 2020, with gross profit margins plummeting to a record low of 19%. Simultaneously, inventory levels surged past the 1,000 billion VND mark, exacerbating the company’s financial challenges.